Does the Market Still Care About Tariffs?

Where Does the Market Go From Here?

When we think about where the market stands today, let’s take a look at the bigger picture.

We broke the 200-day moving average yesterday and finally closed above it. Today, we’re kind of hovering right over it. But what does that mean? Are we headed lower to revisit recent lows? Or are we charging toward new highs?

Honestly, I think a lot of people get stuck thinking the market has to go one of two ways: either new all-time highs or new lower lows. But here’s the thing—there’s a third option. We might just go sideways for a while, chopping around in a range.

Zoom out for a second. We extended far to the upside earlier this year, then pulled back hard in that temporary correction. Now, we’re sitting in the middle—around 6% down from the all-time highs. That doesn’t automatically mean we’re heading back to highs. It just means a lot of uncertainty has already been priced in. What we’re seeing now is the market trying to find some footing.

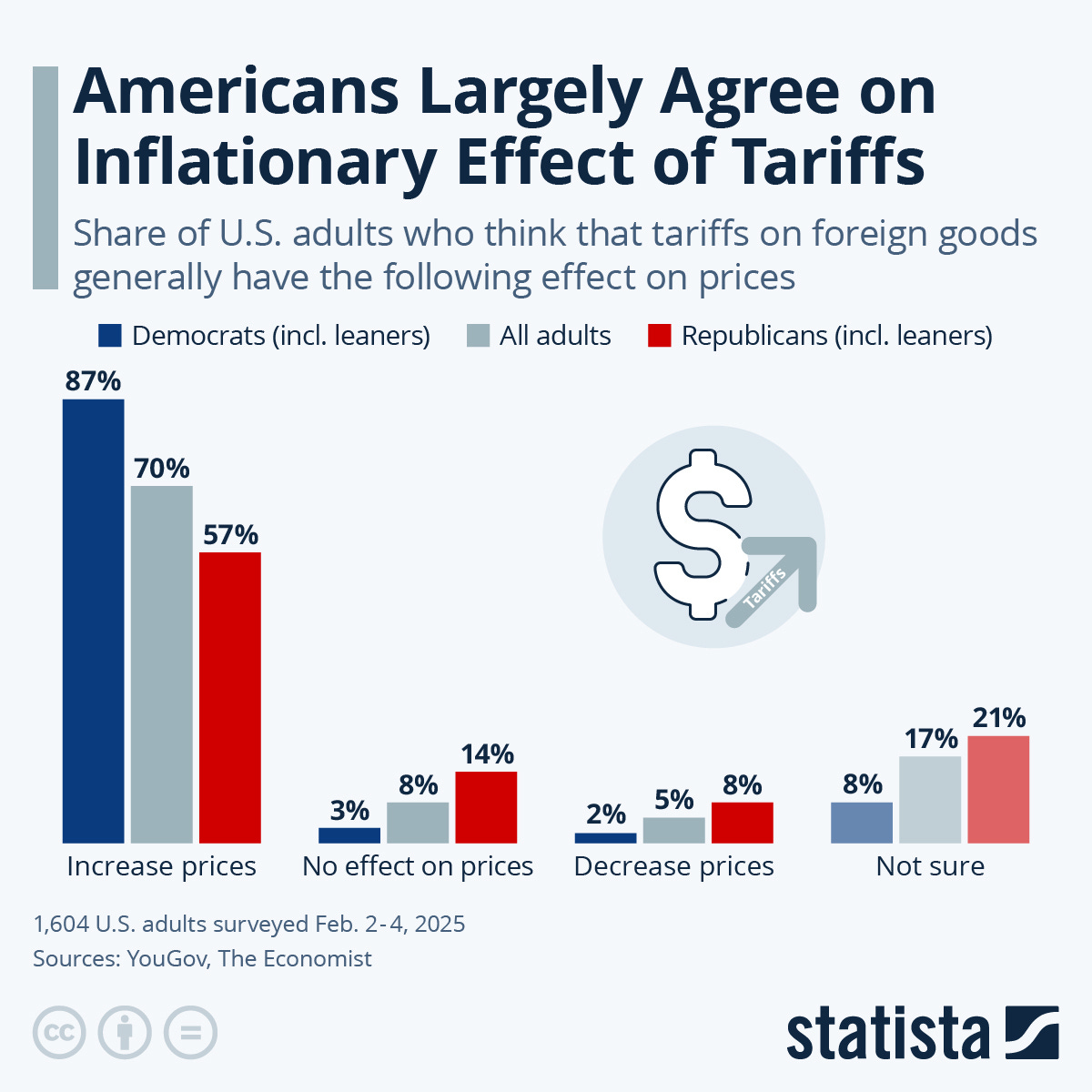

The Tariff Talk and Macro Outlook

This week, nothing really major has changed—except for some of the Trump tariff headlines. He’s been walking back some of the more aggressive tariff talk, softening expectations about how many and how large they’ll be.

But let’s be clear: tariffs are still on the table. The bigger idea behind them is to reduce the amount of interest the US government is paying on its debt by bringing in more tariff revenue and reducing government spending. Less borrowing could mean fewer bond issuances—especially on the short end of the curve where rates are higher.

And speaking of the curve:

• The Fed controls short-term rates.

• The bond market controls long-term rates.

So, if the market expects the Fed to cut, people start buying long-term bonds. Recently, the 10-year dropped from 4.8% (right around peak tariff fears) to about 4.3%. I personally think we might see it fall toward 3.8% before this trend reverses.

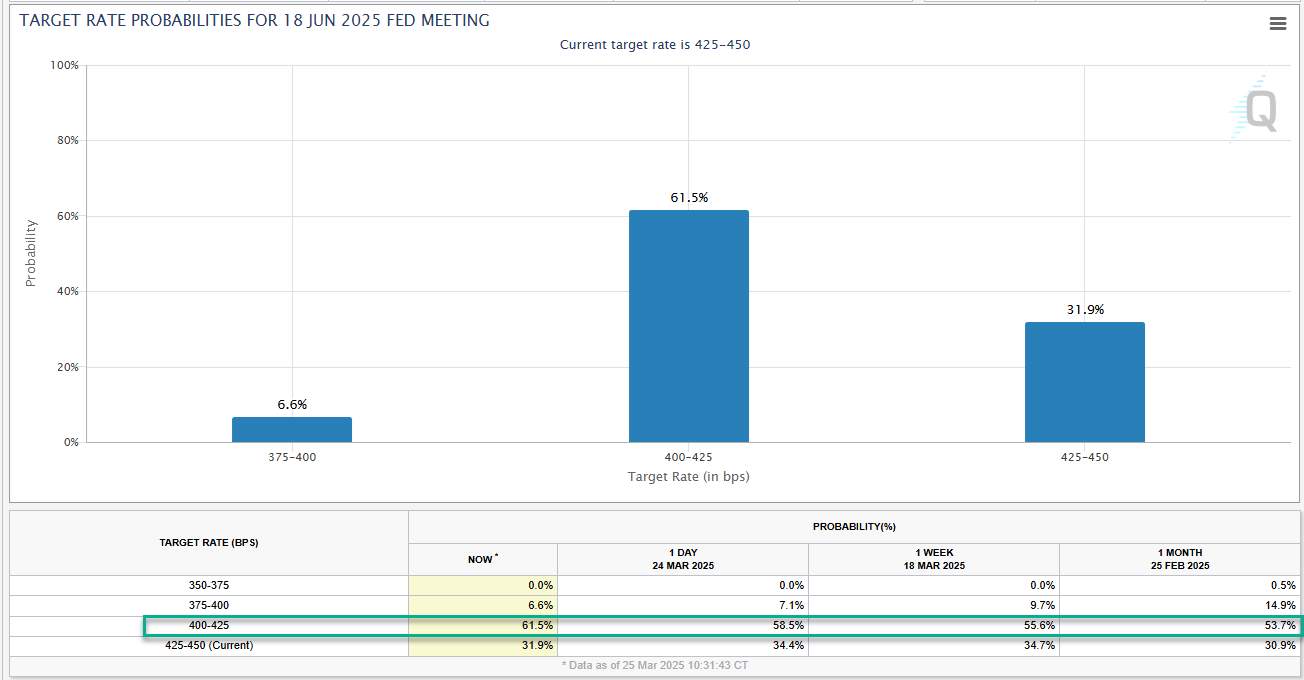

Rate Cuts, Market Expectations, and the Fed

Right now, both the market and the Fed seem aligned—expecting two rate cuts in 2024. That kind of alignment doesn’t usually last forever. As new data comes in, expectations shift. Fed Funds Futures pricing tends to change quickly every few months.

So what happens next? More downside? More upside?

I lean short term bullish. That doesn’t mean I think we’re hitting new highs—just that the downside pressure has eased a bit. I also think the market might be underestimating how soon the Fed could cut if inflation behaves and the jobs market stays stable.

If the tariffs don’t hit as hard as initially feared, and inflation continues to moderate (housing and energy are big drivers here), that could give the Fed a green light to act sooner.

Liquidity, QT, and Balance Sheet Moves

The Fed has already signaled some softening. In the last meeting, they reduced the amount of Treasuries rolling off their balance sheet—from $35B to $5B per month. They’re still letting $25B in mortgage-backed securities roll off.

So while it’s still a tight liquidity environment, we’re seeing signs of a gradual easing. Rates are still in the 4.25% to 4.5% range, and the odds of a June rate cut have increased—but a May cut is off table for now.

My Positioning

So how am I positioned?

I’m not hedging right now. There was a big short-covering rally over the last couple of days, and I don’t think it’s the time to be throwing on puts. I’m mostly long and have deployed most of my cash. I’ll keep adding when I can, but truthfully, the number of “deals” left is thinning out.

• Amazon is back above $200

• Google is flirting with $170

• A lot of small caps and growth names have caught a strong bid

So for now, I’m staying where I am. Might consider hedging later, but this doesn’t feel like the moment. See my latest moves on the Hidden Edge Main Portfolio below!