Axon: The 2025 DCA Plan

Earnings Review and Bull Tehsis

Axon’s Strong Q4 Earnings

Axon Enterprise came out with its Q4 FY2025 results on Tue Feby 25, a triple beat and closing +15% the next day.

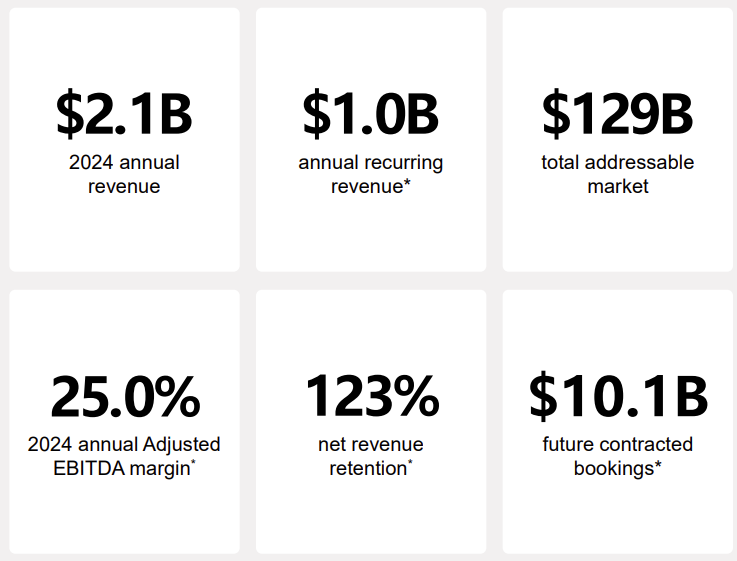

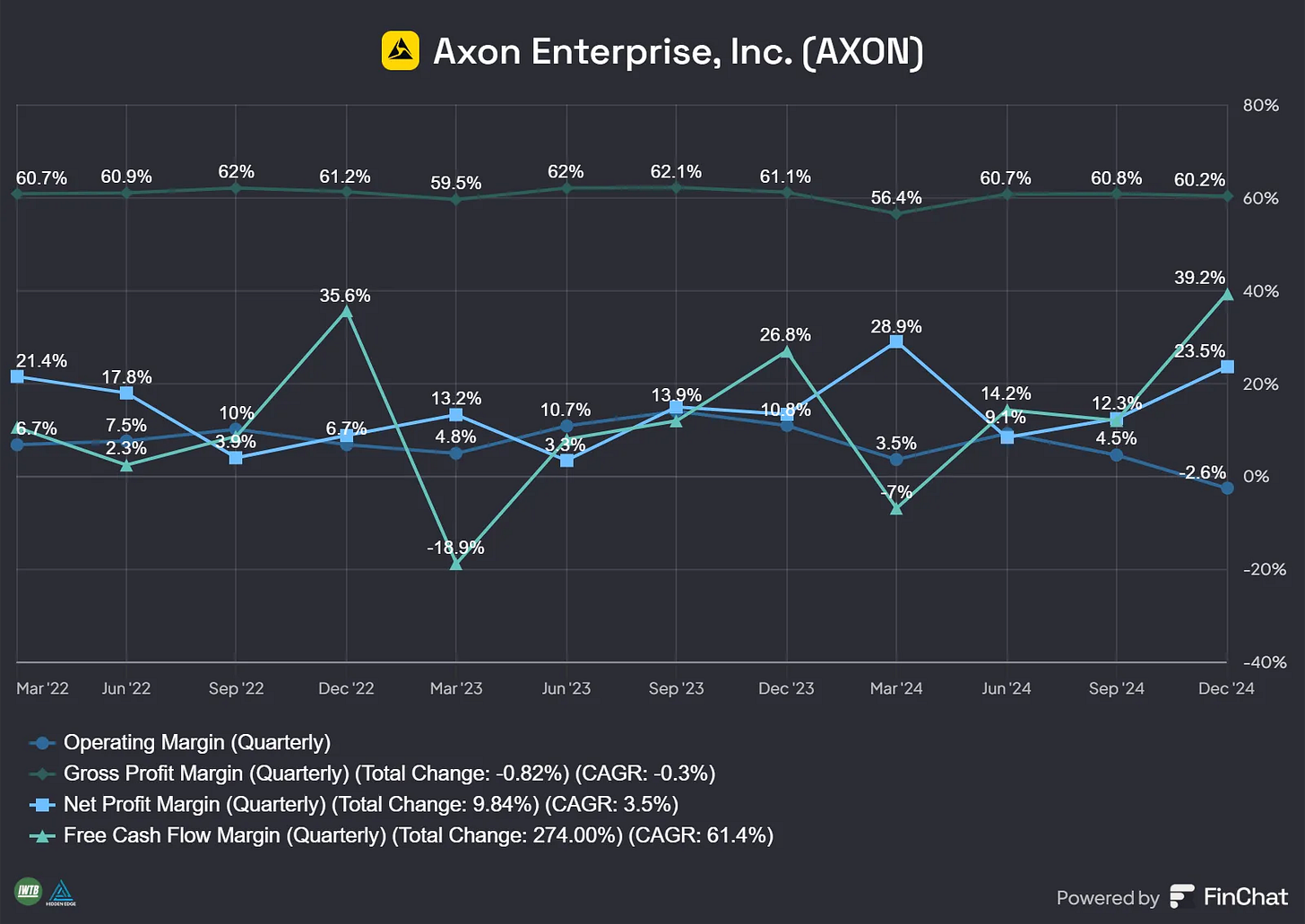

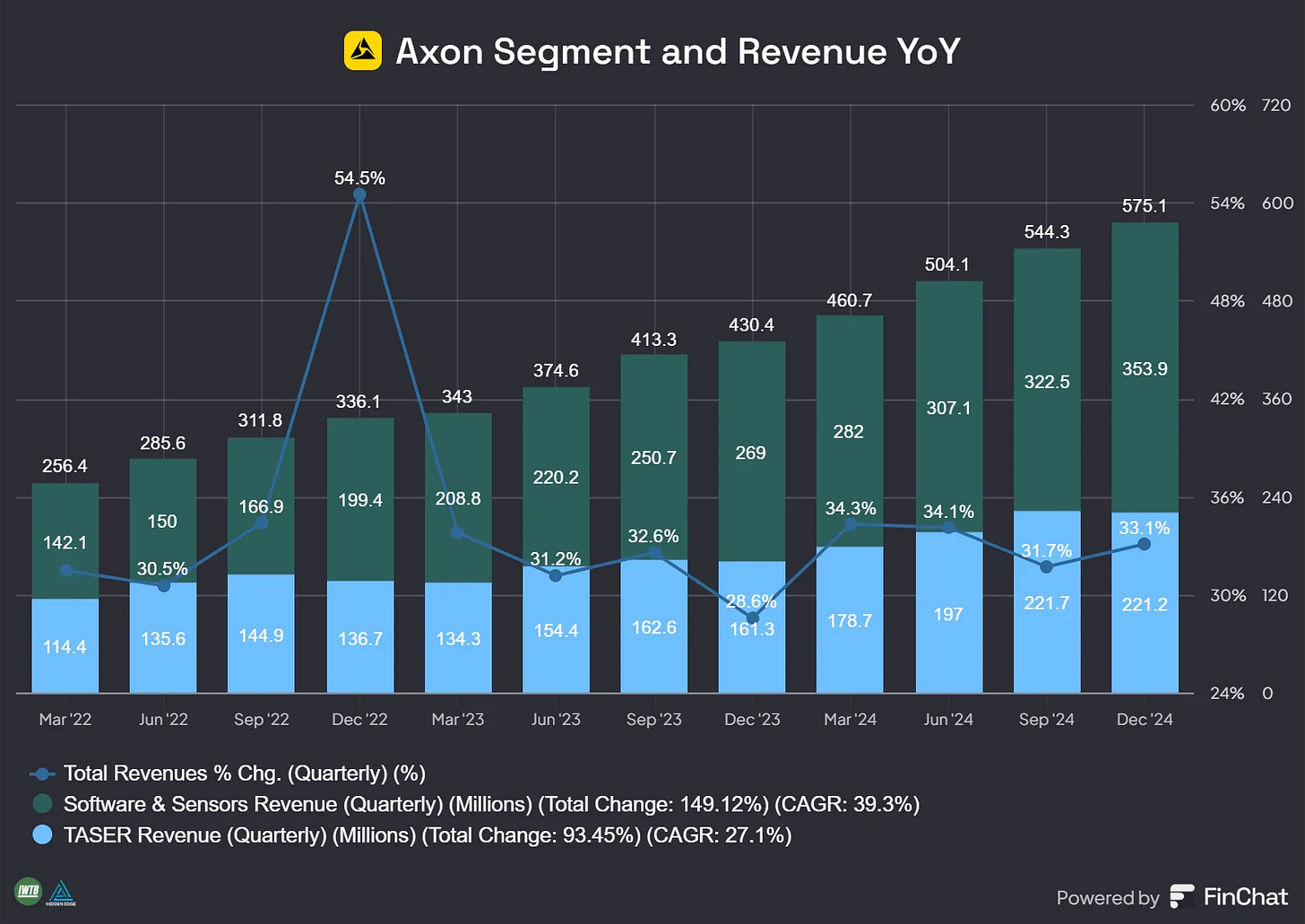

Revenue grew 33.1% YoY to hit $575 million, and both FCF and Net Profit margins improved, showing that Axon can balance growth with profitability. With FY2024 revenue over $2B, it’s clear that Axon knows how to scale.

TASER and Axon Cloud Driving Growth

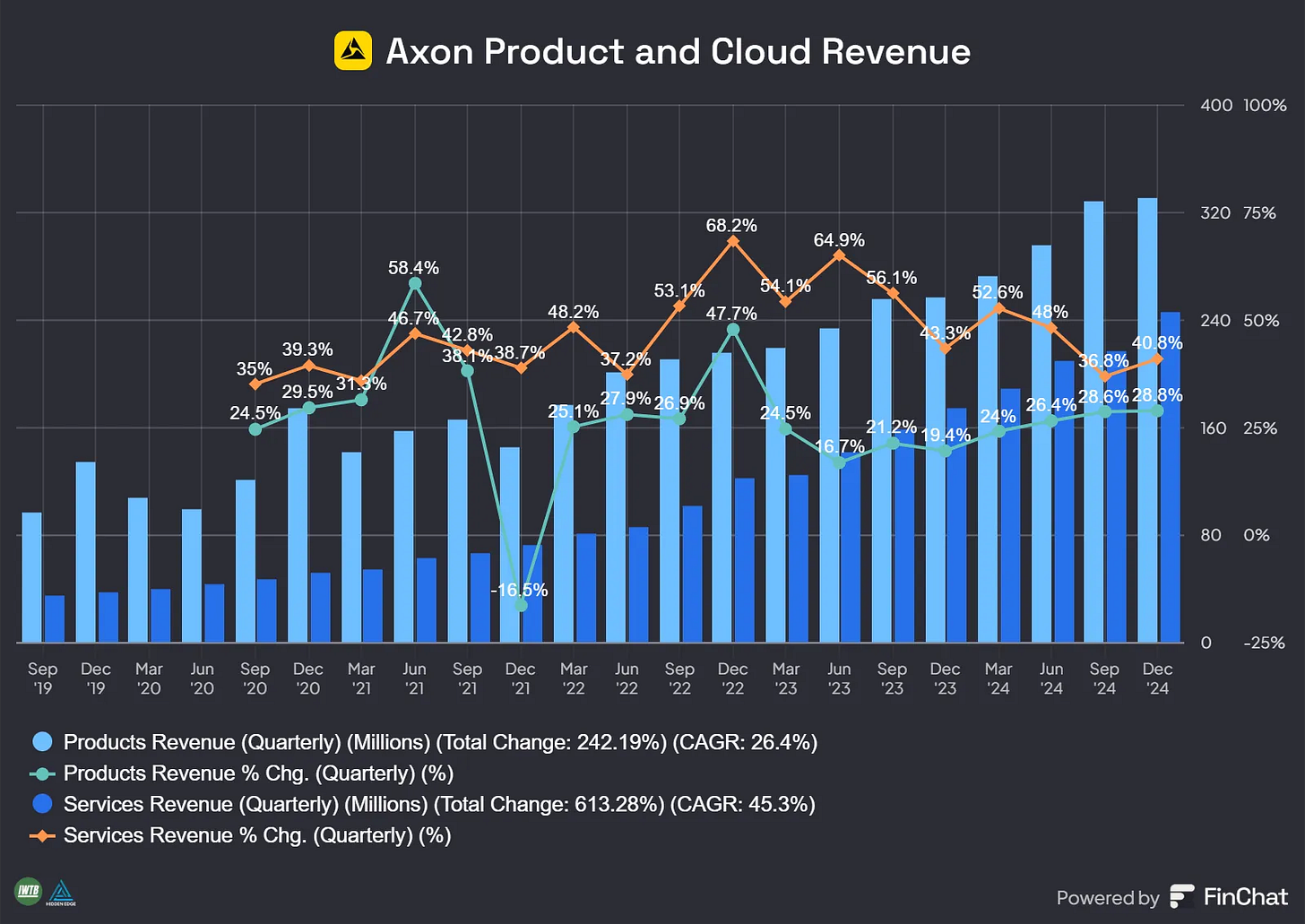

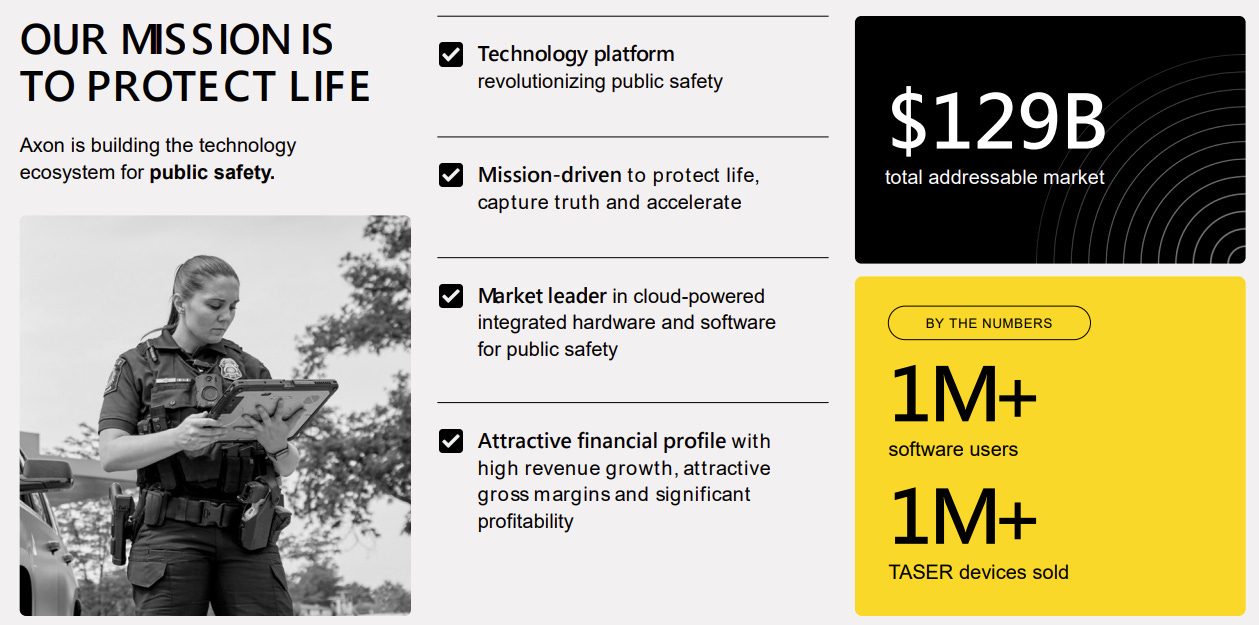

Axon’s business is split into two main parts: its TASER devices and its subscription-based Axon Cloud platform. TASER sales were up 37.1% YoY, proving there’s still plenty of demand for its signature product.

But their predictable segment Axon Cloud, which grew 40.8%, bouncing back from a deceleration and showing that its cloud services are catching on fast.

Key Metrics That Matter

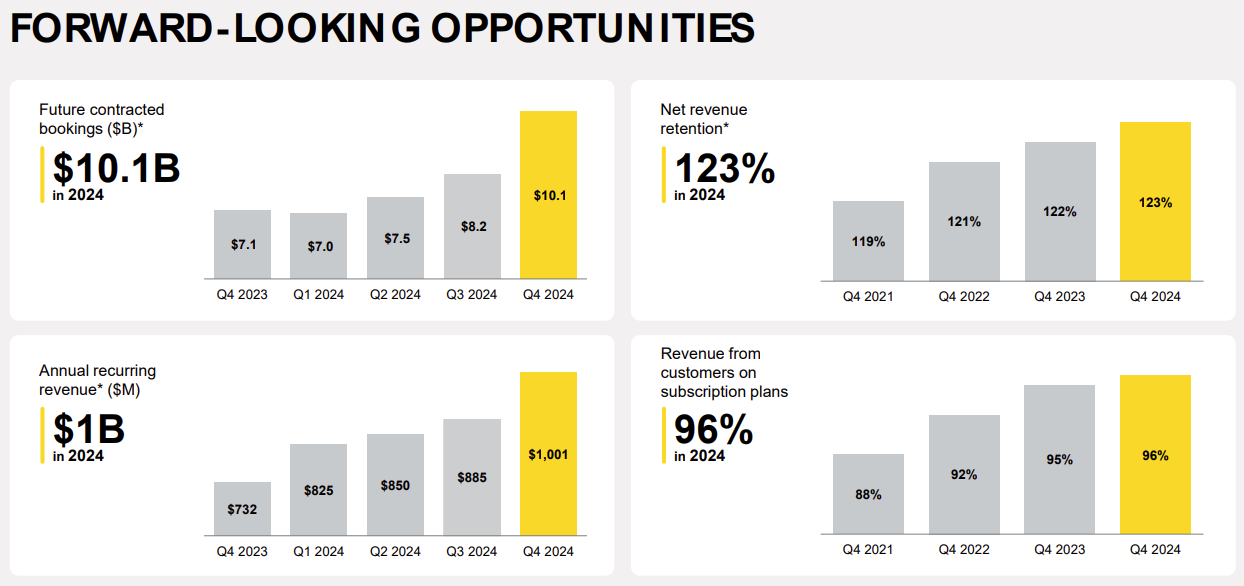

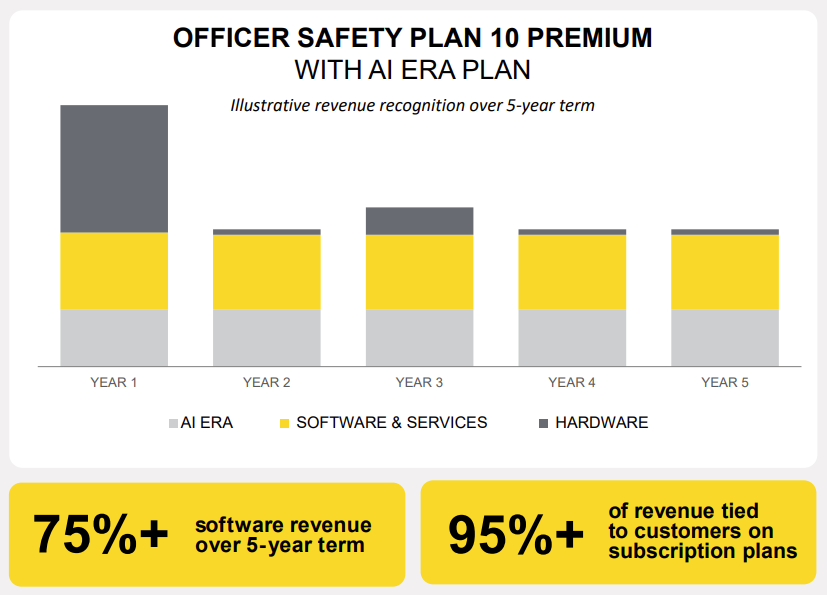

Annual Recurring Revenue increased to $1B, +36.7% YoY, which shows how strong the subscription side of the business is getting. The Net Retention Rate for the cloud segment was 123%, which means existing customers are spending 23% more than they did last year, not counting new customers. Plus, Axon has over $10 billion in future contractual revenue locked in, giving it solid visibility for years to come.

Building a Strong Ecosystem

Axon’s ability to create a sticky ecosystem is one of its biggest moats. With new products like AI-powered tools, DraftOne, and drones, the company is keeping customers hooked. It’s not just about government contracts anymore, either. Axon just signed its biggest deal ever with an enterprise customer, which really opens up its market potential.

Risks That Can’t Be Ignored

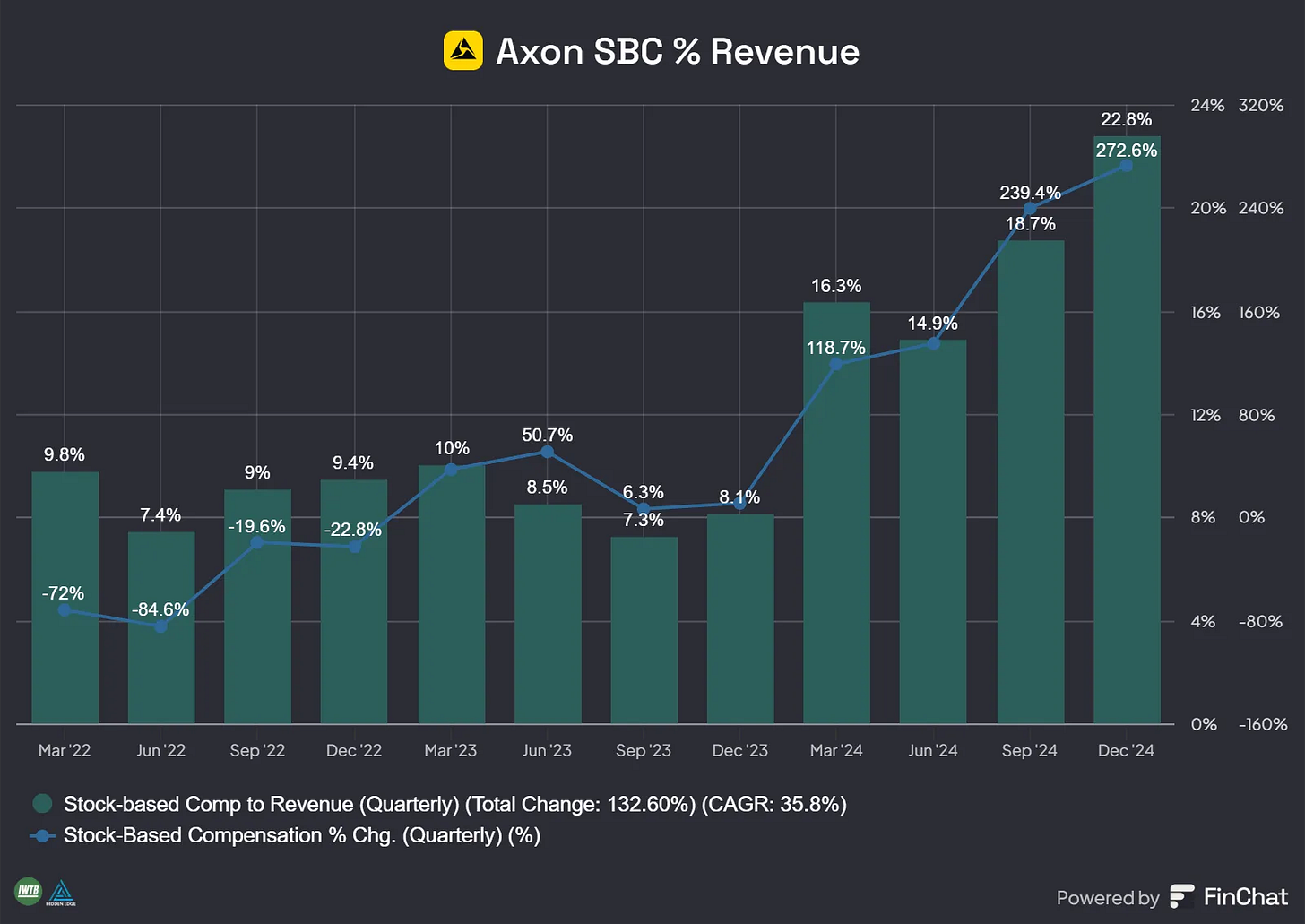

As good as things look, Axon does have some risks. The company mentioned supply constraints for the TASER 10 during its earnings call, which could slow down growth in the short term. There are also some regulatory challenges in Arizona that could complicate its plans to expand. On top of that, stock-based compensation (SBC) is rising, which might not sit well with investors worried about dilution.

That said, attracting top talent isn’t cheap, and the bet is that revenue growth will eventually balance out these costs.

Why I’m Bullish on Axon

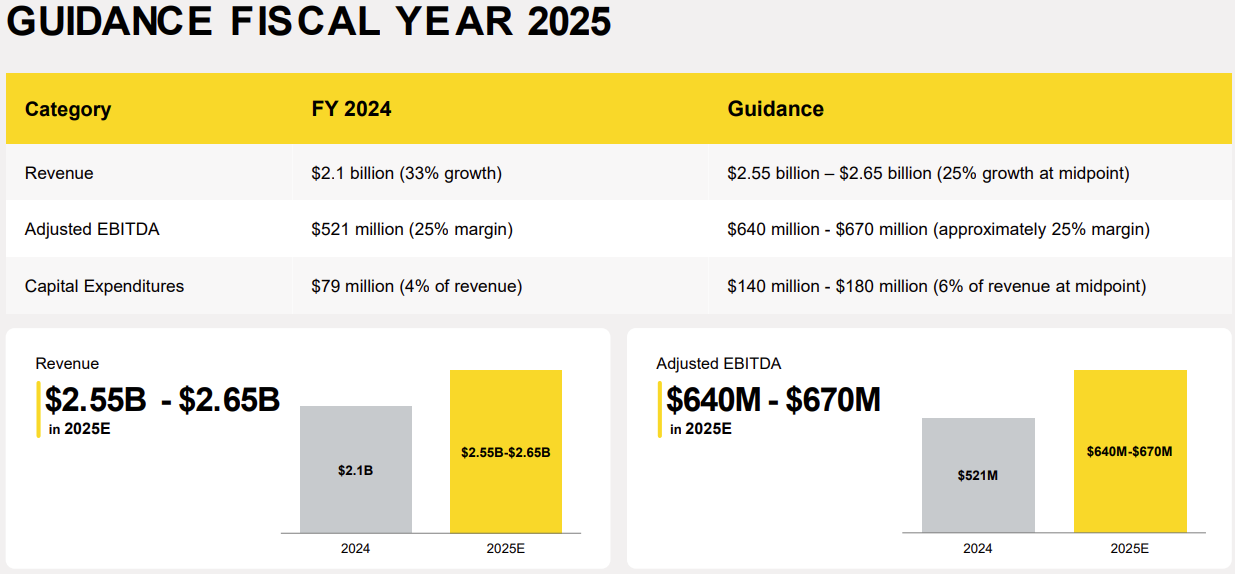

Looking ahead, Axon’s revenue guidance for FY2025 is between $2.55 billion and $2.65 billion, which would mean a 25% growth rate.

Management is doubling down on AI, cloud services, and international expansion, which makes a lot of sense given where the market is heading. With a strong lineup of multi-year contracts and investments in new tech like AI, robotics, and drones, Axon seems set up for a solid run. I’m sticking with $AXON for the long term and plan to keep DCA’ing through 2025.

A truly brilliant company, government revenue is extremely sticky too.