Cloudflare FY2024 Q3 Earnings Review

Quick Analysis on $NET Earnings

Cloudflare $NET FY2024 Q3 Earnings

FY2024 Q3

✅Revenue: $430.1M vs $423M-$424M est

✅EPS: $0.20 vs $0.18 est

✅Non-GAAP Income: $72.6M vs $50-$51M est

FY2024 Q4 Guidance

❌Revenue: $451-452M vs $455.7M previous quarter

✅EPS: $0.18 vs $0.17 previous quarter

FY2024 Full Year Guidance

✅Revenue: $1.661B-1.662B vs $1.657B-$1.659B previous quarter

✅EPS: $0.74 vs $0.70-$0.71 previous quarter

📈 Closing Price Before Earnings: 95.69 [+3.41%]

📉 After Hours Price: 89.49 [-6.23%]

📉 Day After Closing Price: 91.25 [-4.61%]

Earnings Review

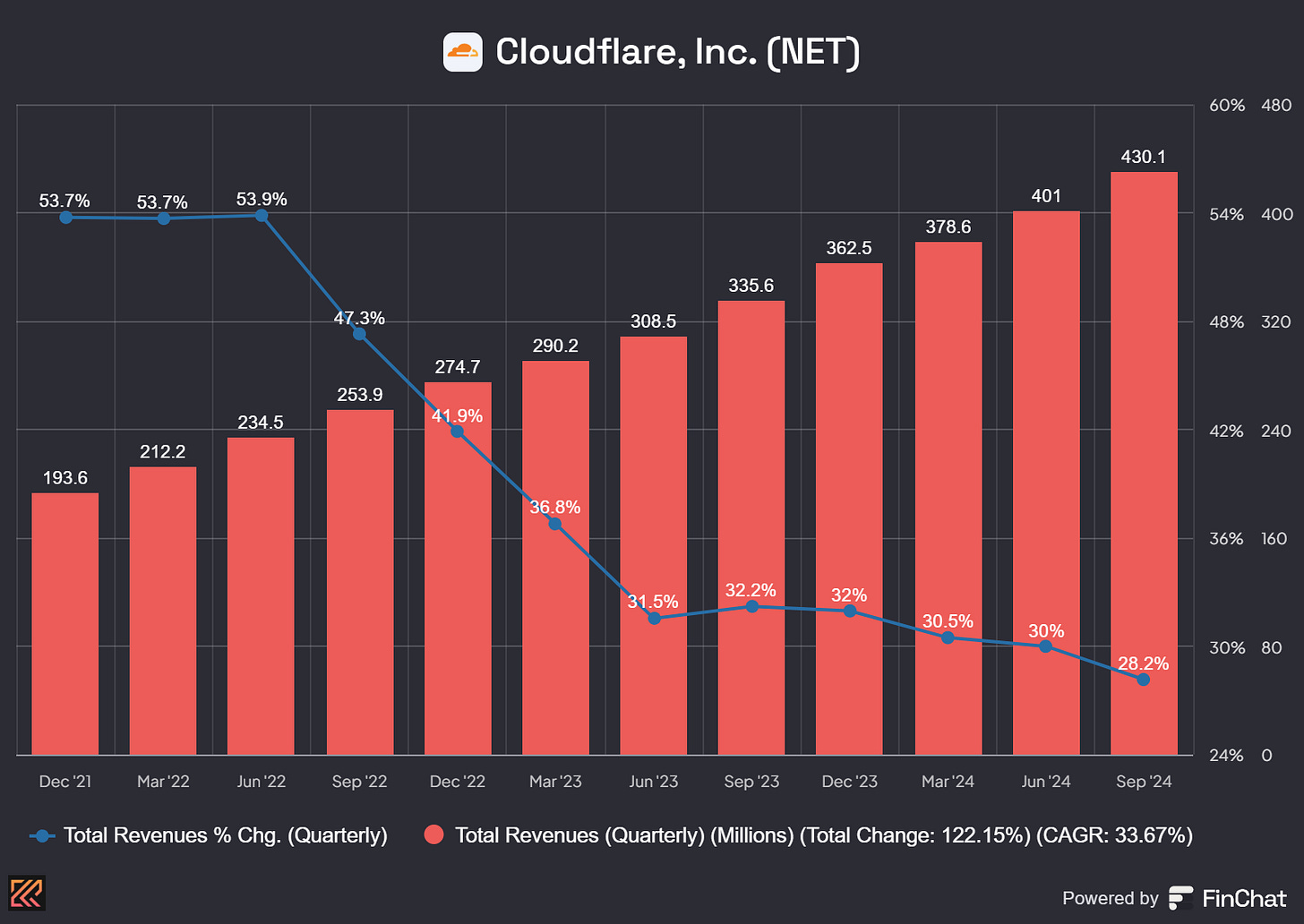

Revenue: We decelerated on the YoY growth rate sequentially from 33% to 30% to 28%. This was not the best quarter.

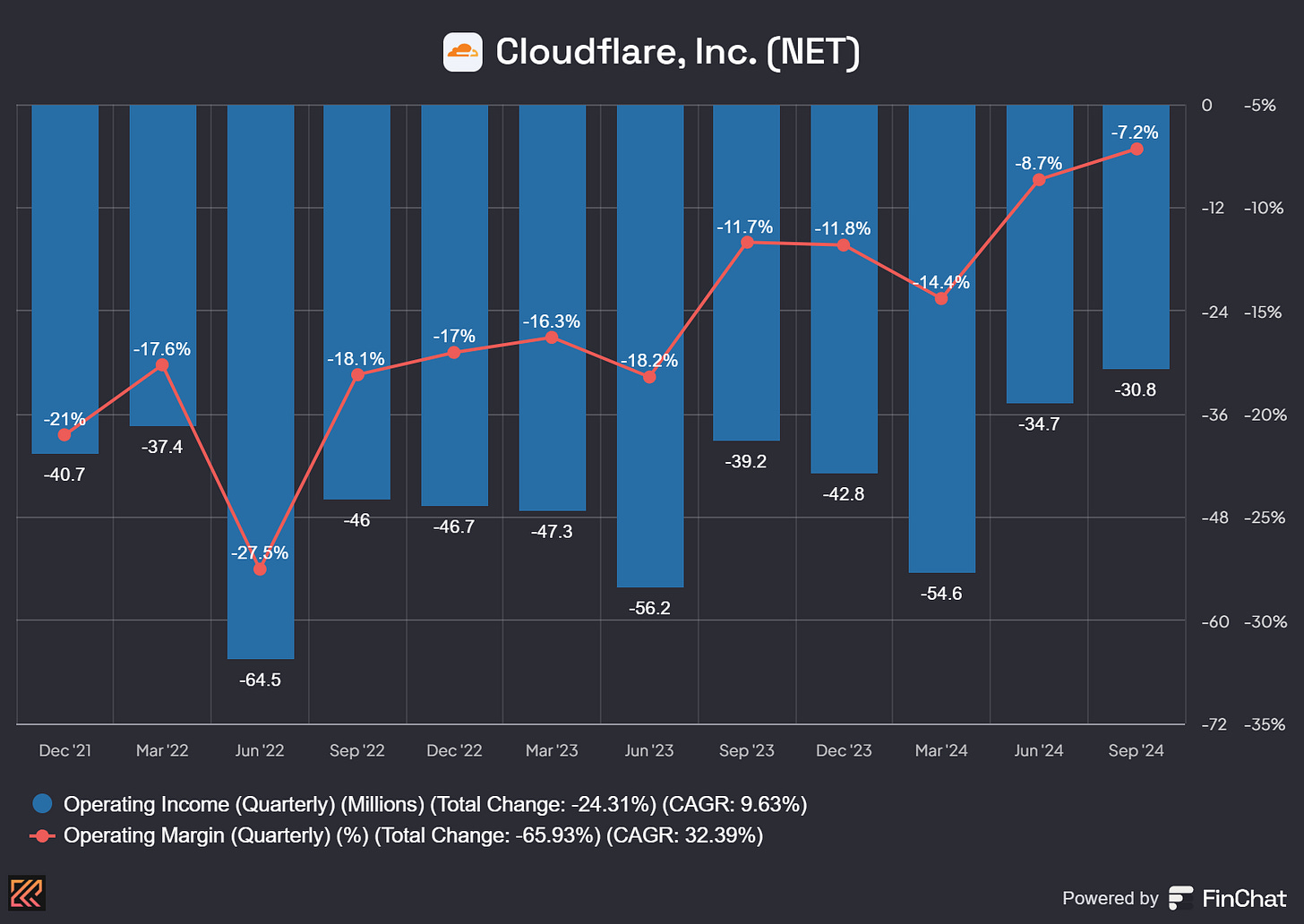

Operating Margin: EBIT as a % of revenue (Operating Margin) is heading closer toward profitability, we cannot deny that. This could be one of the fewest profitable cloud company in the next few quarters on a GAAP Operating basis.

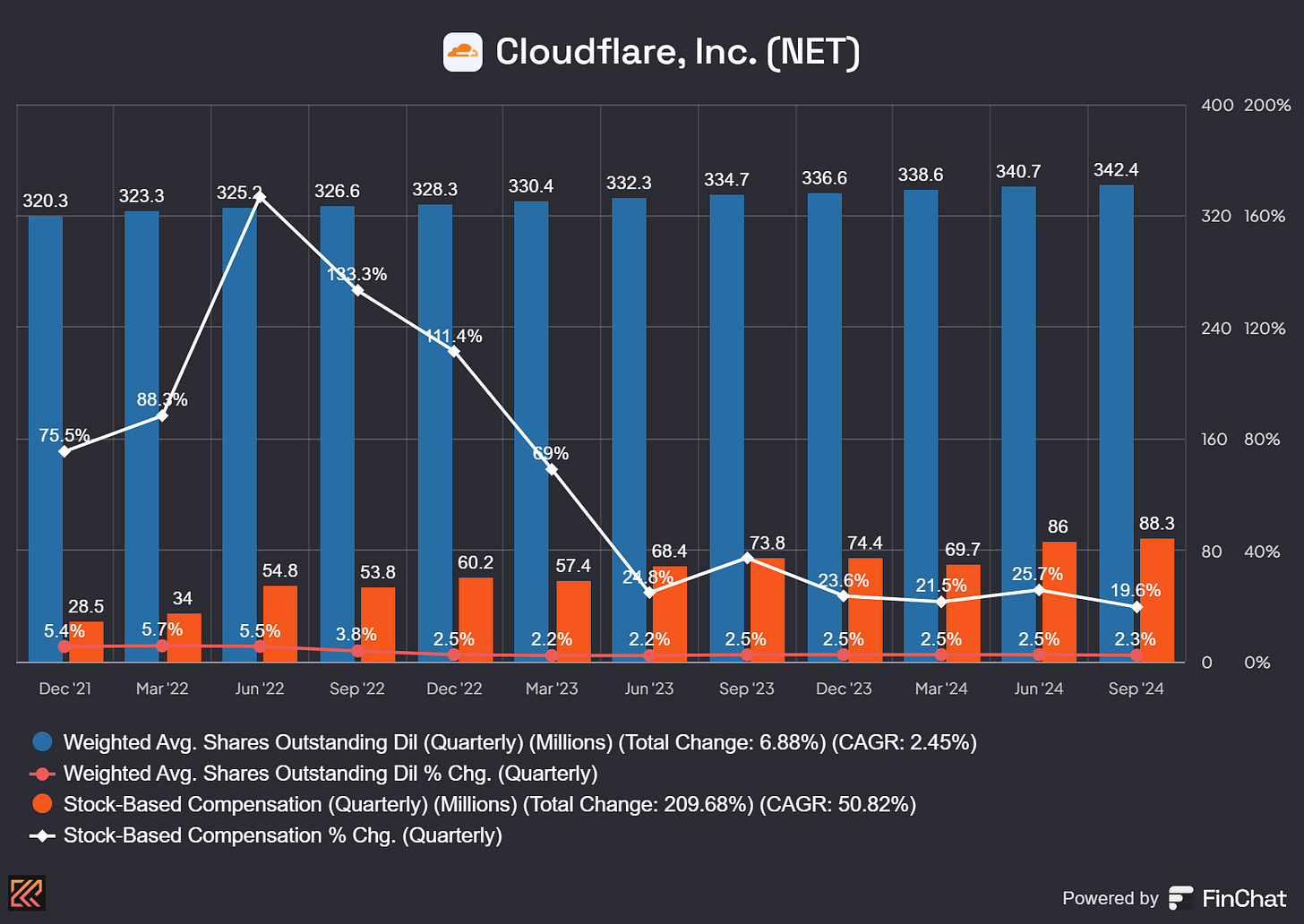

Stock-Based Compensation (SBC): Without any fluff, software companies must secure top-tier talent to stay competitive. Stock-based compensation (SBC) is being maintained at a reasonable level, with a 2.3% year-over-year increase in diluted share count and a 19.6% year-over-year rise in SBC. Notably, revenue is growing at a faster pace than SBC, with a 28% year-over-year increase. This is positive news.

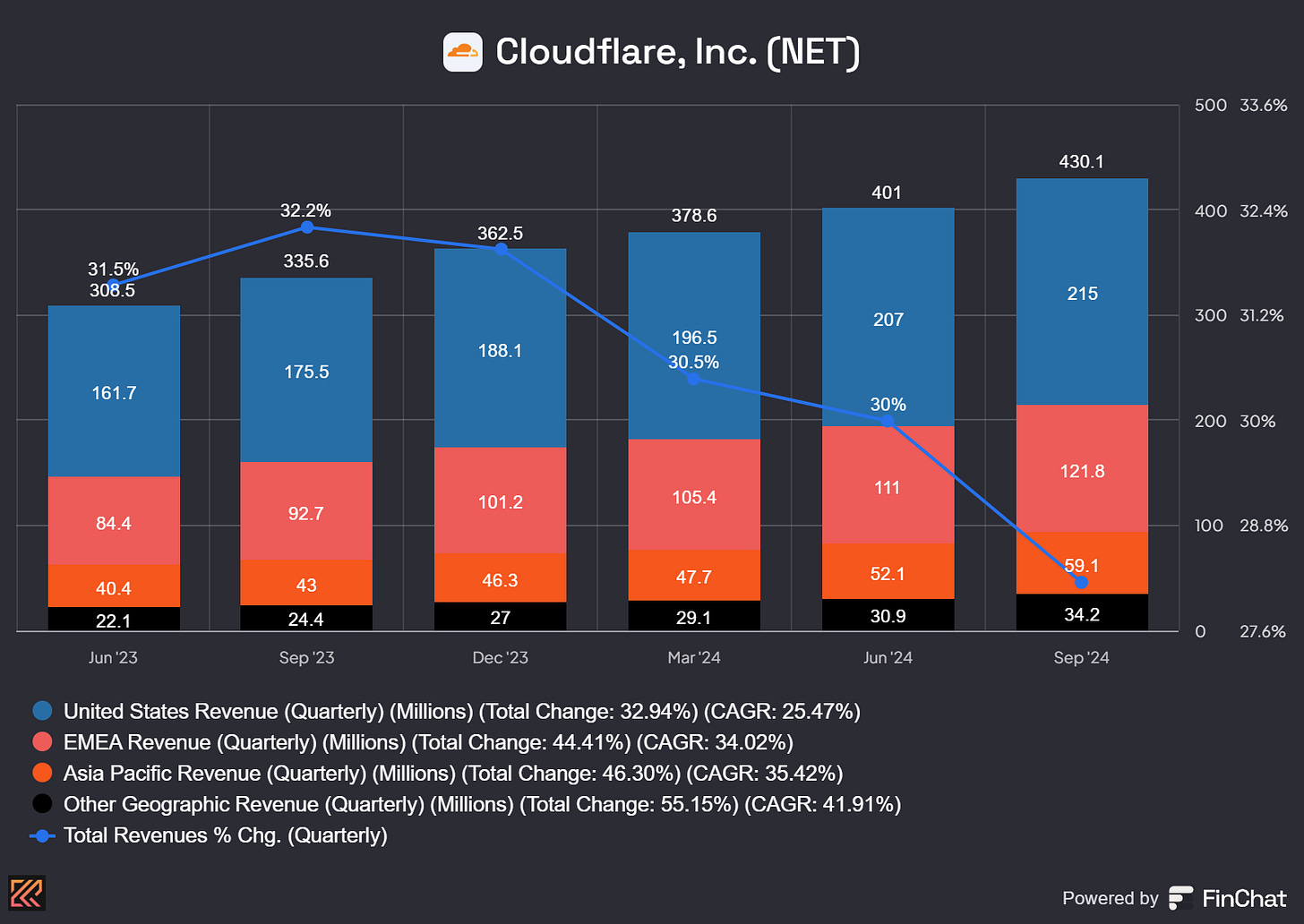

Outlook: Although it wasn't the best quarter overall, Cloudflare remains a flagship company in the cloud industry, offering competitive products and expanding its moat by controlling over 85% of all DNS packets on the internet. The company's revenue continues to grow globally, with the fastest-growing regions being EMEA and Emerging Markets. My exposure to Emerging Markets worldwide is driven by this very growth. With low interest rates and liquidity injections, there will be ample liquidity at cheap prices globally, setting Cloudflare up for continued success.

Summary of Cloudflare Q3 '24 Earnings Call

Positives:

Strong Financial Performance: Cloudflare reported $430.1 million in revenue for Q3, a 28% year-over-year increase. Operating income reached $63.5 million, a 50% increase from the previous year, showcasing the company's effective cost management and ability to scale profitably.

Customer Growth: The company gained 219 large customers (those paying over $100,000 annually), bringing the total to 3,265, also a 28% year-over-year increase. Notably, 35% of the Fortune 500 are now Cloudflare customers, reflecting the growing trust and reliance on Cloudflare’s services by some of the largest companies in the world.

High Gross Margin: The gross margin remained robust at 78.8%, surpassing the long-term target range, indicating strong operational efficiency and cost control measures.

Free Cash Flow: Free cash flow was $45.3 million, exceeding expectations and demonstrating effective cash management even while investing in growth. This is indicative of the company's strong financial health and ability to generate cash organically.

Go-to-Market Transformation: The company is undergoing a significant transformation in its sales organization, expected to enhance sales productivity and capacity, particularly in the enterprise segment. This strategic shift aims to optimize the sales process, making it more efficient and better aligned with customer needs.

Negatives:

Sales Cycle Lengthening: There were reports of longer sales cycles, especially in the U.S., with some larger deals slipping out of the quarter. This suggests potential challenges in the sales process during the transition under new leadership, potentially impacting short-term revenue recognition.

Dollar-Based Net Retention Decline: The net retention rate decreased to 110%, down 2 percentage points from the previous quarter, attributed to a shift towards pool of funds deals, which can impact revenue recognition. This could reflect challenges in upselling and retaining existing customers.

Pressure from Pool of Funds Deals: While seen as beneficial long-term, these deals are currently exerting downward pressure on net retention and revenue recognition, affecting short-term financial metrics. The strategic shift requires careful management to balance immediate impacts with long-term gains.

Cautious IT Spending Environment: The overall IT spending environment remains cautious, with customers scrutinizing deals and emphasizing cost efficiency, potentially impacting future sales growth. This reflects broader market trends and economic conditions that could pose headwinds for the company.

Earnings Call Thoughts: While Cloudflare showed strong financial results and customer growth in Q3 '24, challenges such as lengthening sales cycles and a decline in net retention due to strategic shifts in deal structures present potential headwinds for the company moving forward. Cloudflare will need to navigate these challenges carefully to sustain its growth trajectory and capitalize on its strengths in a competitive market.

Final Remarks and How I am Positioned

Cloudflare ($NET) constitutes only 4.5% of my portfolio, with an average purchase price in the high 70s. The stock has consistently traded at over 12x EV/NTM Sales multiples, which is quite high, especially as we approach earnings. Even in today's market action, it recovered from an after-hours low of $82.43, almost a 14% drop from its closing price, yet it remains expensive. On August 5th, $NET was trading around $59, but purchasing more shares was challenging with $AMZN trading in the 150s on that same day. At current prices, I am not adding to my position. I am holding long shares and spreads for 2027, and waiting for the price to drop into the low 70s, which would bring it to 11-12x EV/NTM Sales. Make no mistake, this is a top-tier company in the industry.