Bounce or Tom Lee Style?

Is this a Bull Trap?

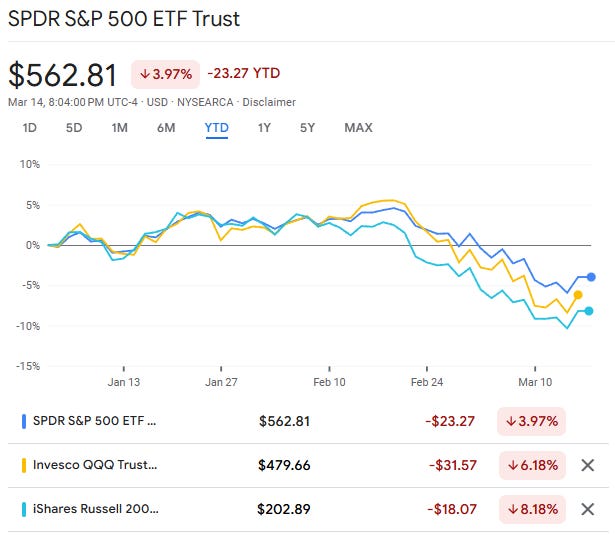

Alright, let's talk about today. NU up 9%—love to see it. But it’s not just NuBank. The entire market ripped higher. QQQ up 2.5%, SPY up 2%, and IWM up 2.5%.

This is a big bounce off correction territory. Yesterday was the first time since the bear market ended in 2022 that we saw a daily close in correction territory for the S&P 500. From ATHs, we hit 10% down, QQQ was down 13.2%, and IWM was knocking on the door of a bear market at 18.5% down.

And let’s not forget, this whole thing has been fast.

Fifth fastest correction in S&P history (20 days)

Hit an all-time high on February 19, then basically straight down

Only four other times have we seen a drop of this magnitude and speed

But unlike COVID, there was no black swan event here. This was more about fear—tariffs, recession talk, and rate uncertainty all swirling together.

So What Now? Bullish or Bearish?

Look, I’m still long-term bullish, but short and medium term? Skeptical.

Today’s rally was probably a short squeeze. Too many traders were leaning bearish, expecting continuation, and got caught.

Check this stat:

S&P 500 and NASDAQ had 16-day streaks without back-to-back green closes

We hadn’t seen a correction since 2023 on a daily close

IWM was almost in a bear market yesterday at 18.5%

People got way too bearish, way too fast. That made this bounce inevitable.

Frothy or Justified?

The market had gotten overheated. We were trading at nearly 24 times forward earnings, which is well above the historical average. Now we’re around 21 times, which is still elevated but better than where we were at the highs of SPX 6100.

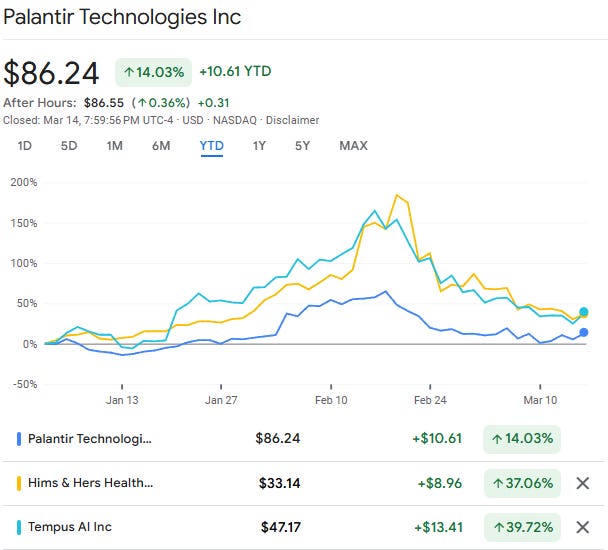

Despite the pullback, some stocks are still holding up surprisingly well.

PLTR is not far from its all-time highs and is still green year to date

HIMS and other small caps with strong retail backing have held up better than expected

But the real question is whether this rally has legs or if we are heading for lower lows.

Market Uncertainty is Still High

There’s no clear answer yet. The biggest issue is uncertainty around tariffs, economic slowdowns, and corporate spending. CEOs across multiple earnings calls have warned about potential slowdowns, but no one knows how deep the impact will be.

Markets tend to bottom when things feel their worst. Today may have been a technical bounce, but was there any fundamental change? Not really.

October 2022 is a perfect example. That was around the time a CPI report came in hotter than expected, and everyone panicked about inflation running out of control. Yet, by the end of that day, the market closed green. That kind of reversal is what you want to see for a true bottom—not just a random short squeeze with no news to justify it.

What’s Next?

Still watching for better prices before getting aggressive. If we drop further, I’ll be buying in tranches, but I want a clearer picture before making any major moves.

Nubank had a strong day, up 9%. A lot of that was driven by the appreciation of the Brazilian real against the US dollar. Nubank tends to track the strength of the local currency, so that’s something I’m keeping an eye on.

Aside from that, the overall market is still in wait-and-see mode. No major hedges or puts, just staying patient and keeping dry powder ready.

Coming into the weekend, I’m basically flat on the week. Maybe even a little green. Year to date, I’m still down a few percentage points from break-even, but I’m not affected by daily PnL. More focused on the long-term moves.

Wouldn’t mind a bit more downside to get better entries, but if that’s not the case, there will always be deals somewhere in the market.