Grab Keeps Growing, But Are Expectations Getting Ahead of Reality?

FY24 Q4 Solid Earnings: Not Great, Not Bad — Just Enough to Keep the Momentum Going

Grab Holdings Limited released its FY24 Q4 earnings, with growth across all three segments, improved Adjusted EBIDTA profitability, and a positive outlook for FY25. The company continues to strengthen its position as Southeast Asia’s leading super app, with strong performance in mobility, deliveries, and financial services. However, the market expected more… were expectations too high? Or is the company thesis breaking?

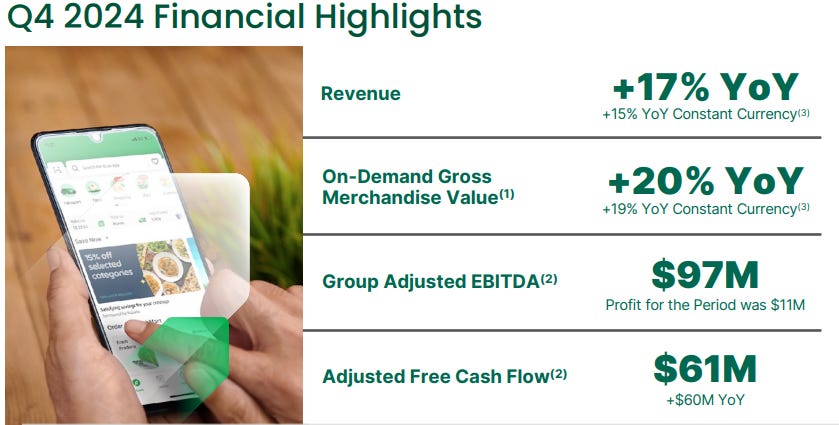

Quarterly Highlights

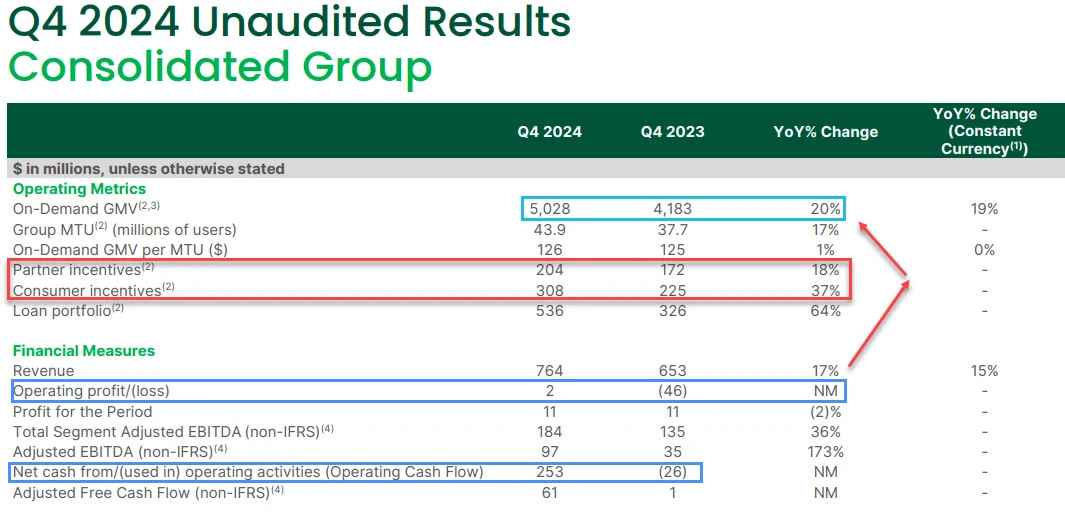

Grab’s Q4 results were a bit of a mixed bag. Revenue came in strong, beating estimates and backed by solid guidance, showing the company is still growing at a healthy pace. They also posted another profitable quarter, surpassing EPS expectations, which is always a positive sign. But it wasn’t all smooth sailing—adjusted EBITDA missed analyst estimates, though it did come in above the company’s own guidance. All in all, a solid quarter that shows progress, but with some lingering challenges around profitability.

Segment Performance

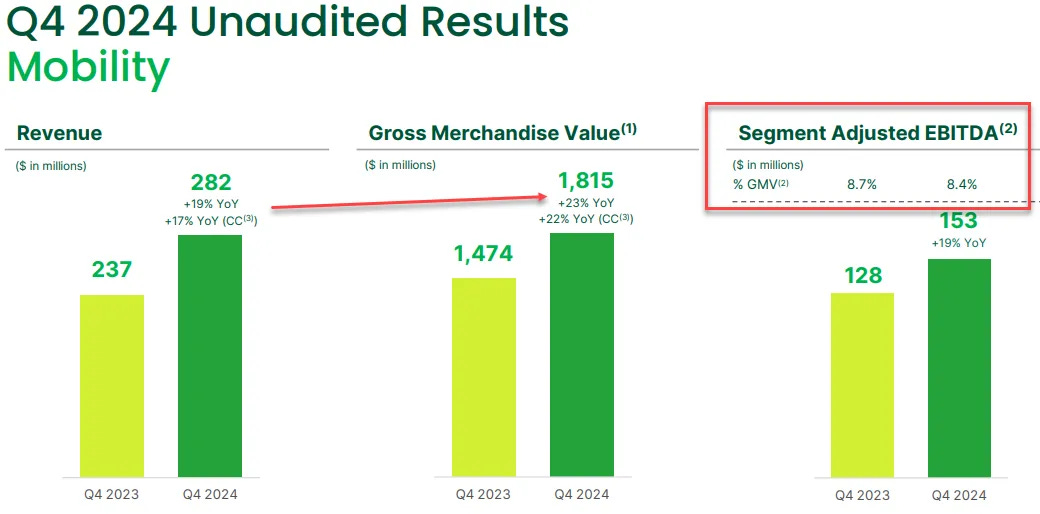

Mobility

GMV growth of 20% YoY

Adjusted EBITDA margin at 8.4% of GMV (down slightly from 8.7% YoY)

Mobility remains a core driver of revenue, showing steady growth despite slight margin compression. Grab continues to dominate the Southeast Asian ride-hailing market, supported by tourism recovery and increased urban mobility.

However, Mobility Adj. EBITDA as a % of GMV compressed due to slower growth in Revenue vs GMV. I will address this later on.

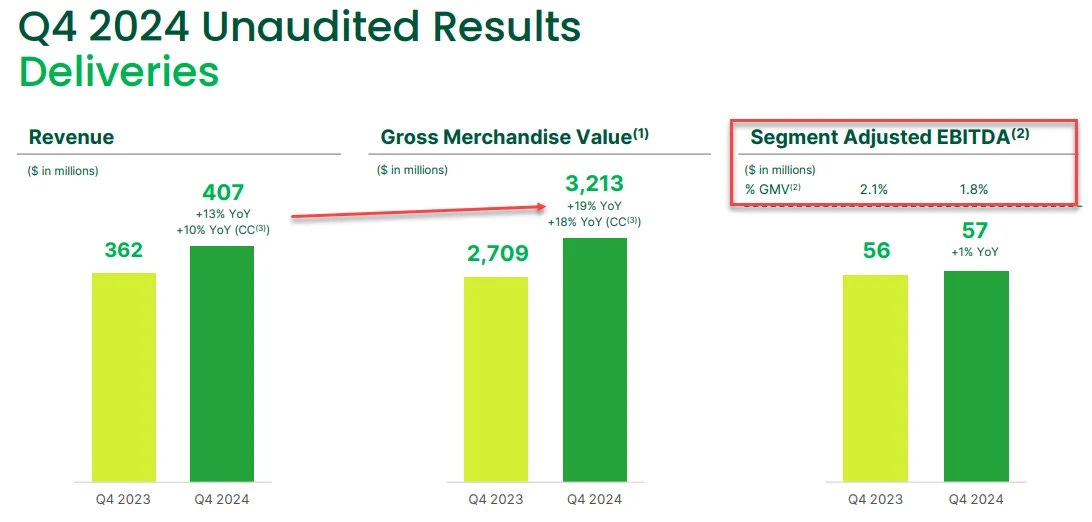

Deliveries

GMV grew by 12% YoY

Ad revenue as a percentage of Deliveries GMV hit 1.7% ($216M in FY24)

Quarterly Active Users (QAU) rose by 63% YoY

Average spend per active advertiser increased by 21% YoY

The deliveries segment experienced moderate growth, with a significant boost from advertising revenue. Grab’s focus on optimizing its delivery network and increasing merchant engagement is showing results, as reflected in higher user activity and advertiser spending.

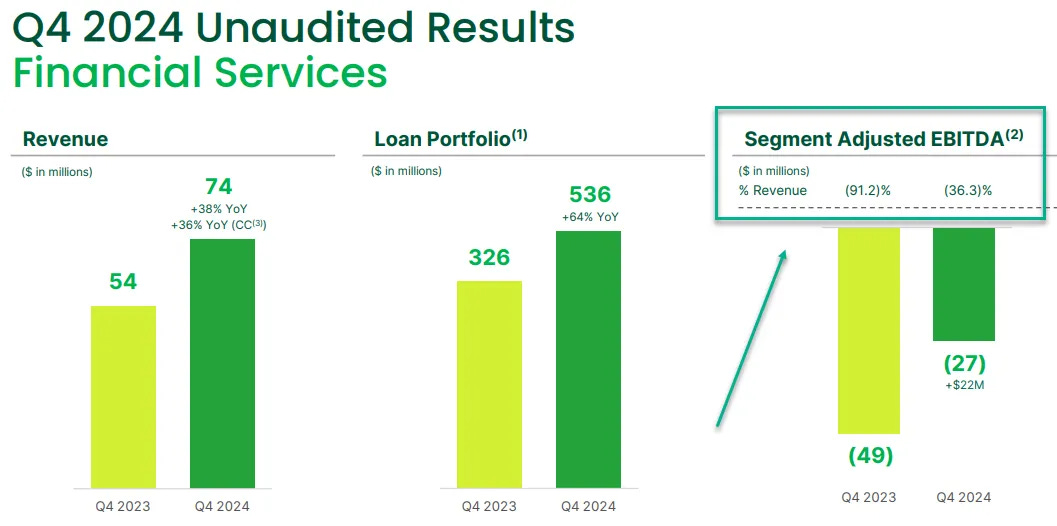

Financial Services

Loan portfolio grew by 81% YoY

Customer deposits at GXS Bank and GXBank reached $1.2 billion (+12% QoQ, +220% YoY)

Non-performing loans (>90 days) remained stable at 2%

Grab’s financial services division is rapidly expanding, with strong growth in deposits and lending. The stable non-performing loan ratio highlights the company’s disciplined approach. Management is targeting adjusted EBITDA breakeven for this segment by the second half of FY26.

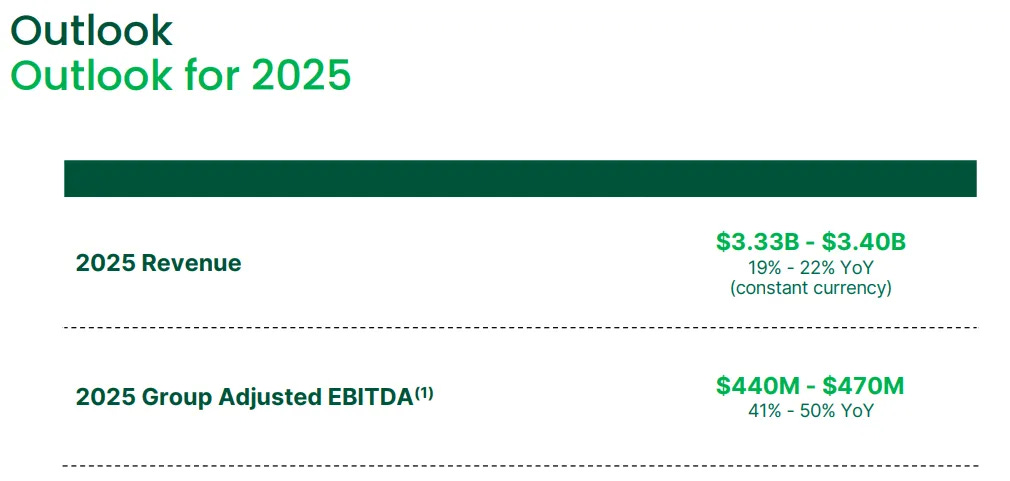

FY2025 Guidance and Outlook

GMV growth projected at +16% YoY (+19% FXN)

Anticipated softness in Q1 FY25 due to Lunar New Year and Ramadan

Sharp recovery expected in Q2 FY25

Stock-Based Compensation (SBC) expected to remain flat YoY

Financial Services targeting adjusted EBITDA breakeven by 2H FY26

While management anticipates a slower start to FY25 due to seasonal factors, they expect a strong rebound in the second quarter. The focus remains on improving profitability, particularly in the financial services segment.

Concerns: Grab Losing Market Share?

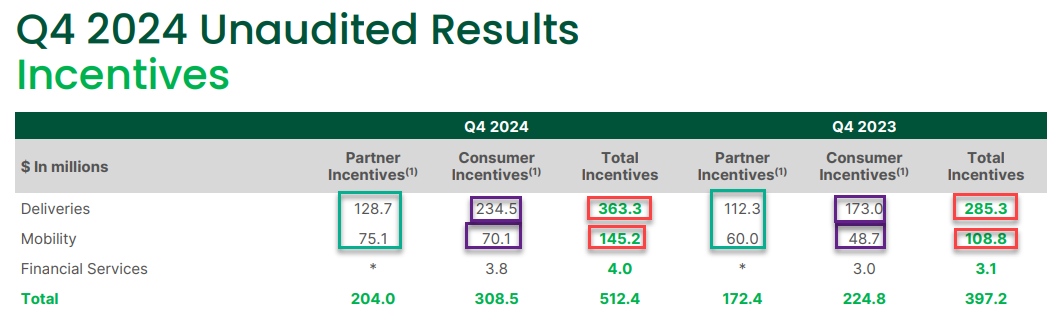

While Grab reported increased revenue in both deliveries and mobility, there’s a growing concern that GMV is outpacing revenue growth. This raises questions about whether Grab is sacrificing profitability for market share. Since revenue is recognized as GMV minus costs and incentives, the widening gap suggests that higher customer incentives are eating into top-line growth. This was mostly in Customer Incentives increasing 37% YoY.

Management has previously cautioned about monitoring new product rollouts and CAPEX, but spending has surged (particularly in customer incentives) which directly impacts revenue. The long-term strategy relies on scaling the business to bring down costs over time, but there’s still a strong focus on keeping EBITDA profitability and generating free cash flow. The real challenge is finding the right balance between driving growth and offering incentives, without cutting too deeply into margins or losing sight of profitability goals.

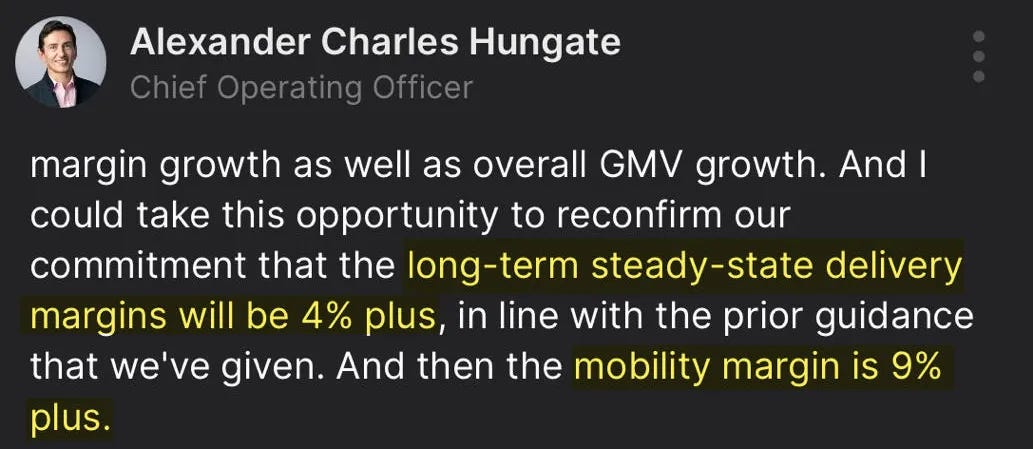

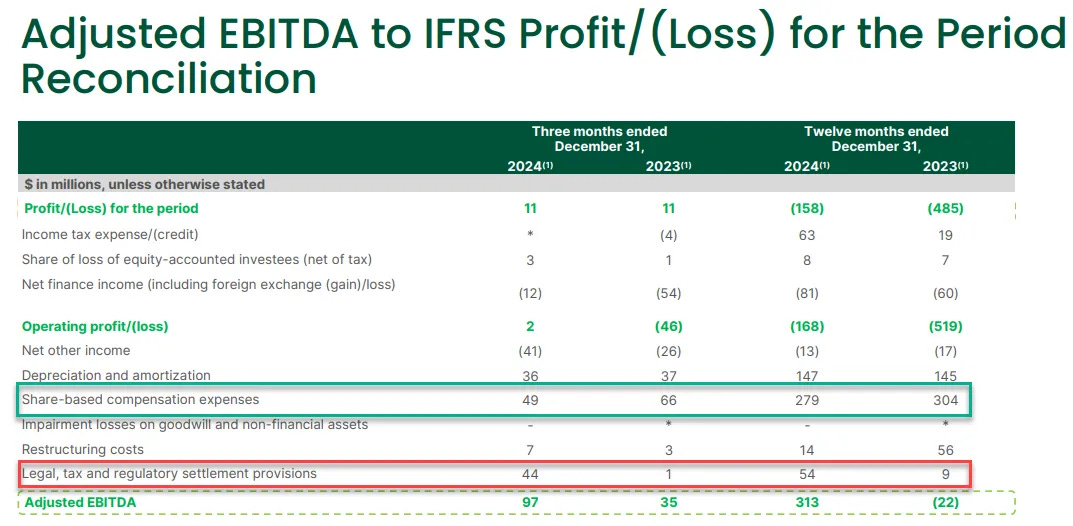

SBC Flat and Cash Balance Strong

Share-based compensation stayed flat year-over-year, and the total number of shares dropped by 1%, showing Grab is being more mindful about shareholder value. For the long term, management is aiming for adjusted EBITDA margins of 4%+ for deliveries and 9%+ for mobility, which are well above where they stand today. It’s a clear sign that Grab is focused on improving profitability and becoming more efficient as it scales.

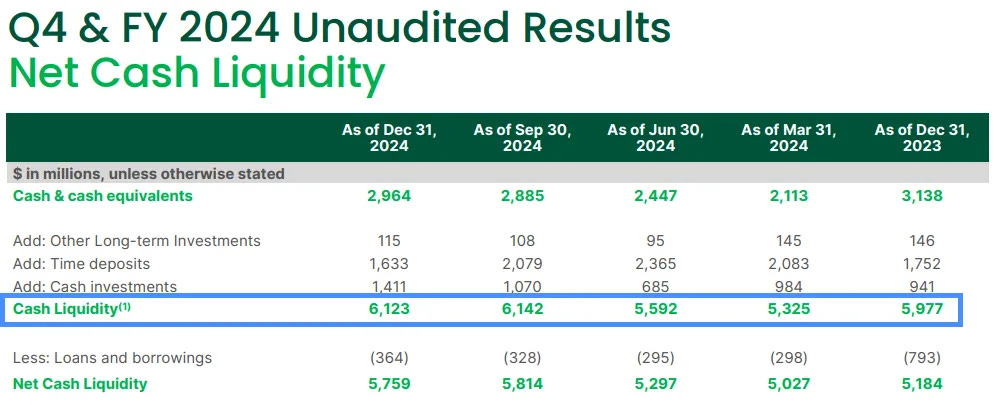

In addition, the balance sheet is quite strong with about $6.1B in gross cash ($5.8B net cash) bringing the Enterprise Value of the company (Market Cap - Cash + Debt) to rough 2/3 of its size. This means that for every share you buy of $GRAB, 1/3 of that is cash.

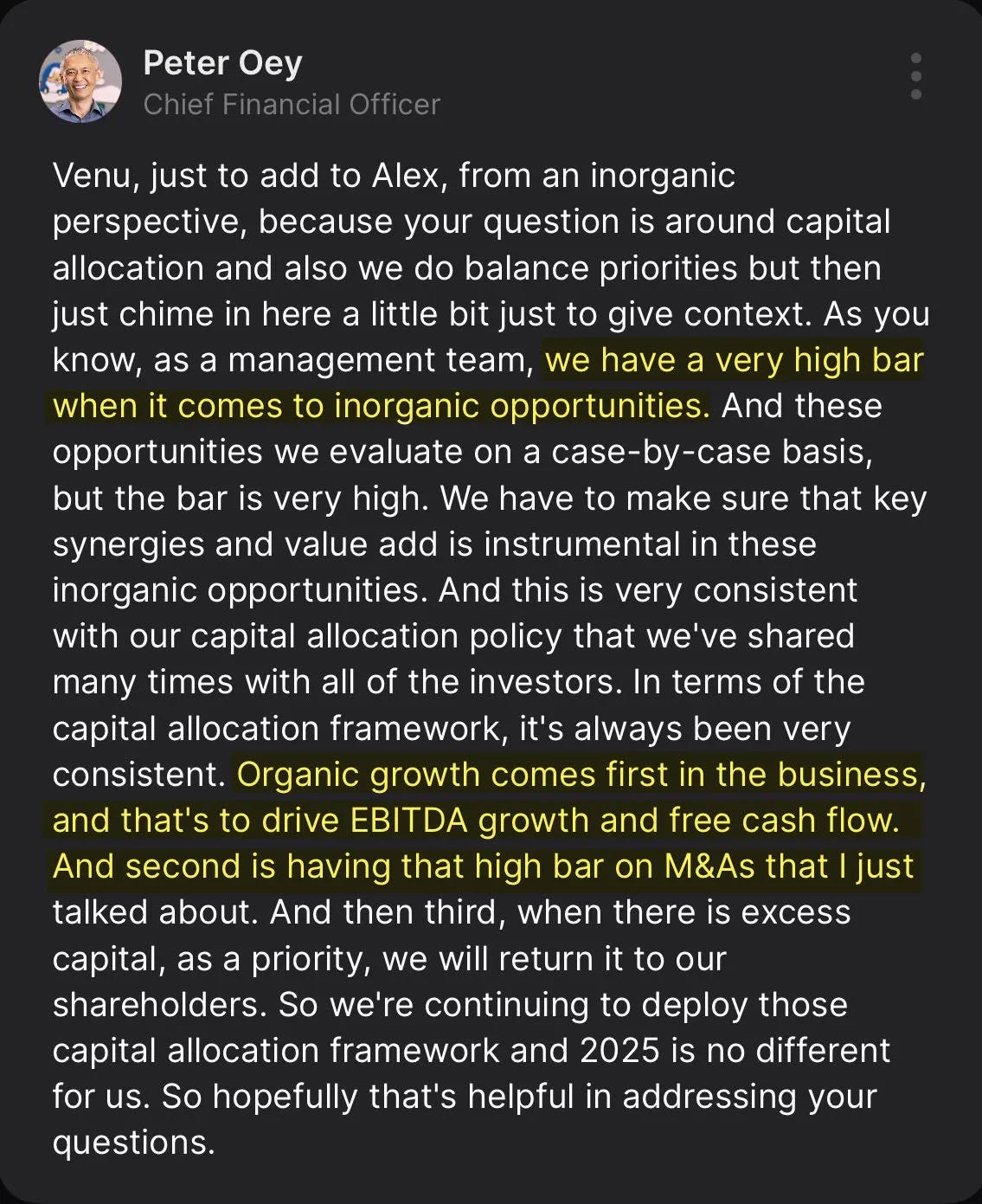

Buybacks and Low Cost Basis

CFO Peter Oey also noted that they are actively returning value to shareholders through its $500M buyback program. In the fourth quarter, the company repurchased 10.2 million shares at an average price of $3.65, totaling $37.1 million. This brings the total buybacks to 67 million shares at an average price of $3.37, amounting to $226 million so far. Today, GRAB trades at 4.75 after hours showing an excellent ROI on it's buybacks.

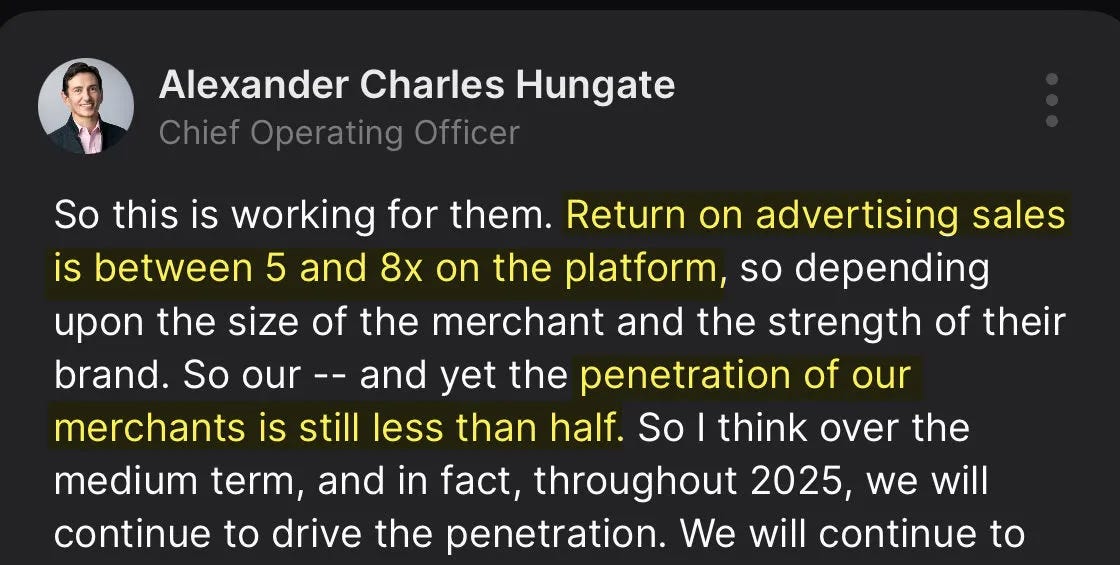

Advertising Revenue and ROI

Grab’s advertising revenue is growing steadily, fueled by the success of its self-service ad platform. During the call, COO Alex Hungate said they have 5-8x return on its investment in the Ad platform, helping boost revenue while giving merchants an effective way to reach more customers.

GOTO and GRAB Merger?

Management gave mixed signals about the rumored merger, neither confirming nor denying the speculation, leaving the situation unclear.

To note, though, Grab did acquire a Cambodian delivery company named Nham24 to assist in expanding operations in that country.

Closing Thoughts: Monitoring the Path Forward, But Thesis Holds

Grab’s FY24 Q4 results showed steady growth across all segments, but rising customer incentives and the gap between GMV and revenue raise concerns about profitability. While these issues are worth watching, the core thesis remains intact. Grab continues to grow, maintains strong cash reserves, and is progressing toward long-term profitability goals.

I’ll be closely monitoring how the company balances growth with improving margins, especially as spending on incentives stays high. Despite some concerns, the fundamentals remain solid, and for now, the investment thesis is still safe.

Great writeup!