AST SpaceMobile: Turning Satellites Into Telecom Infrastructure

Eliminating the Last 5% Coverage Dead Zones with Low Earth Orbit Tech

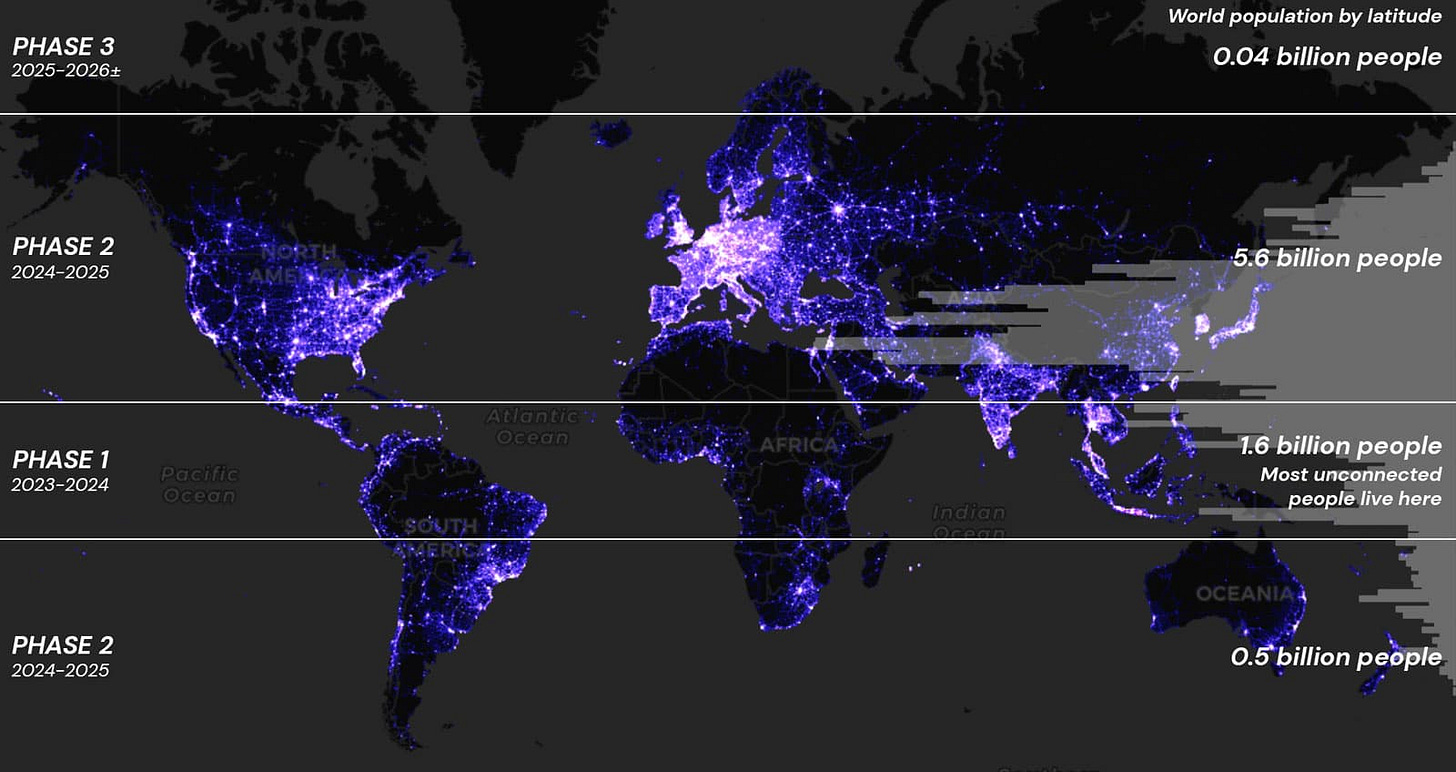

The race for global connectivity has quietly shifted from cell towers to satellites. At the center of it? AST SpaceMobile — the company building the first and only space-based cellular broadband network that connects directly to everyday smartphones.

While others pitch space as a narrative, ASTS is laying the groundwork to make it infrastructure. Let’s break down the company, leadership, partnerships, financials, risks, and why they’re setting up to dominate both commercial and defense telecom.

In this article I will cover:

Company Overview

Executive Leadership

Strategic Partnerships

Financials

Launch Partners

Scaling Production

The Risks

Company Overview: Connecting the Unconnected

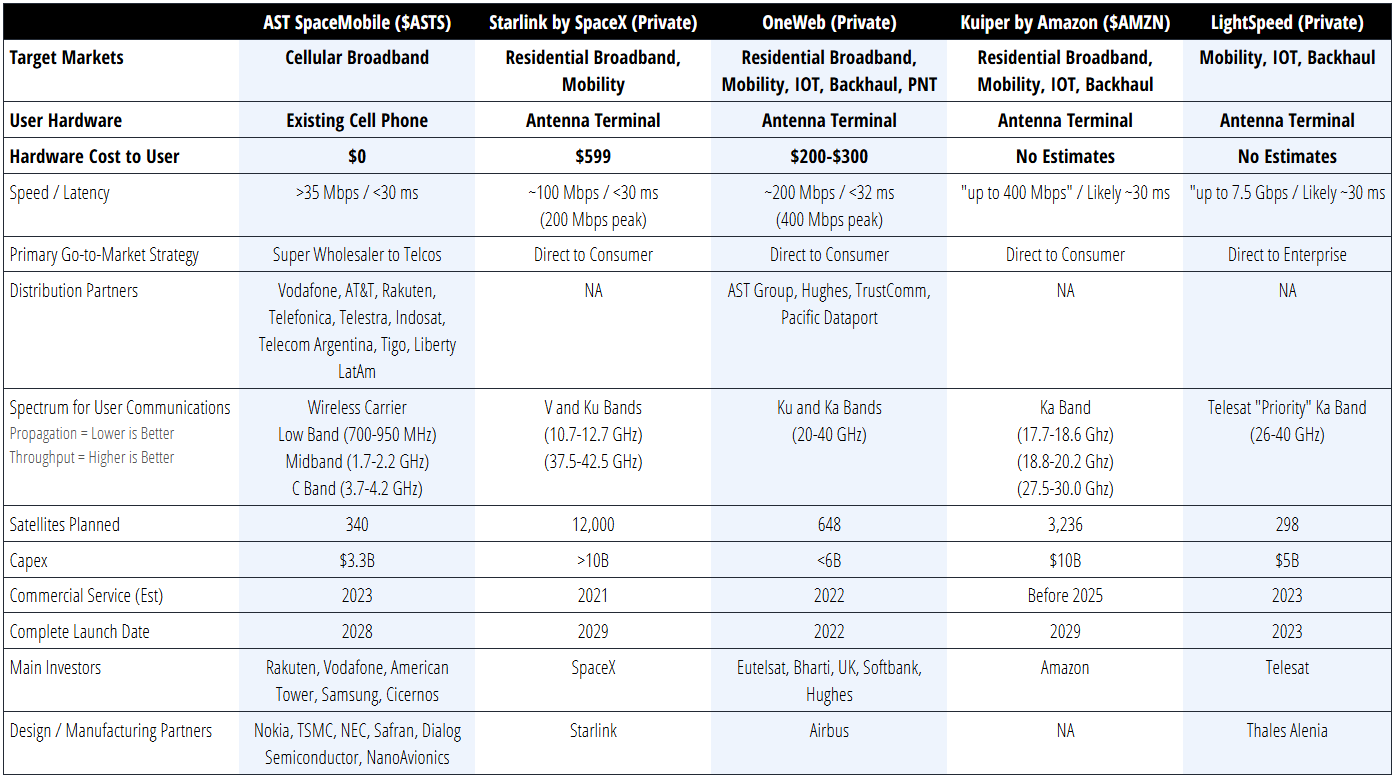

AST SpaceMobile’s mission is straightforward: close the last mile of global connectivity by delivering broadband straight from space to your existing smartphone — no extra hardware, no third party apps or sim-cards. Their tech erases dead zones, bridging the gap between urban hubs and the rural edges, while complementing traditional land-based networks.

Their constellation of low Earth orbit (LEO) satellites, known as BlueBird, act like cell towers in the sky. These satellites integrate with Mobile Network Operators (MNOs), like Verizon or Vodafone, offering full coverage where ground-based towers can’t reach.

Leadership: Abel Avellan’s Vision

Abel Avellan, Founder, Chairman, and CEO. Avellan is a seasoned veteran in the satellite industry. Before AST SpaceMobile, he founded and led EMC, a global satellite services company, which was acquired by Global Eagle.

Avellan’s vision is clear — turn space into a functional, scalable extension of terrestrial mobile networks. Under his leadership, ASTS has secured crucial partnerships and established itself as a first mover in direct-to-device (D2D) satellite communications.

Backing Avellan is Scott Wisniewski, AST SpaceMobile's President and Chief Strategy Officer. Wisniewski spent over a decade at Barclays leading telecom deals before jumping to ASTS. He’s now key to scaling ops and locking down partnerships on both the commercial and defense sides.

Strategic Partnerships: Commercial and Defense

ASTS has lined up partnerships with some of the biggest telecom names globally. These deals give them immediate scale and clear paths to revenue.

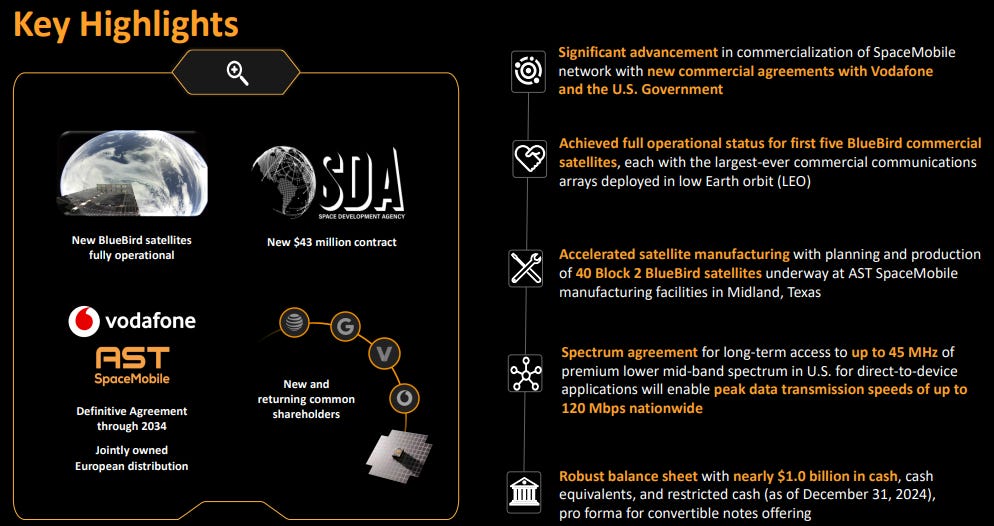

Vodafone: ASTS signed a long-term commercial agreement with Vodafone through 2034, covering 20+ countries in Europe and Africa. They’re also jointly launching SatCo, a European satellite service provider aimed at delivering 100% geographic coverage.

AT&T & Verizon: ASTS successfully tested two-way video calls on unmodified smartphones with both U.S. telecom giants. FCC approvals are already in place for nationwide service trials.

Rakuten (Japan): Testing underway to extend services across Asia.

U.S. Space Development Agency (SDA): ASTS secured a $43M contract after successful satellite testing, marking their entry into government defense contracts.

These partnerships alone represent access to nearly 3 billion subscribers globally.

Financials & Capital Position

AST SpaceMobile released their Q4 and full-year 2024 earnings on March 3, 2025. Here are the key highlights below:

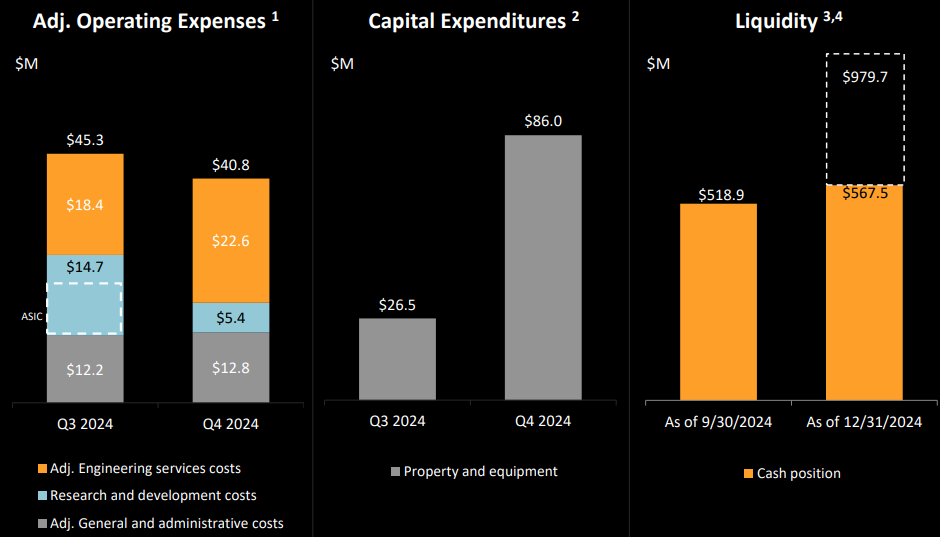

Q4 Operating Expenses: $60.6M, down $6M QoQ from $66.6M in Q3. This is the second straight quarter they’ve cut spending while ramping up production.

Adjusted Operating Expenses: $40.8M, down QoQ from $45.3M in Q3. This drop was mainly driven by lower R&D spend, marking two consecutive quarters of disciplined cost control while scaling up production.

Cash Position: Nearly $1B after raising $460M through convertible notes, with minimal (~3%) dilution. The notes were priced at a 100% premium to the previous share price.

Revenue: Still pre-commercial, but they locked in $43M from the U.S. Space Development Agency and formalized long-term agreements with Vodafone—setting up meaningful revenue inflection starting 2025.

CapEx: Approximately $460M capitalized property and equipment costs as of year-end, heavily invested in satellite production facilities and launch prep.

Looking back, they’ve managed to steadily bring down expenses while accelerating manufacturing and keeping the balance sheet strong. They’re also actively working to secure over $500M in non-dilutive capital from U.S. and international agencies, further cushioning their cash runway and reducing financing risks.

Launch Partners: Booking the Runway

Scaling a satellite network isn’t just about building satellites—it’s about reliably getting them into orbit. AST SpaceMobile has lined up multiple launch partners to ensure smooth, consistent deployment of their growing fleet.

Their primary launch partner is SpaceX, leveraging Falcon 9’s rapid cadence and cost-efficient launches. ASTS has secured enough capacity with SpaceX to cover approximately 60 satellites through 2025 and 2026, keeping timelines predictable.

But ASTS isn’t betting on a single horse. In late 2024, they signed a multi-launch agreement with Blue Origin, utilizing their upcoming New Glenn rocket for additional flexibility and launch capacity.

And they’re going global — ASTS recently announced a contract with the Indian Space Research Organisation (ISRO) to launch their next-gen Block 2 BlueBird satellites. The first of these is scheduled for May 2025 aboard ISRO’s powerful LVM3 rocket.

By partnering with multiple reliable launch providers — SpaceX, Blue Origin, and ISRO — ASTS is diversifying its runway and de-risking its aggressive satellite rollout plans. It’s a calculated move to keep scaling without delays.

Scaling Production & Spectrum Advantage

Production is accelerating. ASTS has:

Fully operational 5 BlueBird satellites.

Manufacturing underway for 40+ Block 2 BlueBird satellites.

Secured launch capacity for ~60 satellites through 2026.

A new Spain facility opened to expand manufacturing and testing.

In the U.S., they’ve secured long-term access to 45 MHz of mid-band spectrum, allowing up to 120 Mbps data speeds. This complements their partnerships with MNOs and strengthens their position in the most valuable wireless market globally.

Risks & Challenges: What Could Go Wrong?

Of course, no investment comes without risk — and ASTS has its share of hurdles to clear:

1. Capital-Intensive Business Model

Deploying and maintaining a satellite constellation isn’t cheap. Even with nearly $1B in cash, unexpected delays, cost overruns, or technical issues could force them to raise additional capital, potentially diluting shareholders.

2. Execution Risk

They’ve proven the tech, but scaling from 5 satellites to 60+ is a massive logistical challenge. Supply chain issues, manufacturing delays, or launch hiccups—especially when dependent on partners like SpaceX or ISRO—could push timelines back.

3. Regulatory & Spectrum Complexity

ASTS operates in a highly regulated space. While they’ve secured U.S. approvals, maintaining long-term spectrum rights and navigating global regulatory environments introduces risk, especially as geopolitical tensions fluctuate.

4. Rising Competition

The direct-to-device satellite race is heating up. Giants like SpaceX (Starlink) and Amazon (Project Kuiper) are eyeing similar plays, with deep pockets and resources to compete aggressively.

5. Commercial Revenue Still Ahead

While they’ve signed agreements, large-scale recurring revenue is still to come. Any delays in onboarding paying customers or scaling services could weigh on financial results.

The Big Picture: Infrastructure, Not Narrative

AST SpaceMobile isn’t just a space company. They’re building telecom infrastructure—satellites that plug into existing mobile networks, both commercial and defense.

Their dual-use tech is validated by live video calls, government contracts, and massive carrier partnerships. With nearly $1B in cash, reduced expenses, and an expanding satellite fleet, they’re well-positioned to turn space-based connectivity from a concept into reality.

But it’s a high-stakes game, and execution will be everything.

Space isn’t a side story. It’s the backbone. And ASTS is laying the bricks.

Am I Buying $ASTS?

Find out in my SavvyTrader Portfolio! Follow me using the link below!

Nice job. Note, they disclosed in the call Q&A the $43m is expected to accrue to revenue over 1 year. Scott: “this is $43 million that we expect to earn in the next twelve months or so, off of the first five commercial satellites and the first Block 2 satellite”

Important info missing from the 2 times the figure was mentioned.

Also the prepays by the MNOs would be important to add.