Bonds Sell Off, Gold Rallies, Dollar Strengthens. What is Happening?

Possible Reasons for Non-Correlating Market Behavior

In recent months, the market has shown many unexpected moves, deviating from traditional historical price action correlations. For instance:

Reflation Regime

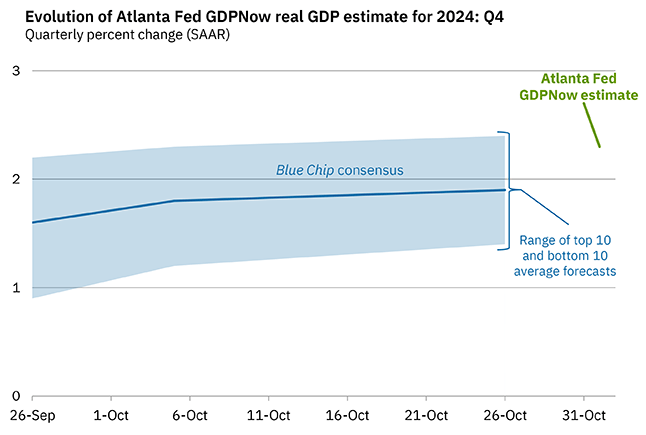

The economy shows resilience while inflation remains “sticky.” Unexpectedly, the unemployment rate held steady at 4.1% in October. Despite this, ADP Non-Farm Payrolls surged into double digits. Alarm bells about a spiraling job market are premature. Recent Hurricane impacts on the East Coast and ongoing strikes skewed the data. Focus on the trend: the economy is resilient. The Atlanta Fed GDP Nowcast remains above 2%.

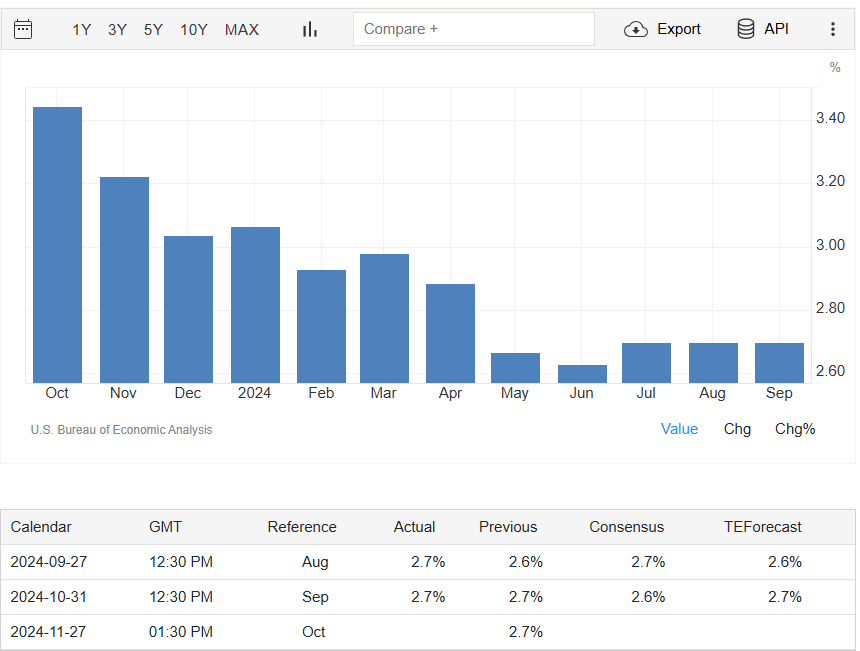

Inflation for Core PCE is at 2.7% just shy above the Fed’s 2% target.

So how does the market react? Well let’s take a look at the different correlations below.

SPY to GLD Ratio

Trending down means Gold is outperforming S&P500.

On a much larger time frame, there have been periods where Gold has outperformed the S&P500.

During the Great Financial Crisis of 2007-2009, we experienced deflation, market fear, and a global recession affecting central banks. Gold rallied until recession fears eased in 2011.

From late 2018 to summer 2020, two significant events occurred. In late 2018, Powell and the FOMC raised rates against market behavior, causing the stock market to drop almost 15% until the Powell Pivot, when they declared a halt on rate increases. Gold outperformed the S&P 500 through COVID until the Oil Crisis in spring 2020. Since then, the market has outperformed gold, up until…

The recent Fed Hike Cycle, where the Federal Reserve increased rates at an unprecedented pace. In 2022, all markets entered a bear market that bottomed in October 2022. The U.S. saw two consecutive quarters of slowing GDP, leading to fears of a stock market tumble. This changed with the release of ChatGPT 3.0, triggering the AI Evolution.

Now, gold has been outperforming the market since spring 2024.

Thesis: Gold is BULLISH during Reflation Regime.

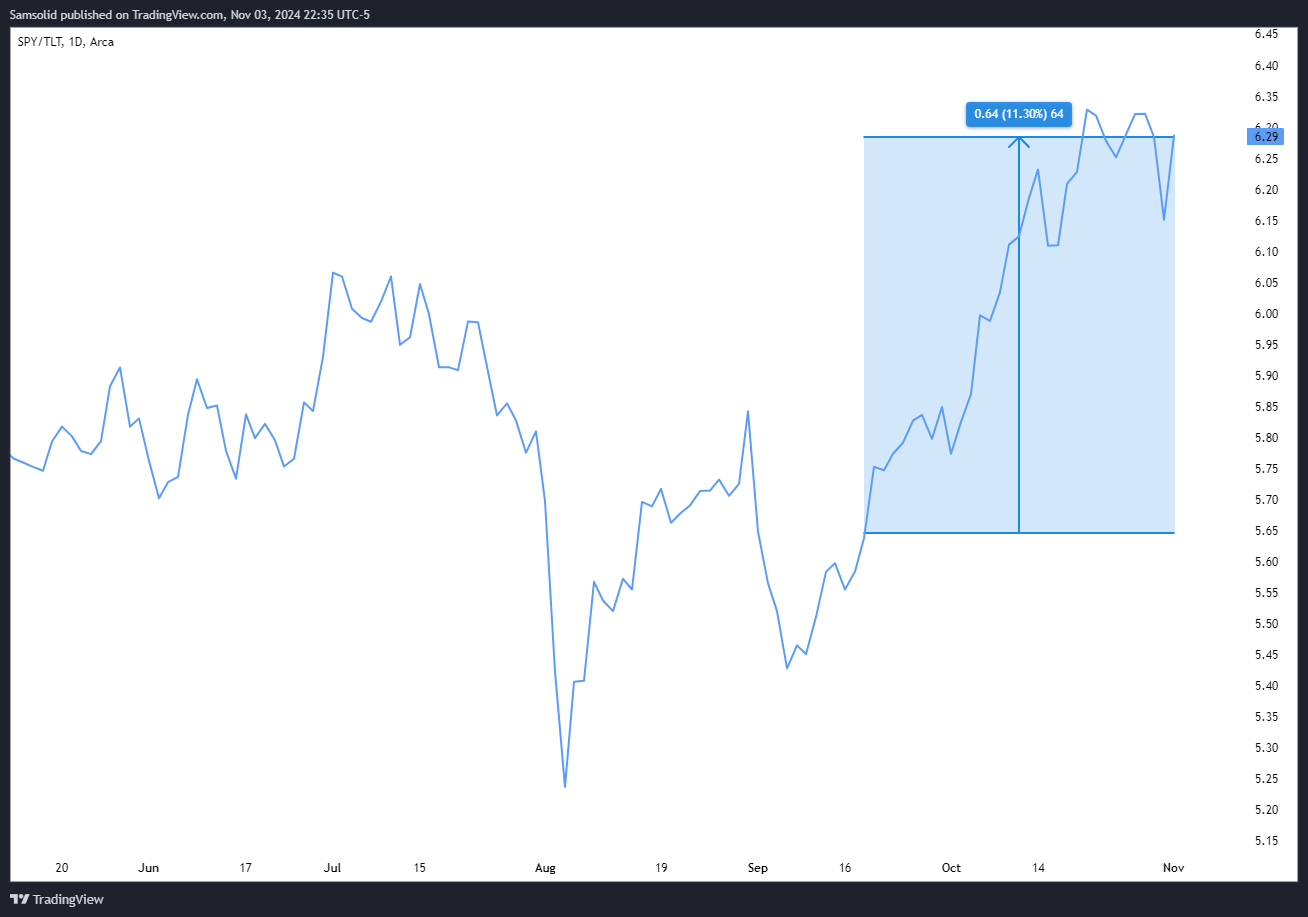

SPY to TLT Ratio

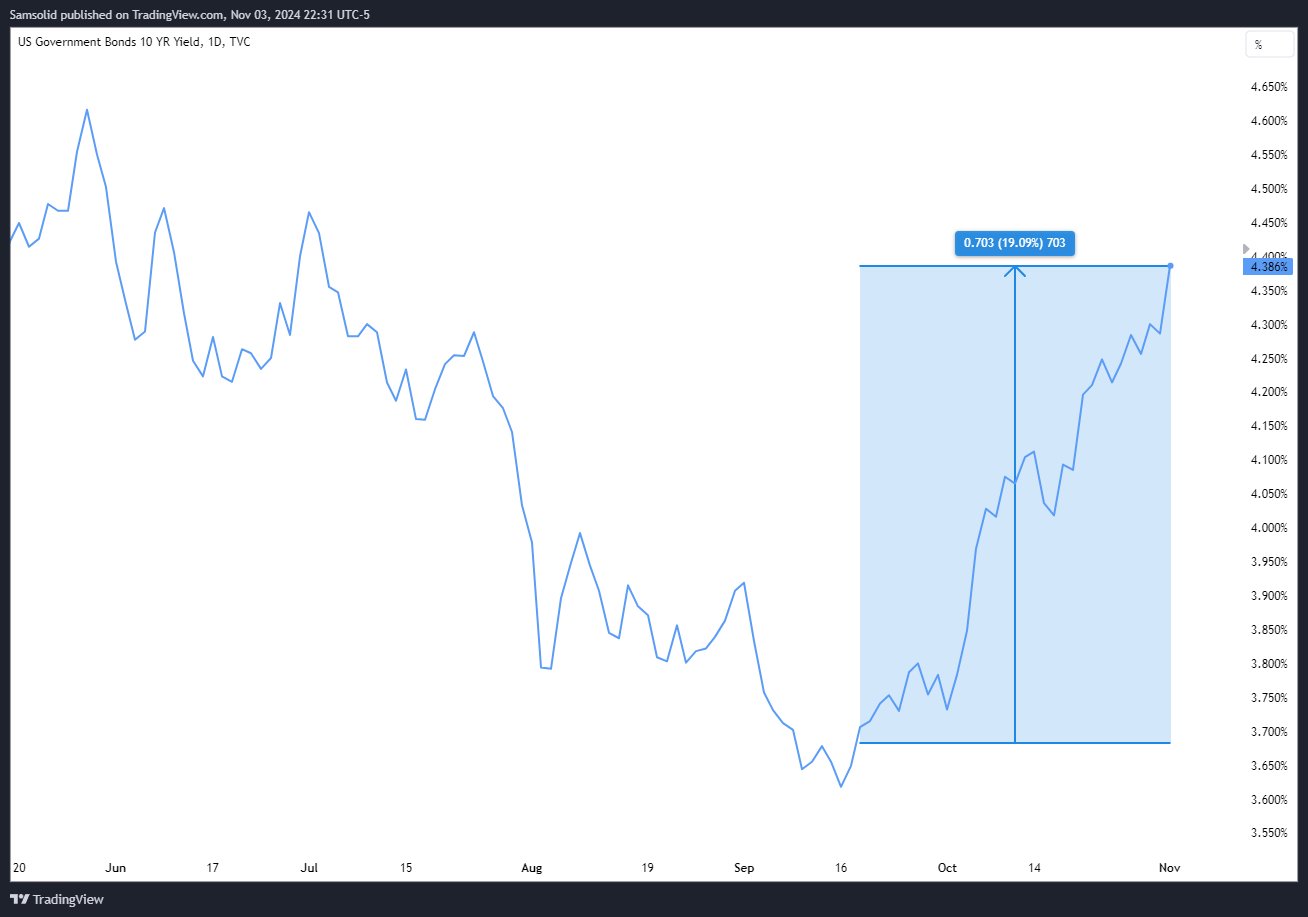

So what does everyone think… when the Fed begins a rate cycle, rates need to fall, right? Exactly. But the Fed only controls the short-term rates, not the long-term rates, unless there's yield curve control. Check out the recent long-term rates, specifically the 10-Year Treasury Yield.

The 10-Year Yield has surged over 70 basis points since the September 18 FOMC meeting, even as the Fed lowered rates by 50 basis points. As evident from the chart, bonds were heavily bought leading up to the meeting, catching bond bulls off guard. Keep in mind that bonds and yields are inversely correlated: when bonds rise, yields fall, and vice versa.

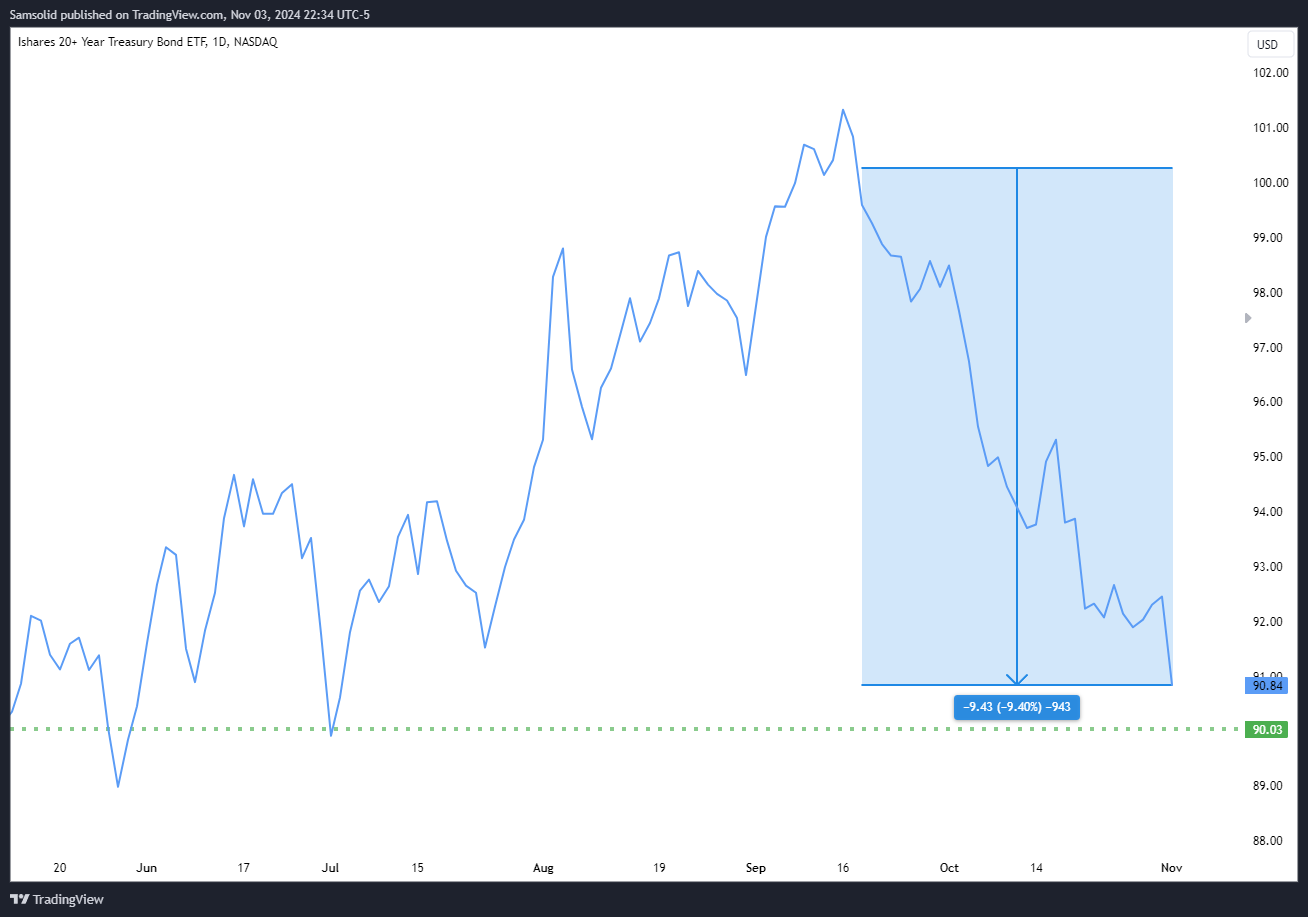

Now let’s take a look at how much return you received being long TLT since the FOMC.

You were essentially taken by surprise. Despite historical price performance, the TLT ETF was sold off heavily, favoring Paul Tudor Jones and Stanley Druckenmiller. How does this compare to the SPY ETF?

Extremely bullish risk assets which favors the Reflationary Regime playbook.

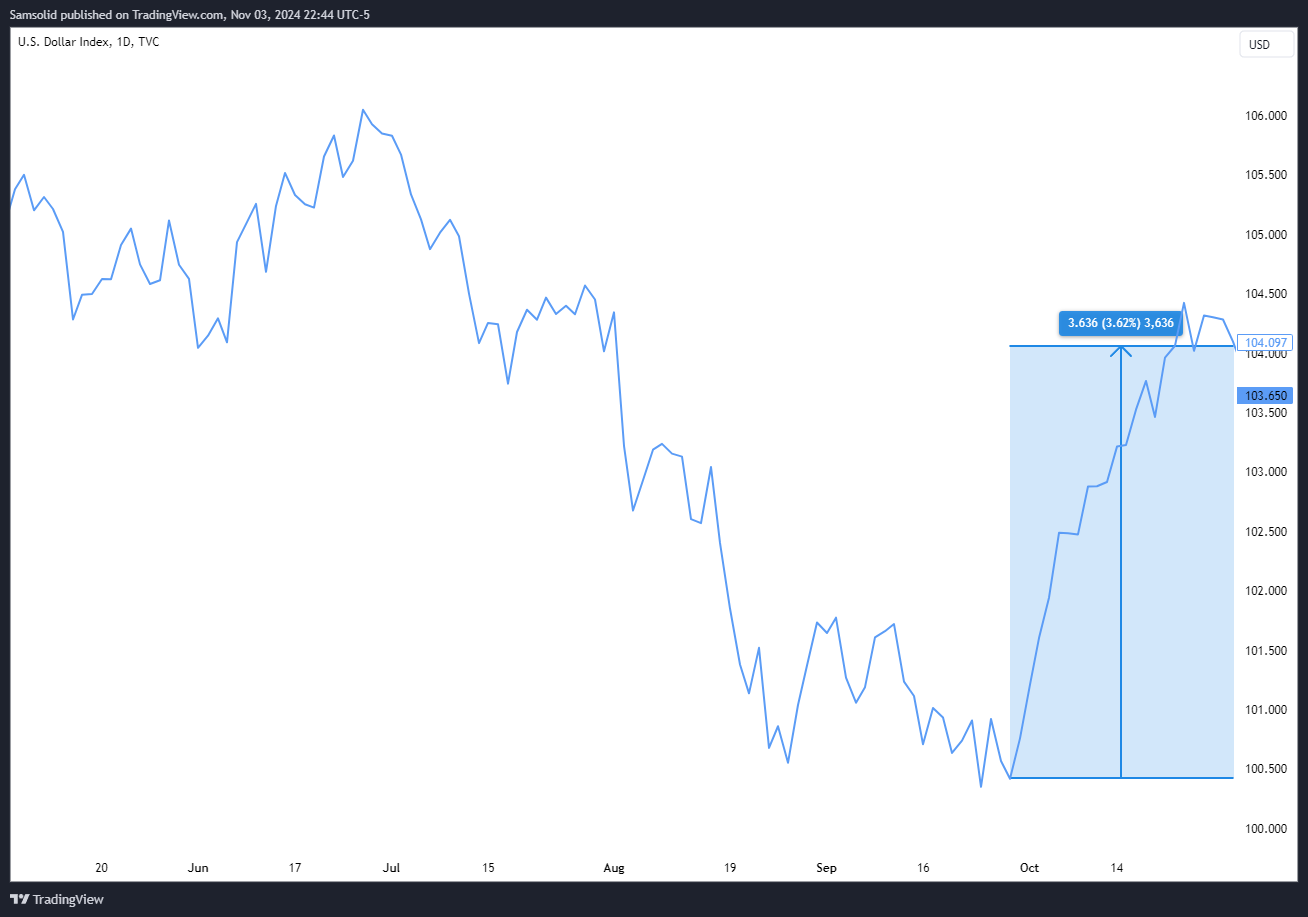

2024 Presidential Election Markets

Let's revisit the Trump Trade. Trump strongly supports cryptocurrency and decentralized banking. He aims to raise about $5T to $7T in government debt through tax cuts and increased tariffs. This move can be seen as a push towards de-globalization and income equality. However, the tax cuts primarily targeted corporate tax rates, and the tariff hikes were meant to address the trade deficit and strengthen the US dollar. By encouraging more exports, the number of transactions involving the US dollar increases. As more countries buy US exports, they need to convert their currency to US dollars, which is extremely bullish for the $DXY. Consequently, we've seen a significant rally in the $DXY.

This rally is significant for the US Dollar, the world's reserve currency. A 3.62% increase in one month represents a substantial amount of money.

Despite the negative correlation between the US Dollar and stocks, the market rallied. This trend persisted until the last two weeks, coinciding with Kamala Harris gaining ground against Donald Trump in the betting markets.

My Thesis

Summing it all up, I firmly believe that it doesn't matter who is elected President. The market dislikes uncertainty, and in the past week, we've seen gridlock in the betting markets for the 2024 Elections. This has unwound the Trump trade and introduced more volatility. With the election just two days away, we're back to where we were a few weeks ago.

Once the election results are in, the markets will likely rally as the uncertainty dissipates. I'm bullish on all dips, long on risk assets, gold, and cryptocurrency, and underweight on bonds.