AI Market Shift & Palantir’s Breakout Performance

The market experienced a significant reversal today, with the Nasdaq recovering from a steep decline. This shift highlights that while the narrative around the second stage of AI remains strong—focusing on software, data integration, and advanced AI applications—many first-stage AI leaders, especially in hardware and data centers, are lagging. However, a few companies, including Palantir $PLTR are excelling in both AI waves, capitalizing on the growing demand for AI-driven solutions across industries.

Palantir has long been recognized as a leader in AI, and their latest Q4 2024 earnings report reinforces that status. The company reported $828 million in revenue (+36.2% YoY), significantly beating consensus estimates of $776 million. Growth was broad-based, with U.S. revenue surging 52% and U.S. commercial revenue soaring 64%, highlighting Palantir’s expanding footprint beyond its traditional government base. On the government side, revenue reached $455 million (+40.4% YoY), while the commercial segment brought in $372 million (+31.0% YoY). Additionally, customer count grew 43%, reflecting strong demand across sectors.

Palantir’s growth is fueled by its robust product ecosystem that addresses both government and commercial needs. Foundry, the company’s flagship platform for enterprises, enables organizations to integrate, analyze, and operationalize complex data, driving significant gains in U.S. commercial revenue. On the government side, Gotham remains mission-critical, providing advanced data analytics that support defense, intelligence, and law enforcement agencies globally. Complementing these is Apollo, Palantir’s continuous delivery system, which ensures seamless deployment and management of AI models across secure environments. At the core of Palantir’s AI momentum is its Artificial Intelligence Platform (AIP), which empowers organizations to securely deploy large language models and advanced AI workflows, enhancing productivity, decision-making, and automation at scale.

Despite a temporary 20% decline in net income ($79 million) due to increased stock-based compensation, Palantir delivered $517 million in free cash flow (+69.6% YoY), crushing expectations by 43.6%. The company also reported a strong operating income of $373 million (+78.2% YoY) with an impressive 45% operating margin, beating expectations by over 500 basis points. Earnings per share (EPS) came in at $0.14, outperforming consensus estimates by 27.3% and growing 75% YoY.

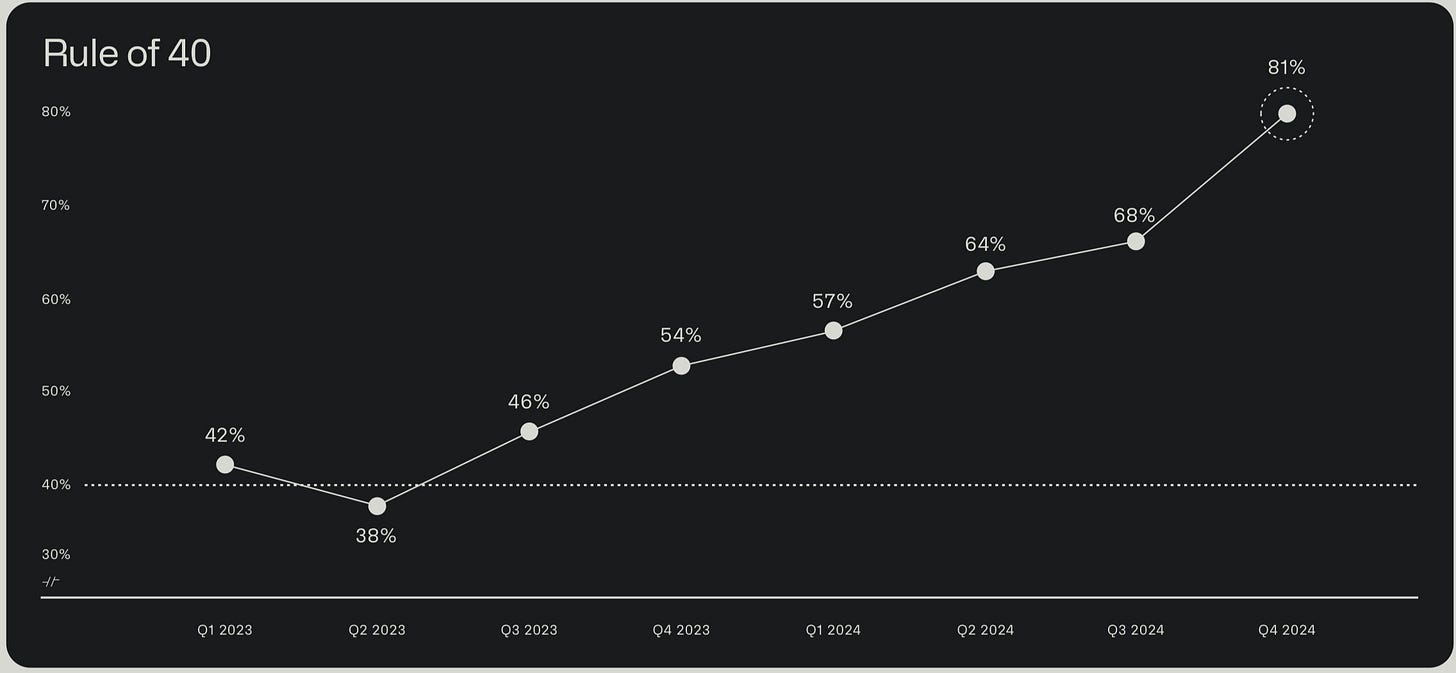

Palantir’s ability to consistently surprise to the upside—as evidenced by the +24% post-earnings stock surge—highlights the unpredictable yet powerful nature of AI growth. Their performance, coupled with a Rule of 81 (revenue growth + FCF margin), reflects the company’s strong growth trajectory, operational efficiency, and scalability. While Wall Street often struggles to fully account for the exponential nature of technological advancements, Palantir’s ongoing success underscores the importance of recognizing and investing in innovative leaders positioned to shape the future of AI.