Amazon’s Stellar Earnings: Strong Performance Amid High Expectations

The World's Largest Hyperscaler Reports

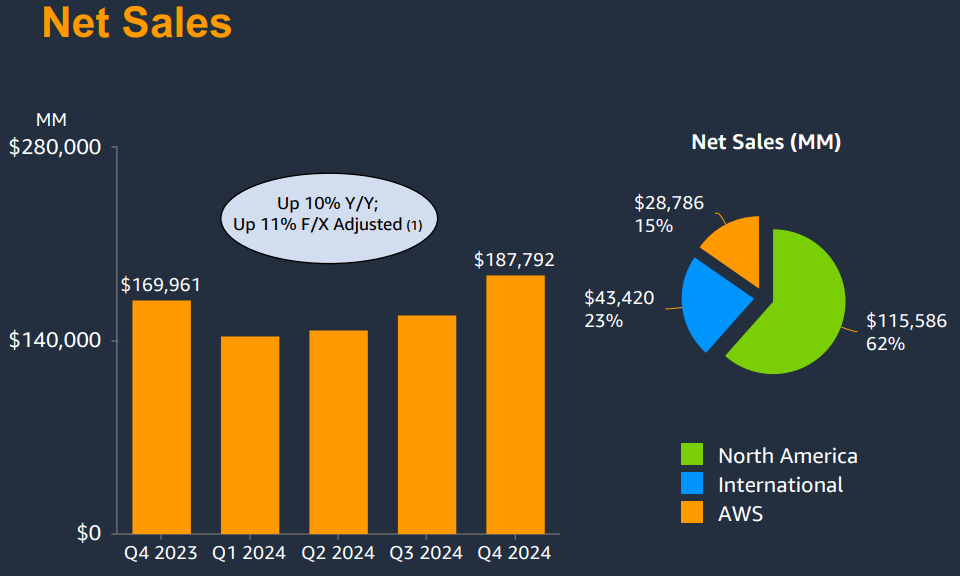

Amazon AMZN 0.00%↑ just reported FY2024 Q4, with 10.5% YoY growth, improved operating margins, and increased CapEx for FY2025. Despite beating expectations in multiple areas, the stock fell almost 6% likely due to the recent run up into earnings. Here's a breakdown of last quarter and my thoughts.

A Strong Quarter, But Expectations Were High

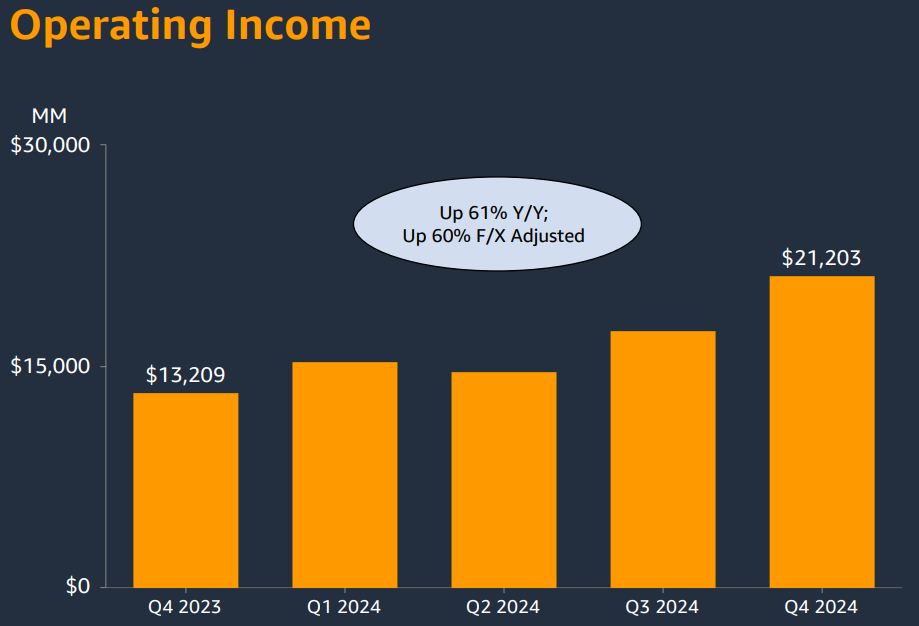

Amazon reported $187.8B, up 10.5% YoY, exceeding its guidance despite FX headwinds of $700 million. Operating income surged 61% YoY to $21.2B, marking the company’s most profitable quarter ever. These numbers underscore Amazon’s ability to balance growth and profitability, yet the stock’s reaction reflects the fact that much of this strength was already priced in by investors who had high expectations for the quarter.

AWS: Still a Key Growth Engine

AWS remained a powerhouse, growing 19% YoY to $28.8B in this segment, at a run rate of $115B. The cloud segment continues to deliver exceptional operating margins of 36.9%, highlighting its profitability and efficiency improvements.

Despite concerns over GPU supply constraints and power availability, AWS managed to expand its enterprise customer base with names like Intuit, PayPal, Northrop Grumman, Reddit, and Japan Airlines. The segment’s robust performance confirms that AWS remains a cornerstone of Amazon’s long-term growth strategy, even as cloud competitors like Microsoft and Google expand their AI and infrastructure capabilities.

E-Commerce Segments Are Becoming More Efficient

Amazon's NA and International eCommerce operations are becoming leaner and more profitable. North America’s EBIT margin expanded 8.0%, while International’s margin increased to 3.0%. The company's cost-optimization strategies, including regional inventory placement, warehouse robotics, and AI-driven logistics are paying off.

In addition, Amazon Haul, its new TEMU price competitor, has been a strong launch, catering to budget-conscious shoppers. Meanwhile, the company's third-party seller services, which now represent 61% of total units sold, continue to generate high-margin revenue. These developments indicate that Amazon is not only growing its eCommerce business but also making it more cost-efficient.

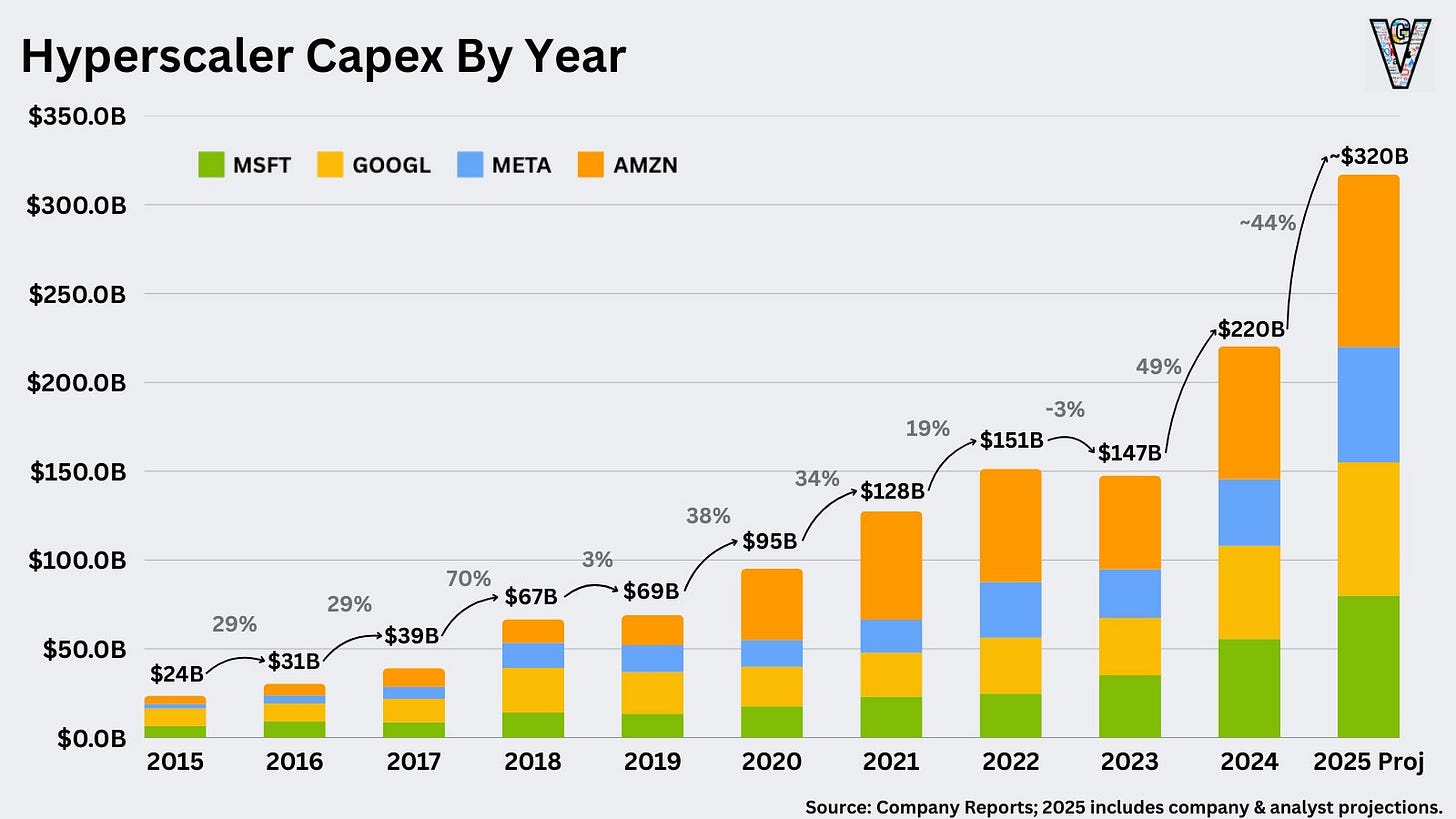

CapEx to Exceed $105 Billion in FY2025

Andy Jassy has projected that its CapEx for 2025 will exceed $100 billion, with a significant portion allocated to AI infrastructure, cloud computing, and fulfillment automation. A major area of investment is Amazon’s custom silicon development, including Trainium 2 and Inferentia 2, its properitary AI chips. These chips are designed to improve efficiency and reduce Amazon’s reliance on NVIDIA for AI compute power. AWS is also working on Project Rainier, an AI training cluster powered by Trainium 2 in partnership with Anthropic.

“…our custom silicon, Tranium 2, we are delivering 30-40% better price performance than other current GPU-powered instances available.”

Andy Jassy, Amazon CEO

Closing Thoughts

Amazon’s FY2024 Q4 earnings demonstrated a company firing on all cylinders. While the market’s high expectations brought the valuation multiple compression, the long-term trajectory for Amazon remains compelling. With AWS maintaining strong growth and profitability, e-commerce operations becoming more efficient, and over $105B in CapEx, Amazon continues to position itself as a dominant force in cloud computing, AI, and retail innovation.

Strong thesis!