Did the Market Bottom Today?

Commentary and Portfolio Adjustments

Market Update: Portfolio Moves and Strategy Shifts

What looked like a massive breakdown under the 200ma for both $QQQ and $SPY turned into a pretty solid dip-buying opportunity. I didn’t waste any time jumping in this morning, making a bunch of buys and tweaking my portfolio. The main idea was to double down on high-conviction plays and cut out stuff I wasn’t feeling too confident about or that might get disrupted down the line.

Portfolio Adjustments: Trimming the Fat, Adding the Muscle

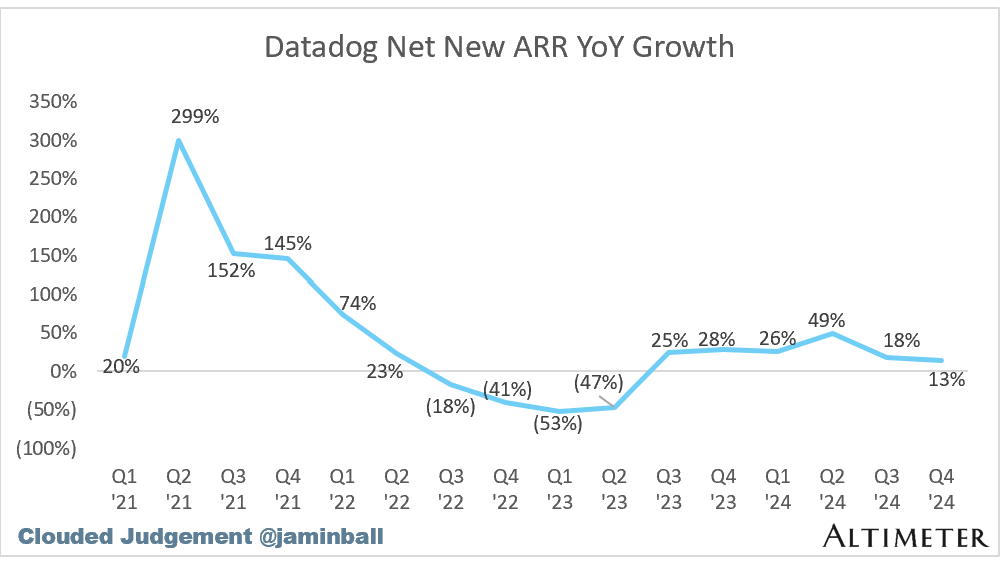

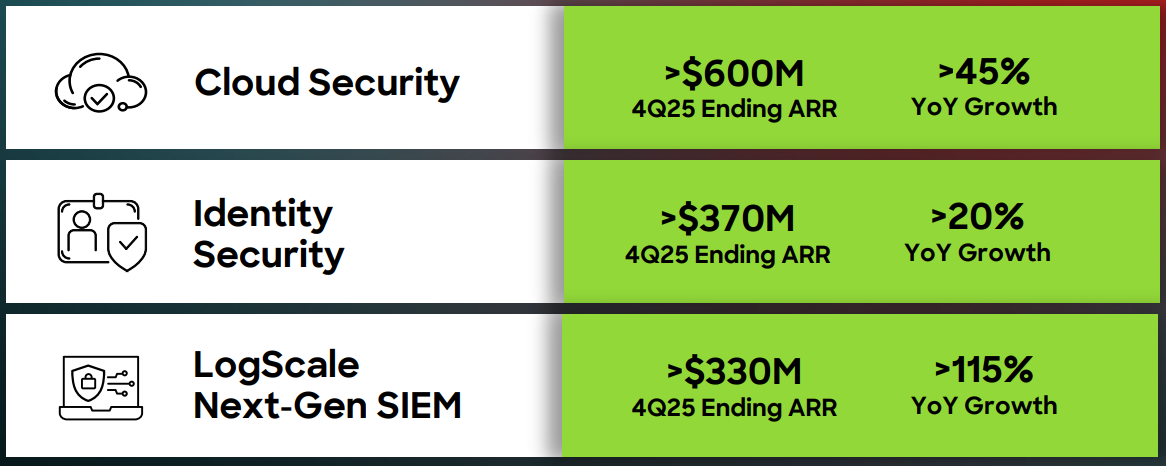

So, first things first—I sold my $DDOG Datadog position. The main reason? Competition. $CRWD CrowdStrike is making some serious moves in the SIEM (Security Information and Event Management) space, with growth hitting 115% and annual recurring revenue (ARR) looking like it could hit a billion dollars in the next few years. It’s not just them; $PANW Palo Alto and $S SentinelOne are also jumping in. That made me question how strong Datadog’s moat really is, so I let it go.

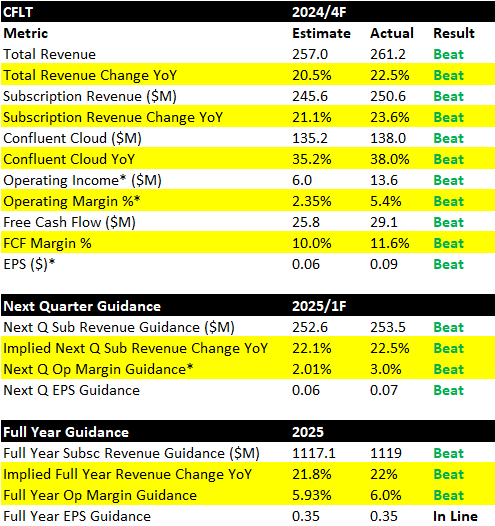

On the flip side, I added to my positions in CrowdStrike and Rubrik. Also threw a bit more into SentinelOne just to balance things out in the cybersecurity space. The market pullback was a decent chance to add $CFLT Confluent back to the portfolio at the same level I sold it for a while ago. I didn’t chase it after earnings when it ran up to around $35 but used this pullback to get back in. Their last quarter was pretty solid, and I didn’t want to miss out if they keep that up.

Swing Trades and MegaCap Plays

Besides the long-term moves, I opened some short-term swing trades. Picked up monthly calls on $MRVL Marvel Technology and $ASTR Astera Labs, along with a few megacap names like $META Meta, $GOOGL Google, $AMZN Amazon, and $SNOW Snowflake. These plays are more about catching a bounce than holding for the long haul, so I’ll keep an eye on them. If we hit today’s lows again, I’ll probably cut them loose, but if we bounce, I’ll happily take some profits.

The Market's Mood: Data and Recession Fears

Let’s talk macro for a sec. The unemployment rate ticked up from 4.0% to 4.1% last month, and ADP’s non-farm payrolls were a bit under expectations. Not terrible, but not exactly encouraging either. Still need to dig into those reports more, but it seems like a lot of recession fears might already be baked into the market. $SPY was down about 8.5% at its lows today, and $QQQ was off 11-12% from its all-time highs. That’s a pretty decent selloff considering we’re not lower than we were back in early August.

In the short term, I wouldn’t be surprised to see a bit of a bounce next week. We’re coming out of a seasonally weak period post-election year, so I’ll be watching the price action closely. Long-term, I focused on moving money from lower-conviction to high-conviction names. If the market drops further, I’d rather be holding my top plays than stuff I’m still researching or that’s open to disruption.

Shifting Convictions and the Path Forward

When it comes to Datadog, here’s the deal: Their core strength is in infrastructure monitoring, log management, and security events. But a lot of cybersecurity players are building these capabilities directly into their platforms. CrowdStrike’s SIEM segment is growing at 115% with $300 million in annual recurring revenue (ARR). Even if that growth slows a bit, it could still become a billion-dollar segment soon. Combine that with Palo Alto and SentinelOne’s moves, and suddenly Datadog’s moat isn’t looking as deep as I thought.

As for Confluent, my main concern was their go-to-market strategy for open-source Kafka. It’s free software, so the question was always about how well they could monetize it. Last quarter showed some pretty strong execution, so I bought back in at the same level I sold it for earlier, not chasing it when it ran up to $35 post-earnings. Sometimes, you’ve just gotta admit you were wrong and get back in when the opportunity's there.

Looking Ahead: SentinelOne and Portfolio Funding

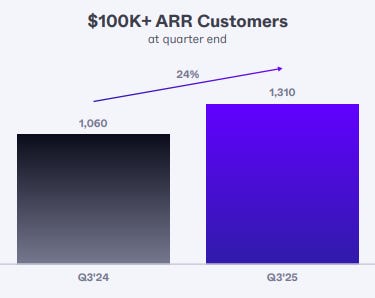

SentinelOne is set to report next week on Wednesday after market close. They’re a solid cybersecurity player but lean more towards small businesses, which makes their revenue a bit less predictable than CrowdStrike’s big enterprise contracts. Still, they’re signing up bigger customers too, so I’ll be keeping an eye on that report.

Finally, I’ve got a decent chunk of cash coming into the portfolio in the next couple of weeks—about 10% of the account. Planning to deploy that cautiously depending on how the market plays out. I’m not a fan of chasing strength, but if that’s how the timing works out, I’ll adjust. Timing the market is tough—even the best hedge fund managers struggle with it. My focus is on the long-term game and buying quality at a discount when the market hands it to me.

That’s the plan heading into the weekend. Time to dig deeper into some of the newer positions and see where the best opportunities are. As always, do your own research—this isn’t financial advice. Thanks for reading.