Hidden Edge Weekly: Inflation, Tariffs, and GPUs

Weekly Commentary on Macro and Micro

Let’s break it all down. This week was a buffet of macro signals—some spicy, some straight-up hard to digest. Here’s what’s moving the market and how I’m thinking about it:

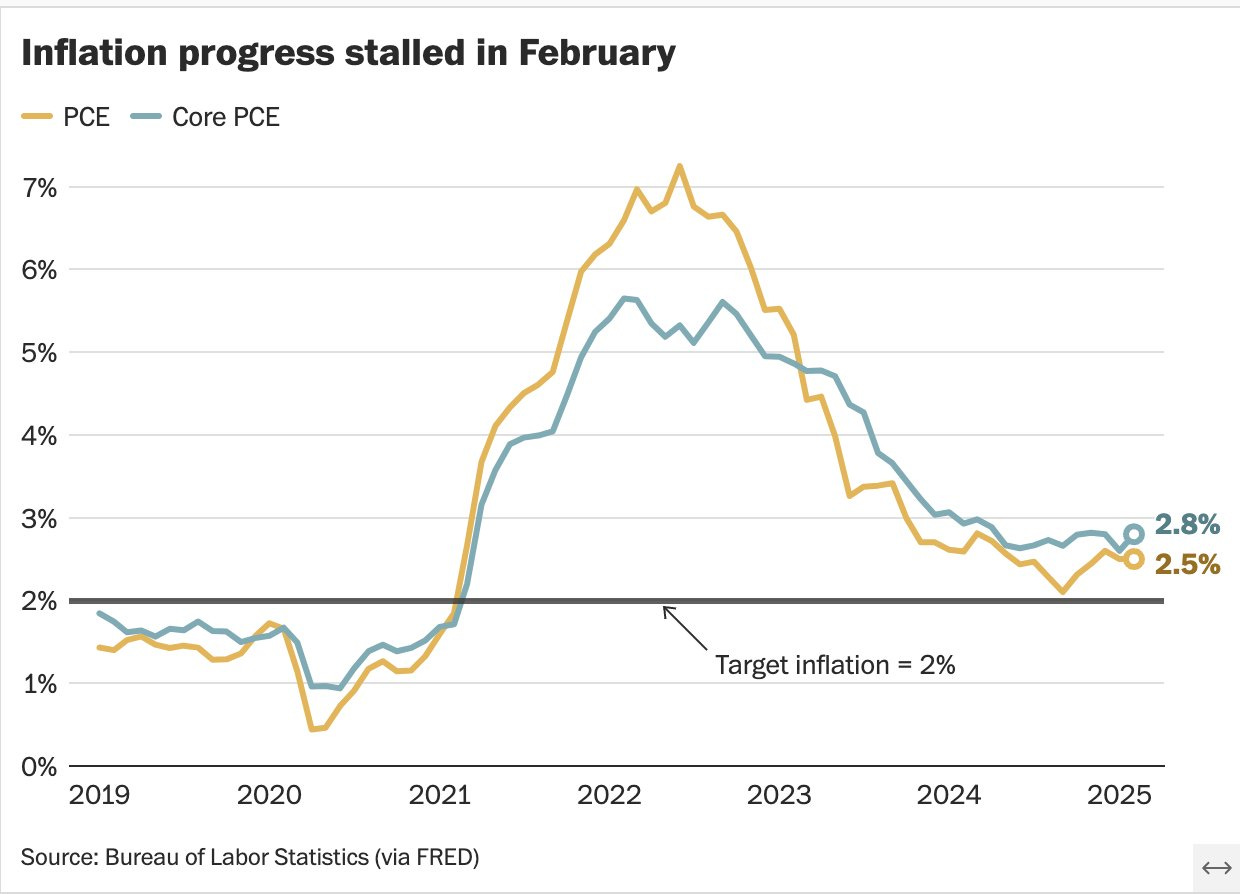

1. Sticky Inflation

The February Core PCE rose +0.3% MoM, with +2.8% YoY, which was above the expected +2.7%. Not a shocker if you’ve been watching energy, services, or, you know, groceries. But it reinforces that inflation is nowhere near “solved,” and that has big implications—especially with tariffs front-loading expected in April.

We’ve got a supply-side inflation risk brewing. Tariffs will likely hit imports on autos and components by 25%, and while some analysts are downplaying the CPI impact, they’re ignoring the ripple through durable goods and logistics.

2. Liberation Day: April 2nd

Markets expecting Trump’s tariff announcements to be bluff. But lets be mindful, this isn’t a tweetstorm, it’s fiscal policy. If he doesn’t walk back after April 2nd, we’re looking at real pressure on auto prices and additional segments. S&P Global Mobility estimates that car prices could rise by $3,000 per unit if the tariffs go through.

S&P Global Mobility estimated Thursday that tariffs will cause annual U.S. vehicle sales to fall to a range of 14.5 million to 15 million in coming years from 16 million in 2024. Cox Automotive estimates tariffs will add $3,000 to the cost of a U.S.-made vehicle and $6,000 to vehicles made in Canada or Mexico without exemptions.

Most of the impact wouldn’t hit right away — it would bleed in through Q2 and Q3, which is why it’s so dangerous for sentiment. A lot of folks called his bluff. If those tariffs stay, that complacency gets punished. Hard.

3. GPU Demand: CoreWeave vs Nebius

There’s GPU demand, and then there’s GPU infrastructure strategy. CRWV CoreWeave is riding the AI wave by renting compute—fast, asset-light, deeply integrated with Nvidia. They don’t build data centers. They lease and scale fast. Valuation? Around $23B, with $8B in debt.

Now contrast that with NBIS Nebius Group. They’re building their own data centers, deploying 22,000 Blackwell GPUs, and sitting on $2.5B in cash with no meaningful debt. Their capex is huge ($490M), but so is their ambition— 1GW of datacenter capacity by 2026 . This is a full-stack model. More risk, more control. Markets are still trying to figure out how to value that—and in my opinion, they’re undervaluing it.

In case you missed it, you can read my Deep Dive on Nebius here on Substack.

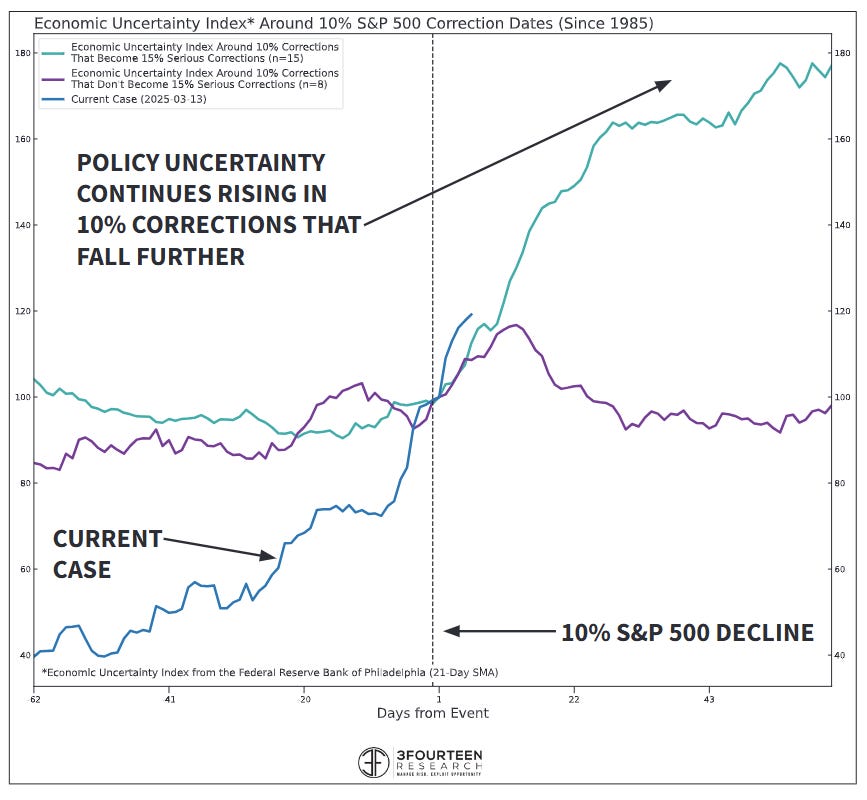

4. Fear is rising, time to DCA

With the market dropping 2% in a day to and volatility ticking up, fear’s creeping back in. You can feel it — risk sentiment is turning. I’m not saying go to cash, but I am saying this is where DCA shines.

Personally, I’m still adding slowly to high-conviction names, but I’m not touching leveraged plays for any swings longer than a day or 2. If the tariff narrative intensifies and inflation stays sticky, the Fed won’t be in a rush to cut. That’s a recipe for more chop — and maybe more pain before relief. Be careful with position sizing. Survive first. Thrive later.

5. AppLovin short report: not the end, but not great

APP dropped nearly 23% after Muddy Waters dropped a short report alleging shady data collection practices. The report was aggressive, citing improper app behavior and weak transparency around user data.

AppLovin fired back with a legal review and the classic “we comply with all applicable laws” line—but the damage was done. Whether this becomes another IOT-style bounce-back or a real unwind depends on what else comes out. Personally? I think some of the thesis is overblown, but the reputational hit could hurt partnerships in the short term.

Follow me on X to read my analysis of the Muddy Water short report on AppLovin.

https://x.com/samsolid57/status/1905605941166321702?s=46

Final Thoughts

Between sticky inflation, tariff escalation, AI infra divergence, and market fear creeping in—this is not the time to go full throttle on risk. It is the time to sharpen your narrative radar and stick to names that either print cash or build moats. Or, in rare cases, both.

More to come next week—especially if the April 2 deadline gets closer without clarity. Buckle up.