IS GOOGLE SEARCH DEAD?

The kind of question that doesn’t get asked… until it’s too late.

There are two big questions I’ve been wrestling with lately. They seem different on the surface, but they’re tied to the same fundamental shift happening in tech.

Is Google Search really starting to decline?

And if so… what does that mean for the stock?

I’ve done a lot of digging, watched the signals, and this week I made a move in my portfolio that reflects where I think things are headed.

But before we get to that, let’s unpack what’s changing under the surface.

The State of Google Search: Not Dead, But Evolving Fast

Let’s get one thing out of the way, Google Search isn’t going away. But that doesn’t mean nothing’s changed.

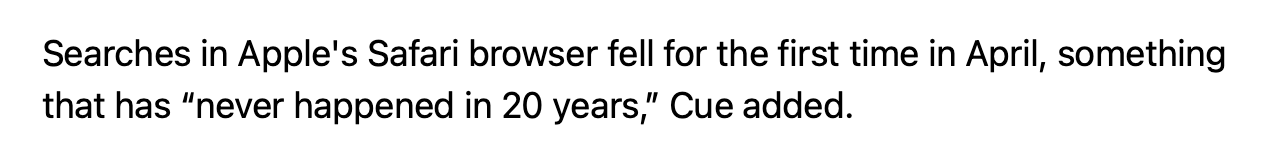

Apple executive Eddy Cue recently testified that Safari searches on iPhones have declined for the first time in years. That’s a significant development, especially considering Google pays Apple billions to remain the default search engine.

Cloudflare CEO Matthew Prince highlighted a similar concern, stating, “AI is going to fundamentally change the business model of the web. The business model of the web for the last 15 years has been search. Search drives everything that happens online.” He noted that today, “75 percent of the queries that get put into Google get answered without you leaving Google.” This shift means users no longer need to visit the original website, impacting content creators who rely on traffic for revenue.

Prince further emphasized the disparity in value exchange, saying, “Ten years ago… for every two pages of a website that Google scraped, they would send you one visitor. That was the trade. Now, it takes six pages scraped to get one visitor.” He also pointed out that AI tools exacerbate this issue, with OpenAI and Anthropic scraping vast amounts of content with minimal return to the original creators.

Reddit CEO Steve Huffman also addressed changes in search behavior, noting that the site experienced “volatility” in traffic due to Google’s algorithm changes. He mentioned that while Reddit saw increased traffic from users appending “Reddit” to their searches, the platform is still navigating the challenges posed by shifts in search dynamics.

Google Is Still Strong, But It’s Not Untouchable

This isn’t about whether Google is a bad company. It’s about understanding whether it still earns its spot in a modern, concentrated portfolio.

Here’s what we know:

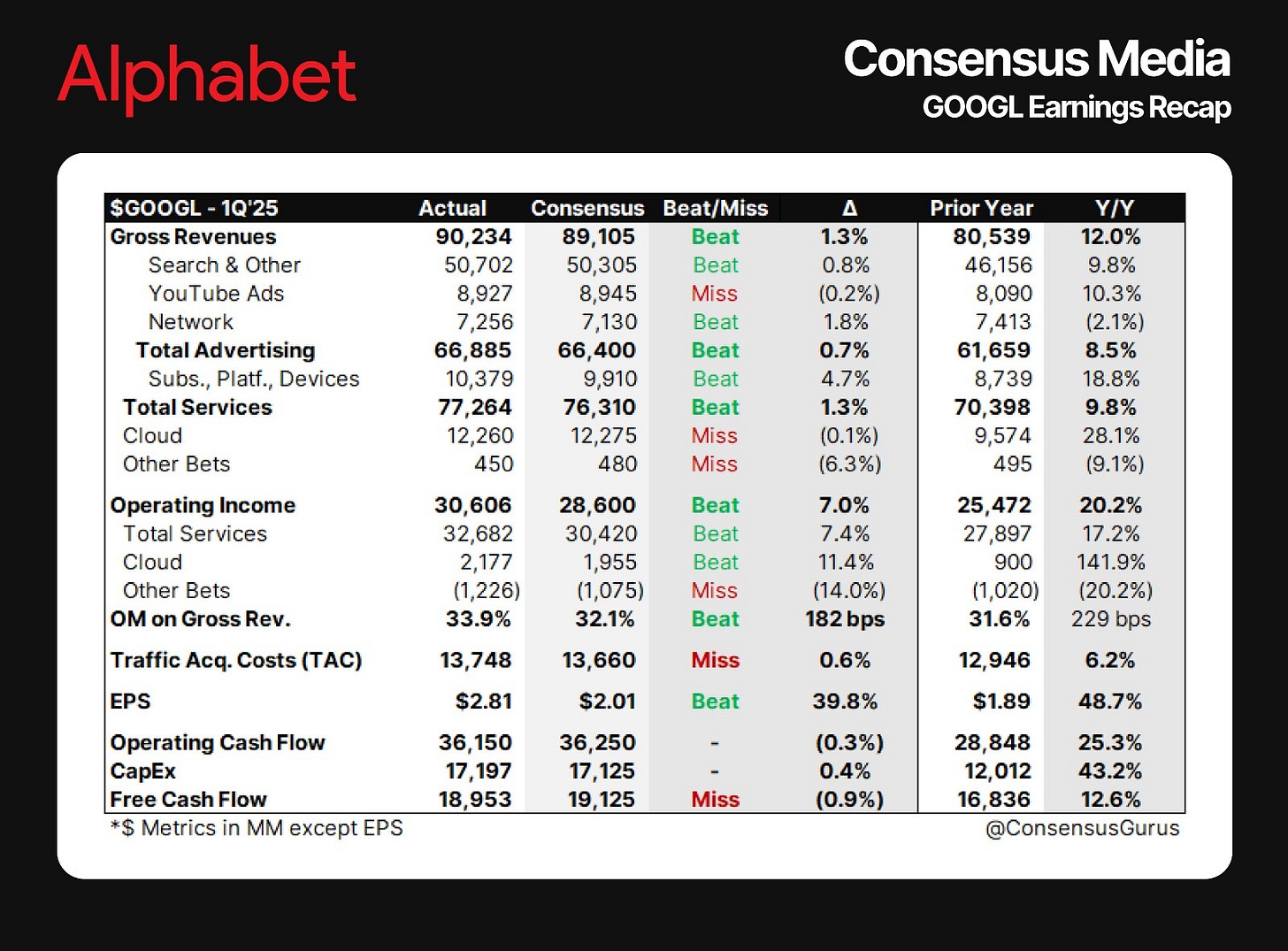

Operating Margin: 33.9%

Operating Income: 20.2% YoY

Revenue: 12% YoY

Google Cloud: 28.1% YoY

Those are strong numbers… no question. But again, the market doesn’t reward what you were, it rewards what you’re becoming. And even great companies can become opportunity costs, especially in an AI cycle that’s moving this fast.

So… What Comes Next?

That’s the real question. If Google’s core search model is being challenged at the edges, and if AI-native platforms are growing their slice of attention, what do we prioritize next?

In my case, I compared two companies. One that’s arguably the most embedded into our digital behavior, and another that’s building its own compute stack, monetizing attention, and scaling faster than anyone expected.

One of them is seeing revenue, operating income, and margins expand simultaneously.

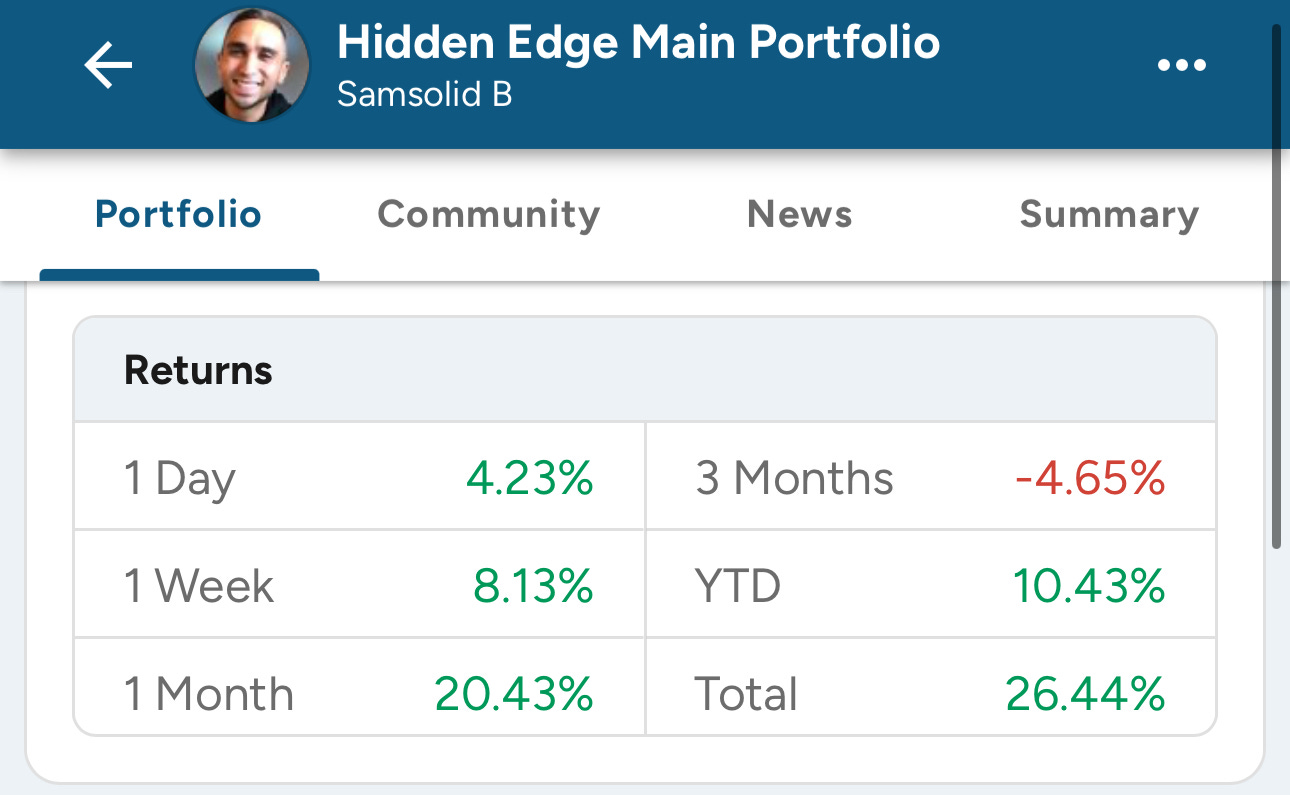

One of them rebounded sharply from the April lows, while the other is still lagging.

I made a portfolio move based on that. And while I won’t spoil it here, you can see what I did and why over on my SavvyTrader profile.

This Isn’t Just About Google

It’s about being early to recognize change. Not necessarily to predict it, but to respond to it before the narrative catches up.

I’m not in the game to hold everything forever. I’m here to outperform. And that means asking hard questions, even about companies we assume are untouchable.

If this resonated with you, follow me on SavvyTrader for full portfolio insights, live moves, and my ongoing thinking behind each name.

So far YTD, my portfolio is +10.43% while the S&P500 is -0.53%. That is nearly a 11% outperformance!

I am currently offering a 50% discount for 3 months. You can use the code below or the link. Feel free to ask me any questions!

Promo Code: summer15only