Amazon: The Next $10T Company

Make way NVIDIA and Apple...

With the recent earnings report from Amazon, many analysts underestimating its position in the AI race despite its sheer scale. This reminds me of $MELI MercadoLibre, the Latin American e-commerce giant, which had selling pressure over its CapEx spending on logistics and delivery. Fast forward, and MercadoLibre dominates its market, much like Amazon did in the early 2000s when critics mocked Jeff Bezos for what they saw as reckless spending. Investors believed Amazon would collapse under the weight of its investments, but those who stayed the course saw massive gains. $AMZN 25,000% stock return over the past couple of decades proves that long-term vision and execution matter more than short-term skepticism.

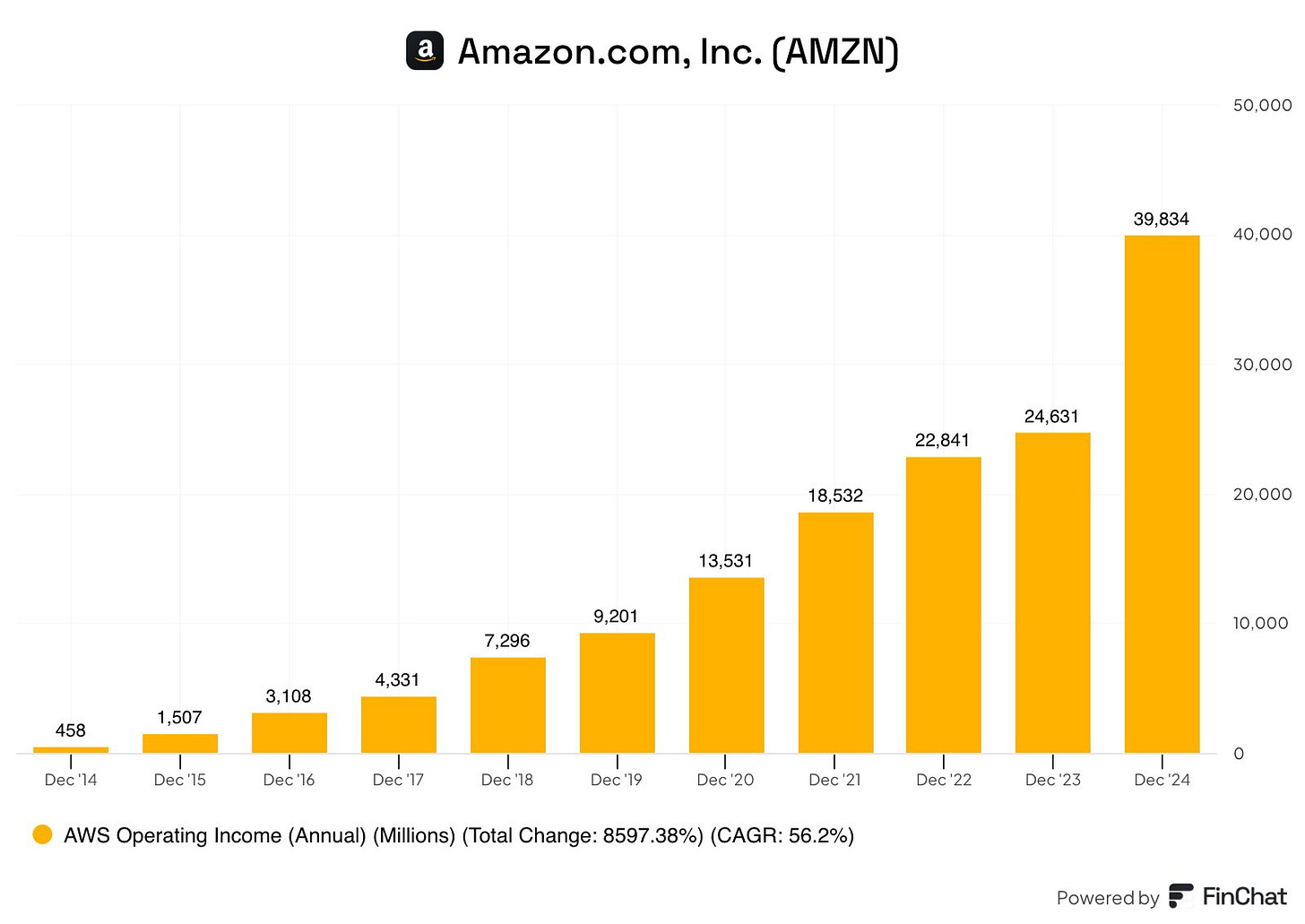

Yet Amazon is not just an e-commerce powerhouse, but an AI and cloud computing juggernaut. Amazon Web Services, its cloud arm, had 19% YoY growth in the last quarter, which some may argue is slower than smaller cloud competitors. But when a $115 billion run-rate business grows by nearly $20 billion in a year, it is nothing short of extraordinary. Even more impressive, AWS has transformed into a high-margin machine, with operating margins expanding from single digits to 37%. That translates to an astounding $40 billion in operating income annually, a testament to Amazon’s efficiency and strategic dominance in cloud computing.

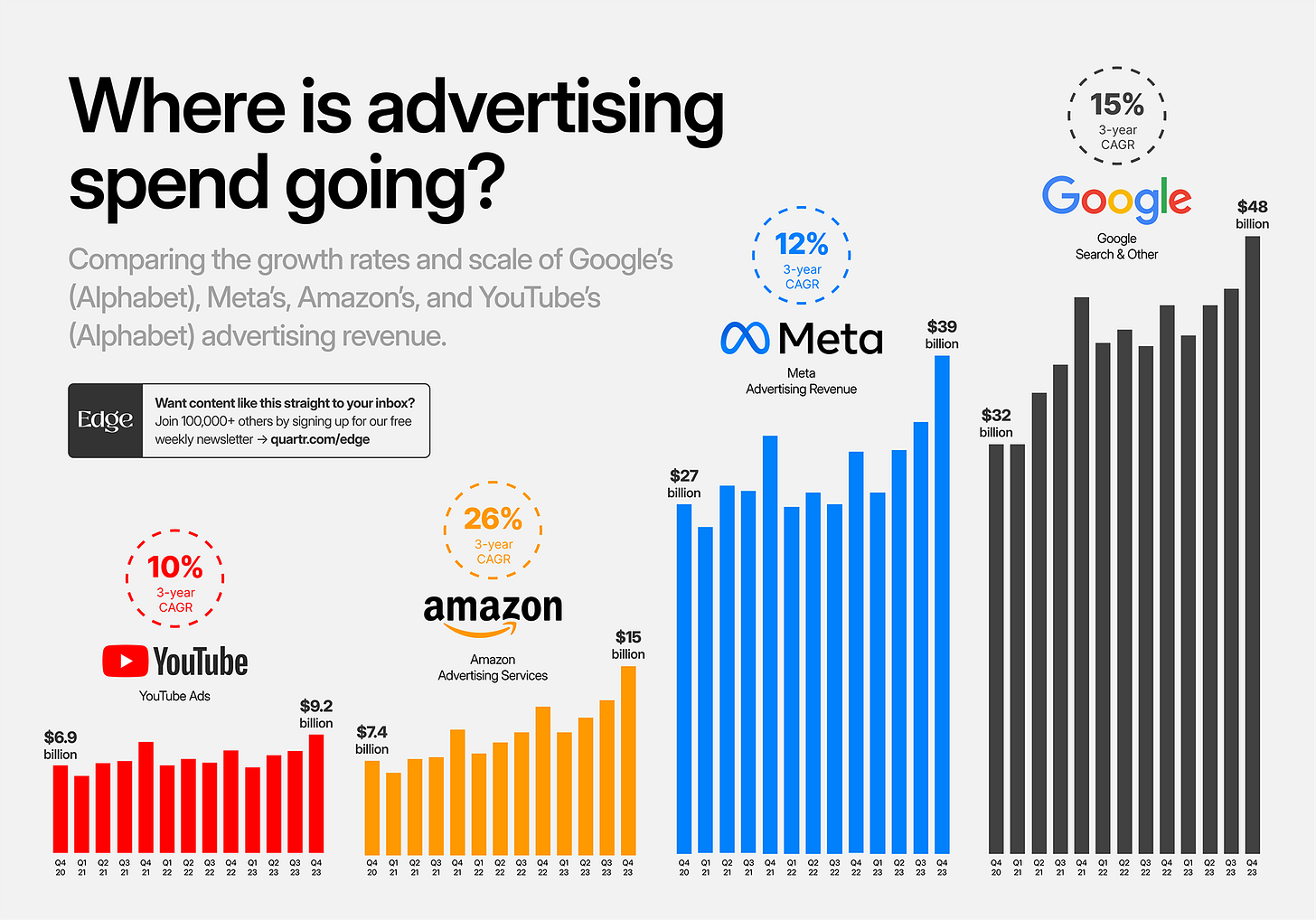

Much of this success is credited to Andy Jassy, who originally pitched AWS and now leads Amazon as CEO. Contrary to speculation, Jeff Bezos remains deeply involved, recently stating that he still works at AWS daily. Meanwhile, Amazon’s e-commerce segment continues to thrive, proving its ability to scale while maintaining profitability. Another major growth driver is advertising, which grew around 18% last quarter and carries high margins, making it a cash-printing business. While Wall Street occasionally nitpicks missed expectations, investors should focus on Amazon’s bottom-line strength—10% operating margins company-wide, which is unheard of for a company of this scale.

Many assume the AI revolution will crown $NVDA NVIDIA as the dominant force, given its compute ecosystem powered by CUDA and its indispensable role in AI infrastructure. However, AI will eventually shift from hardware to software, and at that stage, hyperscalers like Amazon will control the AI supply chain, handling model deployment, data storage, and enterprise AI solutions. Logistics further cements Amazon’s dominance—UPS has essentially conceded defeat in competing with Amazon’s shipping network. Once reliant on third-party carriers, Amazon now owns its logistics, increasing efficiency and cutting costs. No company is as vertically integrated across AI, cloud, e-commerce, and logistics.

Despite short-term market noise, Amazon remains one of the most durable, innovative, and dominant companies on the planet. Investors may trade the stock, but those who lose faith in Amazon’s long-term vision are ignoring its relentless execution. Leadership in AI does not only belong to chipmakers—companies that own the infrastructure, logistics, and cloud backbone will dictate the future. While $AAPL Apple, $MSFT Microsoft, NVIDIA, and $TSLA Tesla may trade the title of the world’s most valuable company, Amazon will always remain at the center of global commerce and technology. That is my bullish thesis on Amazon—dominant today, dominant tomorrow, and dominant for the foreseeable future.