Grab x GoTo: The $6B Power Move

What could happen if Southeast Asia’s super app buys its biggest rival?

A Merger Long in the Making

After years of speculation, it looks like Grab is seriously exploring a deal to acquire GoTo Group. While past talks have fizzled into rumors, multiple reports now suggest that real conversations are taking place. And if successful, this could be one of the most important tech mergers Southeast Asia has ever seen.

The proposed deal isn’t $28 billion—GoTo currently trades around a $6 billion market cap. But given GoTo’s strategic leadership in Indonesia, a key market in Southeast Asia, any premium Grab might pay could be well worth it.

Indonesia: The Missing Piece for Grab

GoTo is the leader in Indonesia—Southeast Asia’s largest and fastest-growing economy. With a population of over 270 million and strong GDP growth (~5% YoY), Indonesia represents the biggest addressable market in the region.

Grab already dominates in eight countries, including Singapore, Malaysia, Thailand, Vietnam, and the Philippines. But Indonesia is where GoTo holds the maintains market share, and this merger would give Grab immediate leadership in the most critical market it doesn’t fully control yet.

Why Grab Wants GoTo

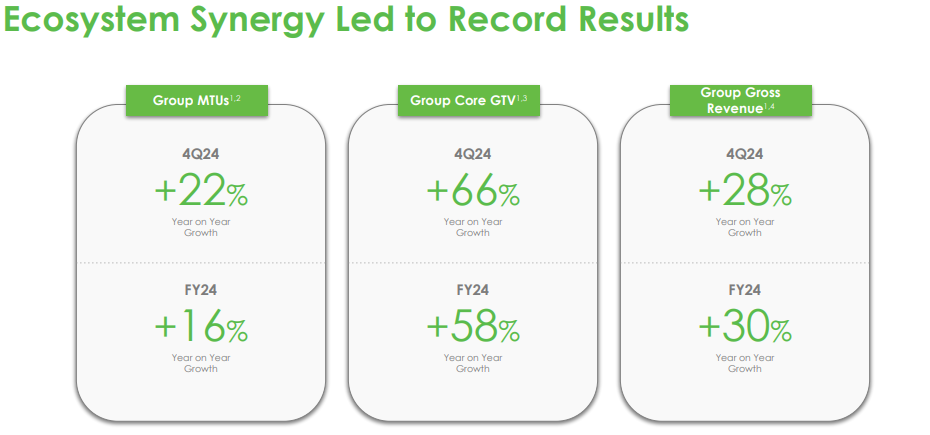

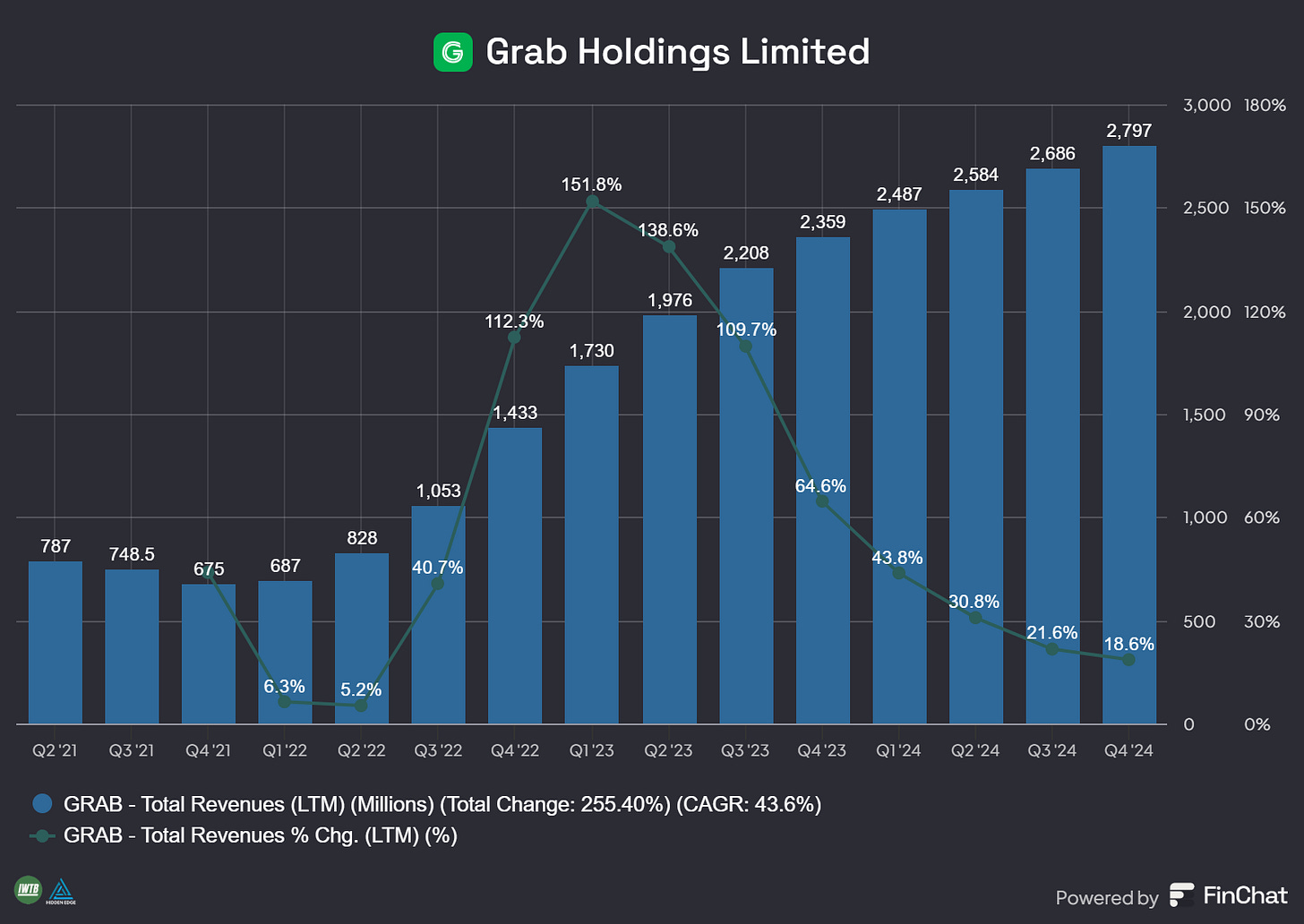

Grab is much larger in terms of financial scale:

Grab FY2024 Revenue: $2.8B (+19% YoY)

GoTo FY2024 Revenue: Rp18.1T (+30% YoY)

Grab Cash Position: $6.1B

GoTo Cash Position: $1.3B

GoTo still holds strong market share in Indonesia, especially across ride-hailing, deliveries, and fintech. But Grab’s broader reach, larger user base (43.9M MTUs), and strong balance sheet give it the upper hand.

Reports also suggest that Grab is preparing to raise an additional $2 billion in capital—likely to fund a deal like this one. Combined with existing cash, they could easily afford a full acquisition of GoTo, even with a premium.

More Than Just Market Share

This deal is about more than expanding footprint. GoTo brings deep local expertise and leadership. Successfully navigating Indonesia’s regulatory and competitive environment isn’t easy, and GoTo’s team has shown it can lead in a tough market. That experience could be a huge asset under the Grab umbrella.

There’s also the potential to leverage GoTo’s past partnerships—like its relationship with ByteDance, parent of TikTok, which purchased 75% stake in GoTo’s e-commerce arm, Tokopedia. A deal could open new monetization opportunities for Grab in social commerce.

What It All Means for the Region

Southeast Asia is undergoing a digital boom. Smartphone penetration is soaring, millions remain underbanked, and the region is one of the fastest-growing in the world. Grab already offers financial services—like loans, deposits, and insurance—and bringing GoTo’s customer base into that ecosystem could multiply reach quickly.

This isn’t just about ride-hailing anymore. It’s about dominating the digital infrastructure of an entire region.

Final Thoughts

This deal, if completed, would reshape Southeast Asia’s tech landscape. Grab would gain an immediate and dominant position in Indonesia, secure long-term leadership across the region, and significantly expand its financial and consumer ecosystem.

With $6B in cash, a growing top line, and increasing free cash flow, Grab has the tools.

Let’s see where this goes.