GitLab: The DevOps Powerhouse Poised to Lead the AI-Driven Software Revolution

The Bull Case for $GTLB

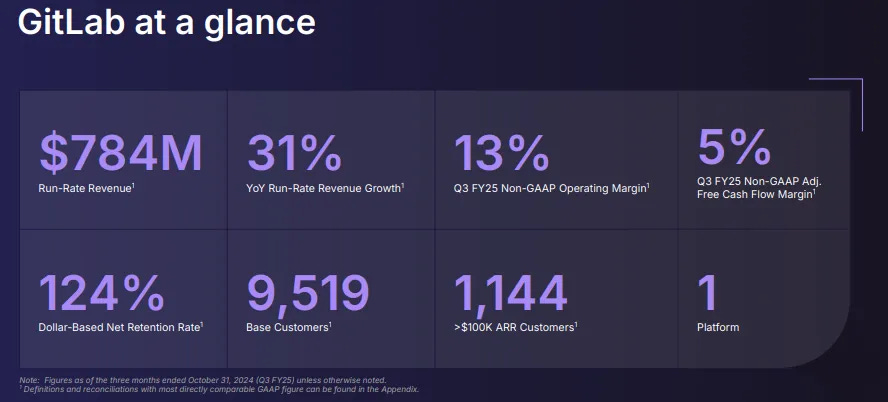

GitLab $GTLB stands as a leading DevOps platform, seamlessly integrating application development, infrastructure deployment, and security into a unified environment. Its recent performance has been nothing short of extraordinary, with revenue growing 30.9% year-over-year. Despite a slight downtick in gross margins, they remain exceptionally strong at 91%, providing ample room for profitability. GitLab’s operating margin sits at 19.9% on a non-GAAP (adjusted) basis, showcasing efficient cost management. Additionally, the company is generating positive free cash flow at 4.9%, and its recent adjusted EPS of $0.23 beat estimates by 50%, highlighting the effectiveness of its growth strategy.

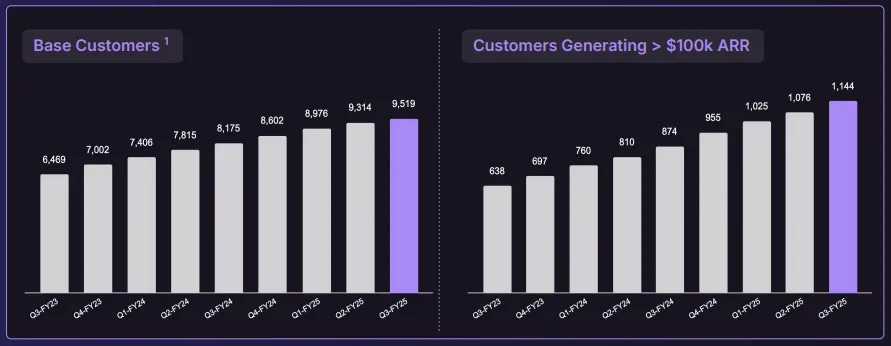

What truly sets GitLab apart is its ability to execute flawlessly across key metrics like customer acquisition, market share expansion, and tangible AI-driven revenue growth. A pivotal development fueling my bullish outlook is the recent leadership transition. The founding CEO, Sid Sijbrandij, is stepping down due to health concerns, making way for Bill Staples from New Relic. This change is a significant positive, as Bill brings a wealth of experience in driving revenue strategies that transformed New Relic into a leader in data and infrastructure monitoring. His leadership is expected to accelerate GitLab’s growth trajectory, optimize operations, and expand its market presence.

Looking ahead, GitLab’s future is incredibly bright. The company is on the brink of profitability on an EBIT basis, with strong potential to achieve this milestone either late this fiscal year or early next fiscal year. This progression will not only reinforce investor confidence but also showcase GitLab’s ability to deliver sustained revenue growth while expanding margins. Companies that can simultaneously drive top-line growth and improve profitability are rare, and GitLab is positioned to be one of them. Their disciplined approach to cost management, combined with strategic investments in growth areas, sets the stage for long-term success.

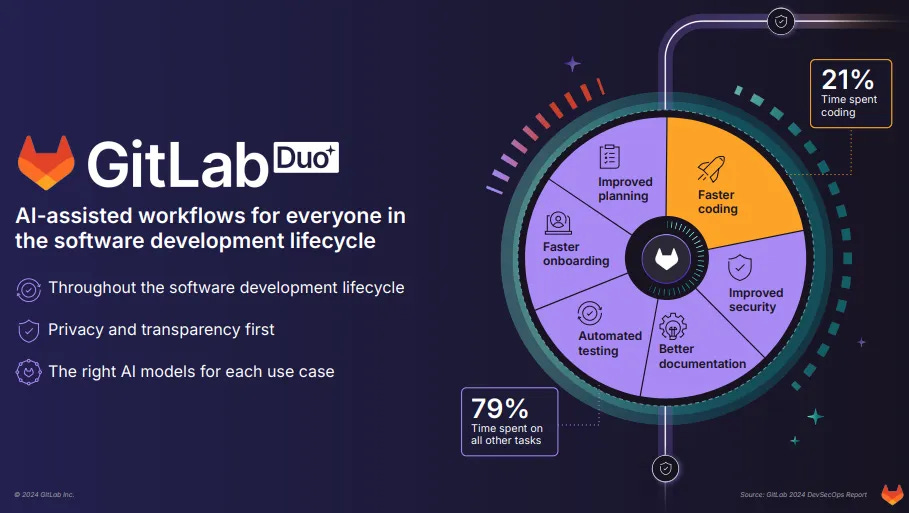

Moreover, GitLab is poised to benefit significantly from the broader shift in the AI cycle from hardware to software. As companies reduce capital expenditures on infrastructure, more budget will flow toward software solutions that enhance data flow and data quality. GitLab’s platform is perfectly suited to capitalize on this trend, offering businesses the tools they need to innovate efficiently and securely. This evolving landscape strengthens GitLab’s growth prospects, making it a compelling investment as demand for AI-driven software solutions continues to rise.

This combination of exceptional financial performance, strategic leadership, and alignment with transformative market trends is why GitLab holds a large concentration in my portfolio. I believe its ability to execute, adapt, and lead in the DevOps space will drive substantial shareholder value in the years ahead.