Is the Trump Put in Play?

Futures were down 23% on Sunday. Today we closed flat. This could be the turning point.

Things have definitely turned a page in the market today.

This morning, during the lows of the intraday gap down, S&P 500 futures were down about 23% from all-time highs, officially hitting bear market status.

Through the overnight session, the price action was choppy, but the direction was clearly up. We didn’t make any lower lows since the open, and since then, we’ve just been melting upward with volatile swings in both directions.

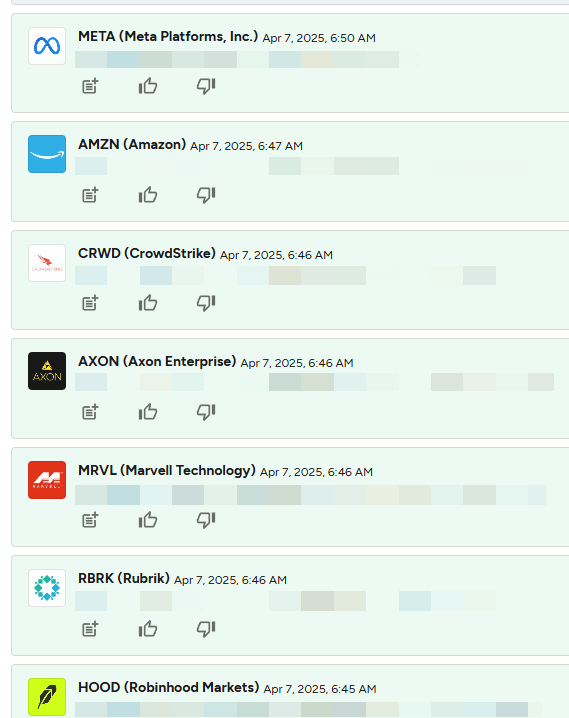

If you were buying overnight through Robinhood or another platform, you probably picked up some great names at deep discounts from just a few weeks ago. Not saying things are exactly cheap here, but a lot of these companies are trading at less than half the valuations they had just a few weeks ago.

What I Bought

Yesterday, I added to my Amazon position and reopened a position in Meta.

The market action felt completely detached from fundamentals. Based on the way things were selling off, you'd think the AI cycle was over and the bubble had burst. But in my view, we’re still in the early innings.

This is just the natural volatility of an early-stage secular trend. If you zoom out, we’ve basically retraced to where we started the year. Still, a lot has changed fundamentally.

Amazon dropped to around $160 during the drop, compared to its $150 starting point in January

Meta was around $300 at the beginning of 2024, but fell to $465 last night

These aren’t the same companies they were a year ago. We’ve seen increased free cash flow, expanding margins, and stronger moats.

Meta is more than just a social media or ad tech company now. Their LLM Llama 3 is putting them in serious competition with players like Grok, OpenAI, and Gemini. On top of that, their core business prints cash with strong margins, helping them absorb Reality Labs losses.

I still believe that division will matter eventually, and Zuck’s not doing it for nothing.

If valuations run too hot again, I may trim Meta since it’s still volatile for a mega cap. But that decision depends on what else is in my portfolio at the time. If I don’t have a better alternative, I might just hold onto it. You can follow my real-time moves on SavvyTrader below.

Hidden Edge Capital Main Portfolio

Market Action and Volatility

When the market opened, we saw a big pullback from the overnight levels. Hedge funds and institutions were likely forced to liquidate or cover shorts, maybe not even at their target levels.

The VIX was almost 60 in the morning, triggering wild swings. It reminded me of March 2020 when the VIX hit 70 during the COVID crash.

If you were trading, you probably got chopped around - unless you really knew what you were doing. But as long-term investors, that’s not the focus. We pay attention to fundamentals, earnings calls, and macro data. We react if the thesis changes - not just because of noise.

Lately, nothing fundamental has changed, aside from some short-term concerns around tariffs or a possible economic slowdown. Most of the companies I hold have weathered storms before, and I believe they’ll come out stronger again.

Political Headlines and Tariff Whiplash

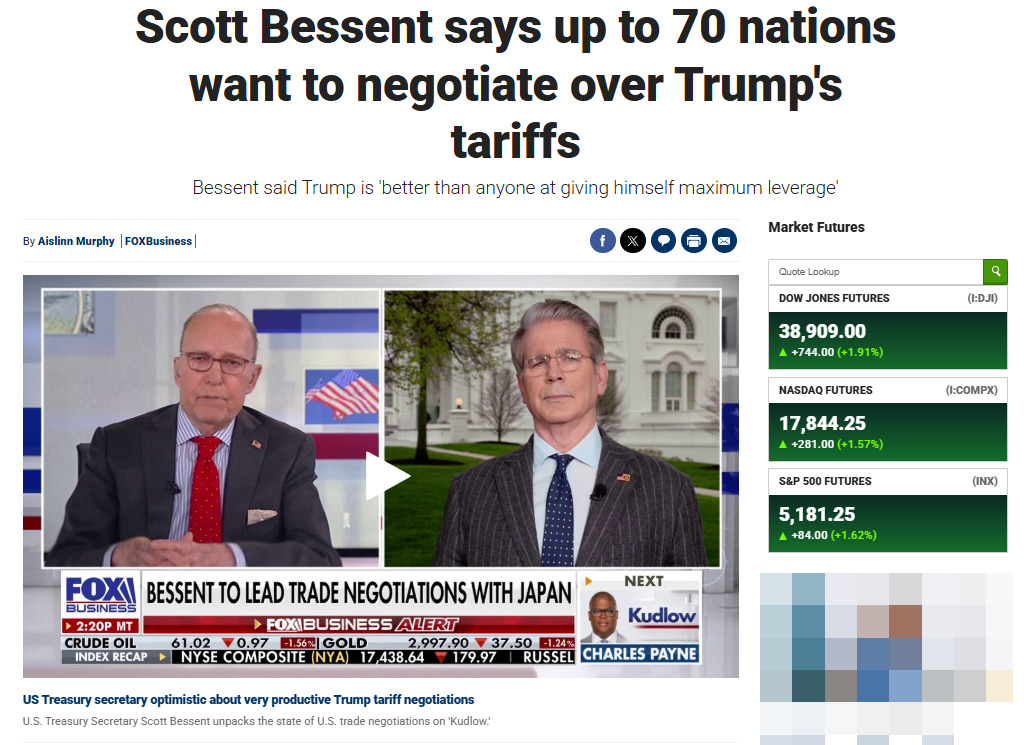

We had a 200-point SPX rally after a tweet claimed Trump was considering a 90-day delay on tariffs. That was quickly walked back as a misinterpretation, and the White House came out to deny it too.

Still, markets grinded higher throughout the day.

Scott Bessent said most countries are already in tariff negotiations with the U.S. The big outlier is China. Last week, Trump proposed a 20% increase on top of the existing 34% tariffs on Chinese imports. China responded with talk of a 50% tariff on U.S. goods.

Clearly, the U.S. has more leverage here. Our imports from China are more essential than our exports to them. But that doesn’t mean this is resolved - there’s still a lot of uncertainty.

How I See It

I think the market is overpricing the impact of tariffs. Nothing is finalized yet, and markets always react sharply to uncertainty. But over time, that uncertainty gets priced out.

April 9 is a key date to watch. Several countries have already struck deals, but the EU and China are still in limbo. I think things will get resolved eventually, but not overnight.

For now, we’ll likely continue seeing some uncertainty in the market. And with earnings season approaching, don’t expect many CEOs to give guidance. We might get a couple soft quarters before financials catch up to market optimism.

But just remember - markets bottom before the economy does. When fear is at its peak, that's often when the bottom forms.

We might have seen that moment yesterday. Futures were down 5% at the open. The S&P was down 23% from highs. As of today’s close, it’s now just 18.5% down.

My Positioning

My cash is mostly deployed. I have emergency deposits ready if needed, but I’m holding off for now.

There could be another leg down, or we might chop sideways for a while. Either way, I’m continuing to dollar-cost average weekly.

If we bounce hard, I’ll keep any new cash as dry powder. Otherwise, I’ll keep tracking economic data, earnings, and macro signals.

It’s very possible we saw the bottom. Hopefully some of you took advantage of the early morning panic.

If you’re a long-term investor or someone who buys index funds weekly to manage risk and avoid the stock-picking grind, this is probably a good time to nibble - not go all in, but start building.

As always, none of this is financial advice. I’m just sharing what I’m doing and how I’m thinking.

Thanks for reading. Let’s see what happens next.