How to Time the Market

It's not what you think it is.

“Markets in Turmoil”

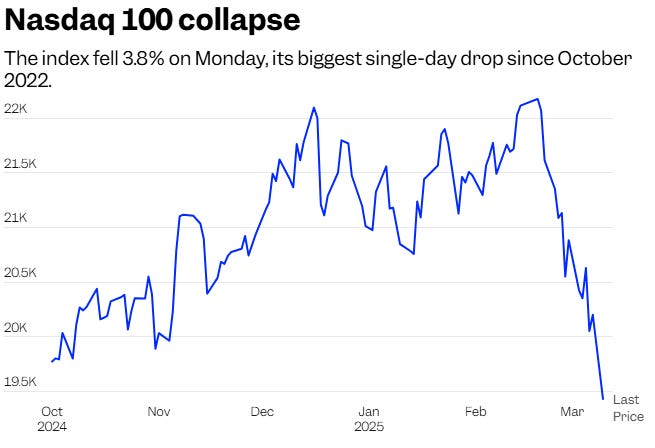

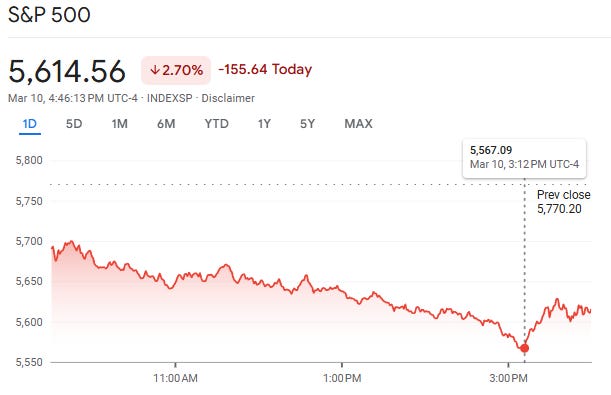

All right, what a day in the markets. Unbelievable, the kind of drops and drawdowns we saw today. Unbelievable. The S&P 500 closed -2.7% and the QQQ, as much as 5.00% at the lows today, closed down 3.88%. Literally, the worst day since October 2022.

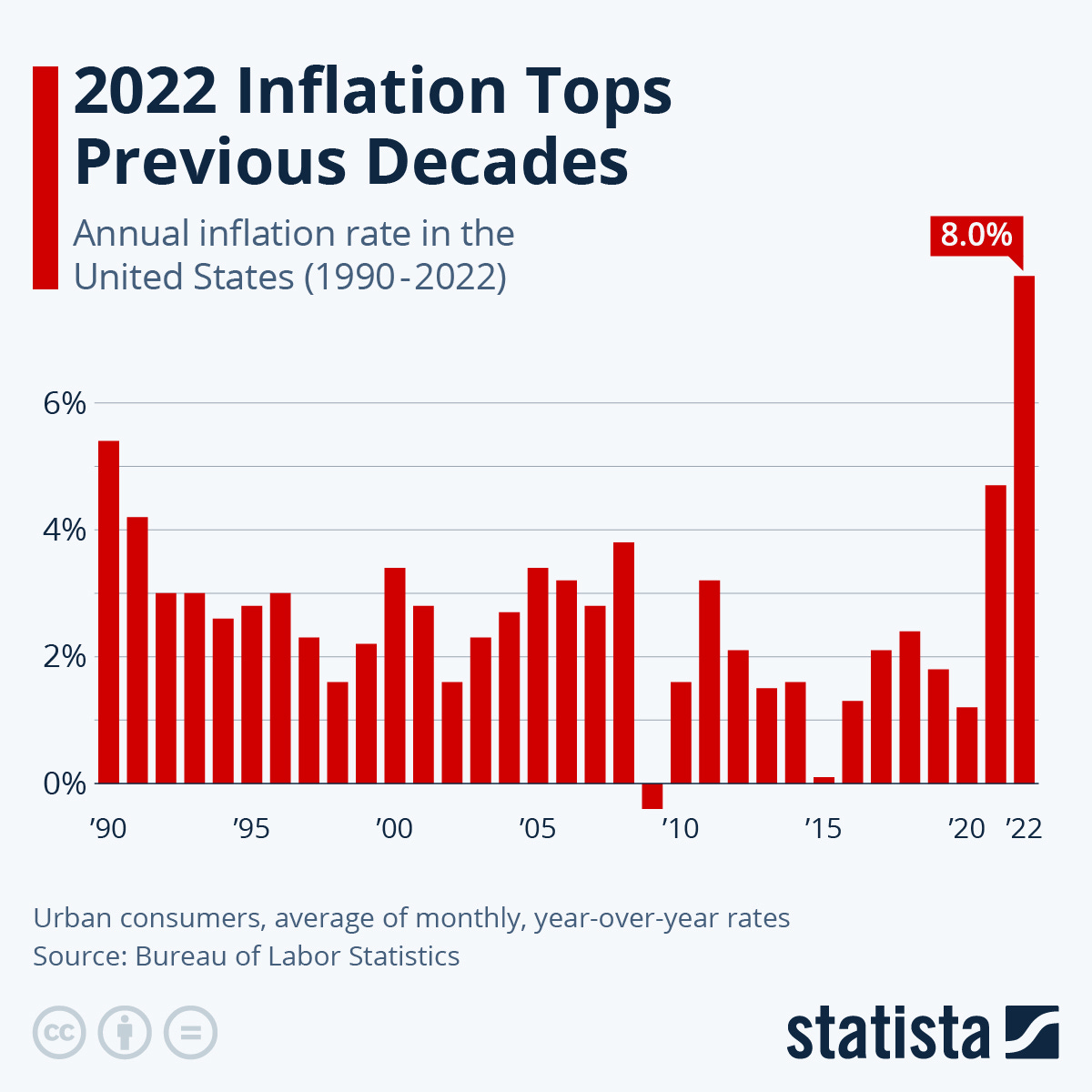

Inflation Peaked in October 2022

Now, I don't know if you guys remember what happened in October 2022, but that was around the time when inflation basically peaked, and people thought the Fed was going to raise rates all the way up to 10% or some crazy amount. And everyone thought the S&P 500 was going to just keep going down over and over again. As you guys know, the market did bottom in October of 2022 and then it rallied into December, and then pulled back very sharply toward the end of the year. People thought we were actually going to revisit those lows.

Is There Further Downside?

Typically, everyone thought we were going to revisit those lows, even into the banking crisis in March 2023, but yet the bull market prevailed, finally breaking out of that bear market. Since then, we have not had a close below the 200-day moving average since October 2023. But even before that, we have not had a full-on close or any 10% correction on the S&P 500. Even at today's lows on SPX, we were down to 5567, which would only bring us down to about 9.0% from the all-time highs of 6144.

So even at today's lows, we still were not at a correction. The market, of course, did close almost 50 points up from the lows, which really just brought us down 9% from the all-time highs. Given that, even if we had this major drawdown since the lows, I would argue that we are still up pretty insane since the beginning of 2024. I mean, I still remember the beginning of 2024. We rallied pretty sharply off the October 2023 lows, and then especially when Powell came out and was extremely dovish, more than people expected. That really fueled that rally.

Toward the end of 2023, people thought we were going to have a massive correction year in 2024. Look what happened. We had double-digit gains in the 20% range for the entire year across all the indices. And then this year, people thought, you know, we're going to have the bear market in 2025, and we rallied pretty hard, around 5% year-to-date in the S&P 500. But today, we're actually sitting down, I think, 5% or 6% down for the entire year in the S&P 500. Pretty much the bulk of that was today.

From the all-time highs, yeah, we're about 8.7% down. The QQQ is about 12.5% from the all-time highs. So things are pretty rough out there. I mean, if you're green for the entire year so far, year-to-date, you're doing well. Don't worry about it. Don't stress out.

YTD Performance and Expectations

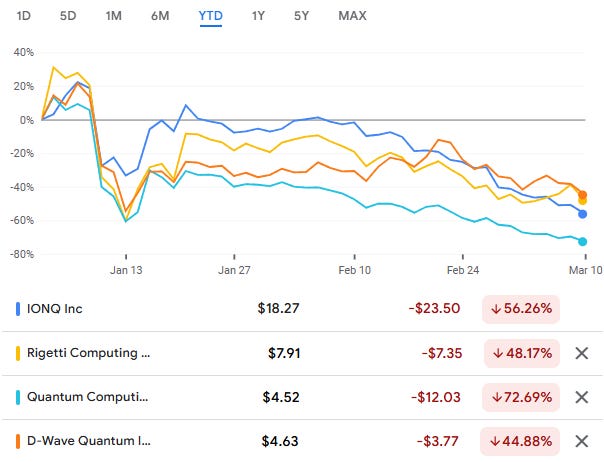

Quantum computing stocks took a big hit. Tesla took a massive hit—down almost 50%, I think more than 50% from its all-time highs around 488. Today, Tesla was down about 16%, which is the worst day it has had since 2020. So, you know, it's not painting a very good picture.

This is really on the back of recession fears. There's a lot of talk about the tariffs coming into effect, a lot more fears of tariff talk, a lot more fears with Europe buying natural gas from Russia, which is going to slow down the demand for U.S. natural gas. There’s just a lot of fear centered around pretty much everything across the board.

And to top that all up, the largest down day since 2022. As a long-term investor, especially if you're in shares, it's not really the best time to be going all cash or putting on heavy hedges. There's nothing wrong with a little bit of hedging, but going too heavy on puts would not be ample timing. Hedging is something you want to put on when you can, not when you need to.

But let's look at the bright side. We've all been up pretty handsomely for the last couple of years. Today, especially this year, we're just giving a little bit back. That's just how this thing works, right? You go up a bit, you take a step back. Sometimes you take more than one step back, but you just got to keep your eye on the prize and look at the long term.

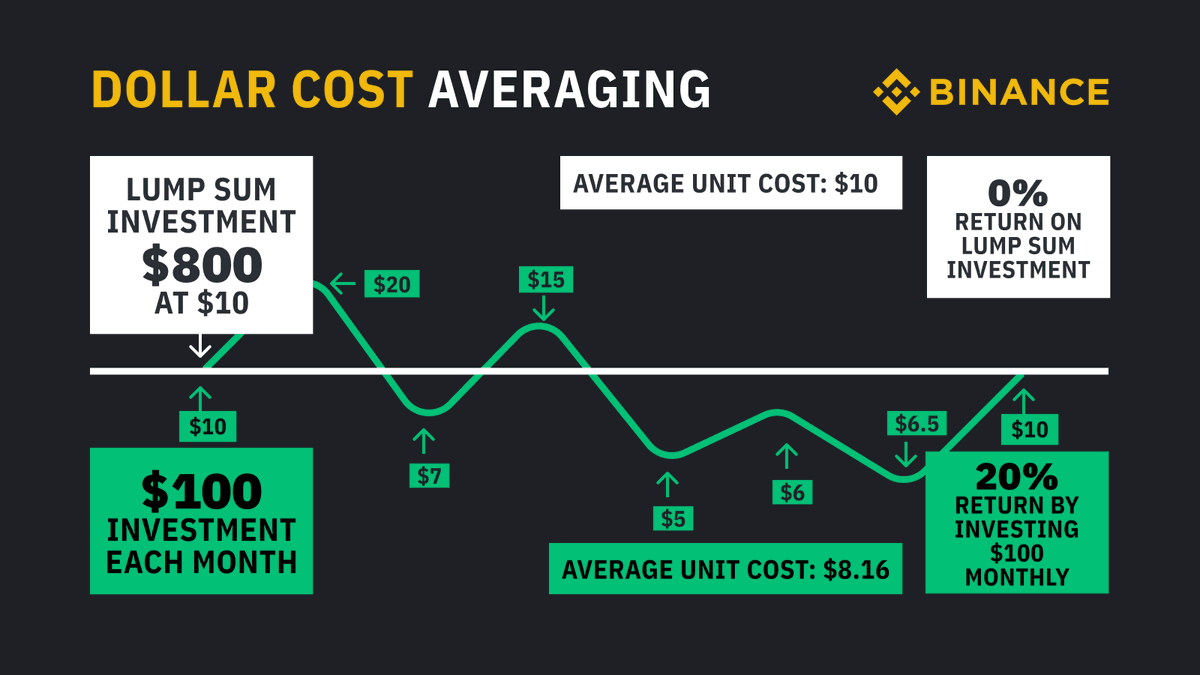

Coping: The Answer is DCA

If it helps, try journaling a little bit. That certainly helps me. Also, do a little more due diligence—solidify your conviction in the positions you're in, so you feel more confident adding as they go down.

For me, I feel more comfortable buying into weakness versus strength. When I'm buying into strength, I always feel like I could be getting a better price, so it kind of stops me from adding more. But buying into weakness is easier because you go in with the mindset that you're not going to be able to time the bottom. And clearly, I did not time the bottom.

So, all I got to say is, continue adding to your portfolio. Dollar-cost average, think long-term. Don't try to call the bottom by going heavily leveraged long at random. That's going to kill you.

Take it easy, don't buy too aggressively, take things slow, and continue adding to your portfolio. In my opinion, if you keep doing that, in five or ten years, you're gonna be very happy about the buys you're making today and maybe even the buys you're gonna make a couple of months from now if we are, in fact, lower.

There's really no way to tell where the bottom is going to be. Even if we bounce, there's no way to tell if that's just a bounce or if we're going back to all-time highs. So, in my opinion, just keep buying for the long term. You'll be happy you did, years from now.

Okay, so that's really all I got. Take care, guys. Have a good one.

Awesome mate, thanks. Nice to hear a level head in the crazyness