LAST WEEK IN MARKETS

[FREE] Here we are backtesting the 200-day moving average. Breakout or breakdown?

This week marked one of the first red weeks in $SPX in quite a while.

What made it fascinating wasn’t just the drawdown itself, but how it happened… an entire week of choppy, indecisive price action that eventually fell off a cliff after the 20Y U.S. Treasury auction.

That auction matters more than most people realize. Bonds are one of the largest and most predictive markets in the world. When you see yields spike… like we did with the 20-year trading above 5%… it’s the market’s way of saying it expects federal interest rates to remain elevated for decades. Of course, the real answer is more nuanced. A lot of factors go into those yields. But broadly speaking, rising yields suggest market participants are growing less confident in the U.S. economy's long-term stability, especially its ability to service debt.

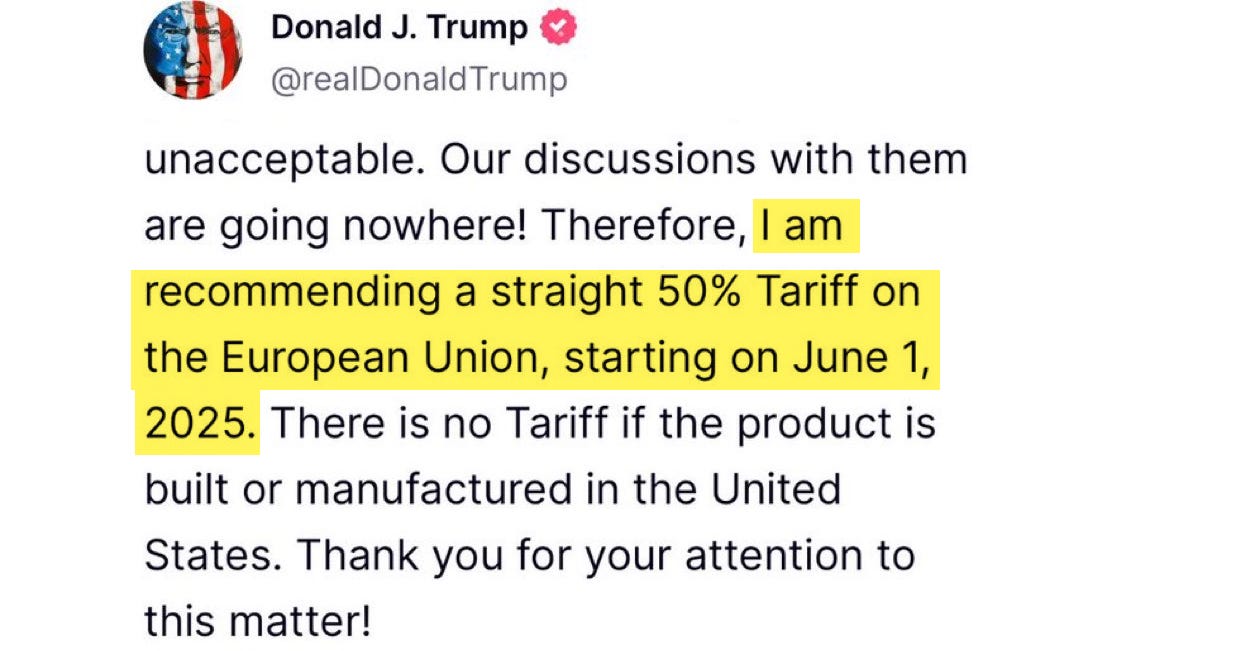

That’s where things get dicey. GDP came in negative last quarter, and it might be negative again. Meanwhile, there’s some talk of tariffs making a comeback, which historically has impacted trade behavior… especially when inventories are already elevated.

But if those tariffs don't materialize in a meaningful way, we may see things normalize sooner than expected. The front-loading phase might be over. And that means a smoother, less panicked return of imports… which also means maybe, just maybe, the bond market is overdoing it.

The stock market has definitely felt the heat. The S&P 500 has pulled back roughly 2.5% from its highs. We briefly flipped negative on the year again. VIX is back above 22, which is not ideal, but also not a total panic. We also had a few important earnings reports this week that added more color to the macro backdrop… particularly from the software side.

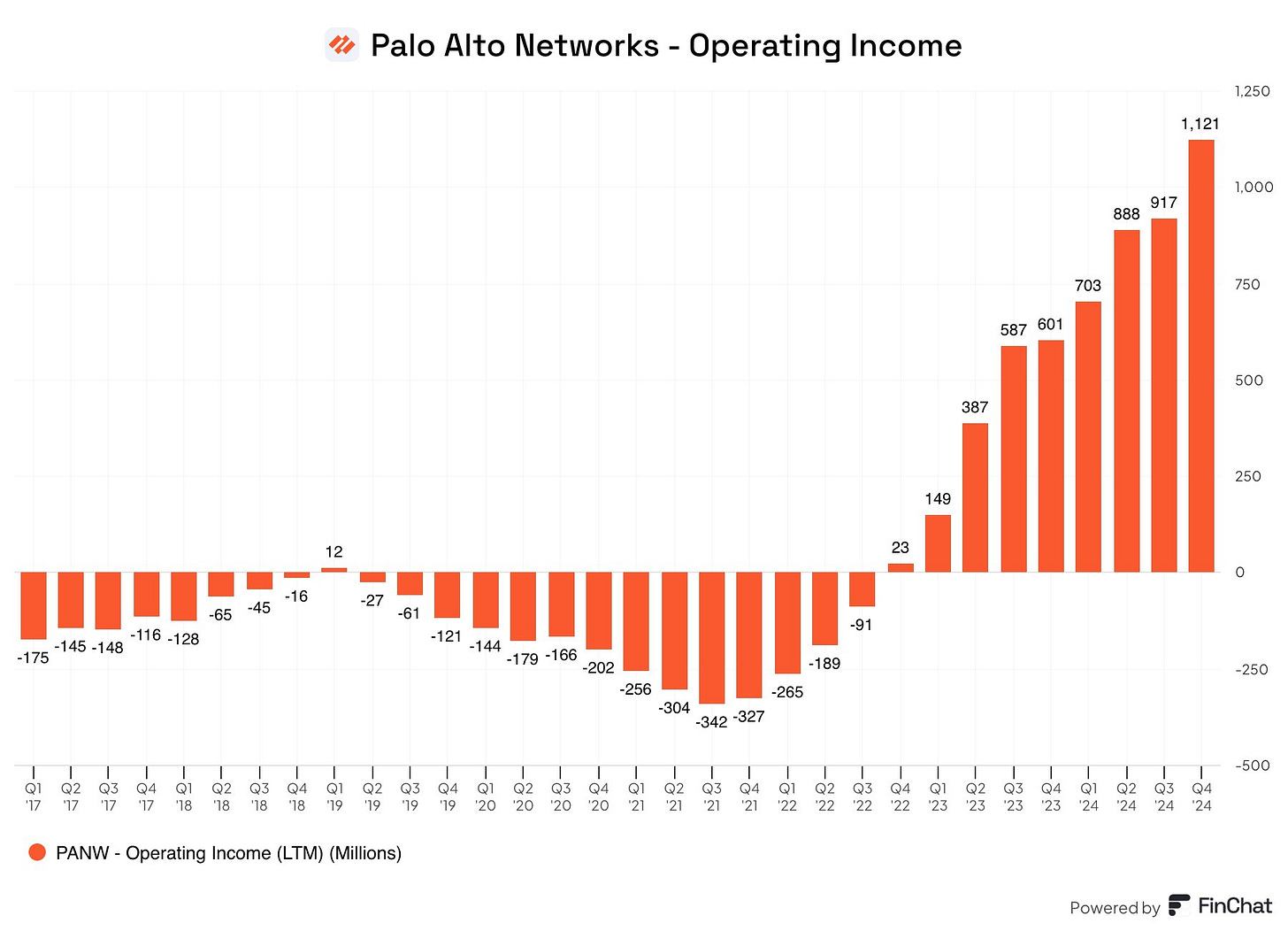

First up was Palo Alto Networks. The company is still the clear leader in cybersecurity, and it continues to grow its RPO impressively year over year. But the market didn’t love what it saw… margins contracted, and earnings showed signs of slowing. $PANW was trading near all-time highs after a big April rally, so this might’ve been just a bit of healthy profit-taking. Still, the long-term theme for the company is that they are the leader in cybersecurity as a platform, and they continue to show remarkable RPO growth.

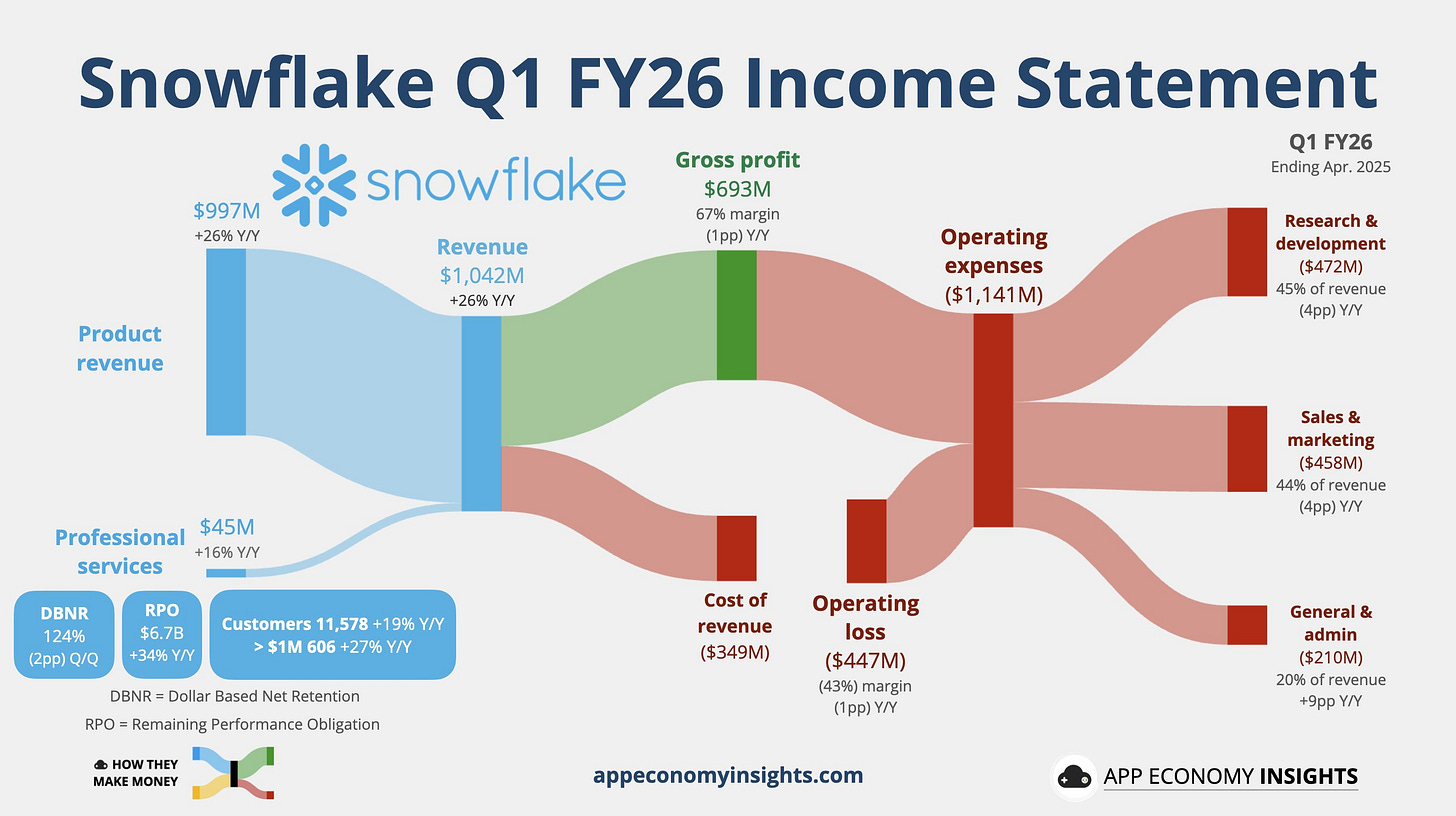

$SNOW told a different story. Sentiment has been brutal around this name for the past year. It rallied off its COVID lows, but it’s still miles away from its all-time highs… and even from the 2024 levels it saw before Frank Slootman stepped down. That said, this quarter was strong. Revenue grew 26% YoY. They beat estimates and raised guidance. And importantly, they’ve managed to cut stock-based compensation from 43% of revenue down to 36%. Stock comp grew just 14% YoY while revenue grew 26%, meaning they’re moving toward healthier operating leverage. They’re still not profitable on a GAAP basis, but free cash flow is strong, and adjusted margins are improving.

What’s clear is that secular trends… especially AI… are moving forward no matter what’s happening with bonds, tariffs, or GDP prints. Companies are investing in efficiency, and Snowflake is a good example of that. If the market pulls back more, I see it as an opportunity… but I’m also not sure what the bears are waiting for.

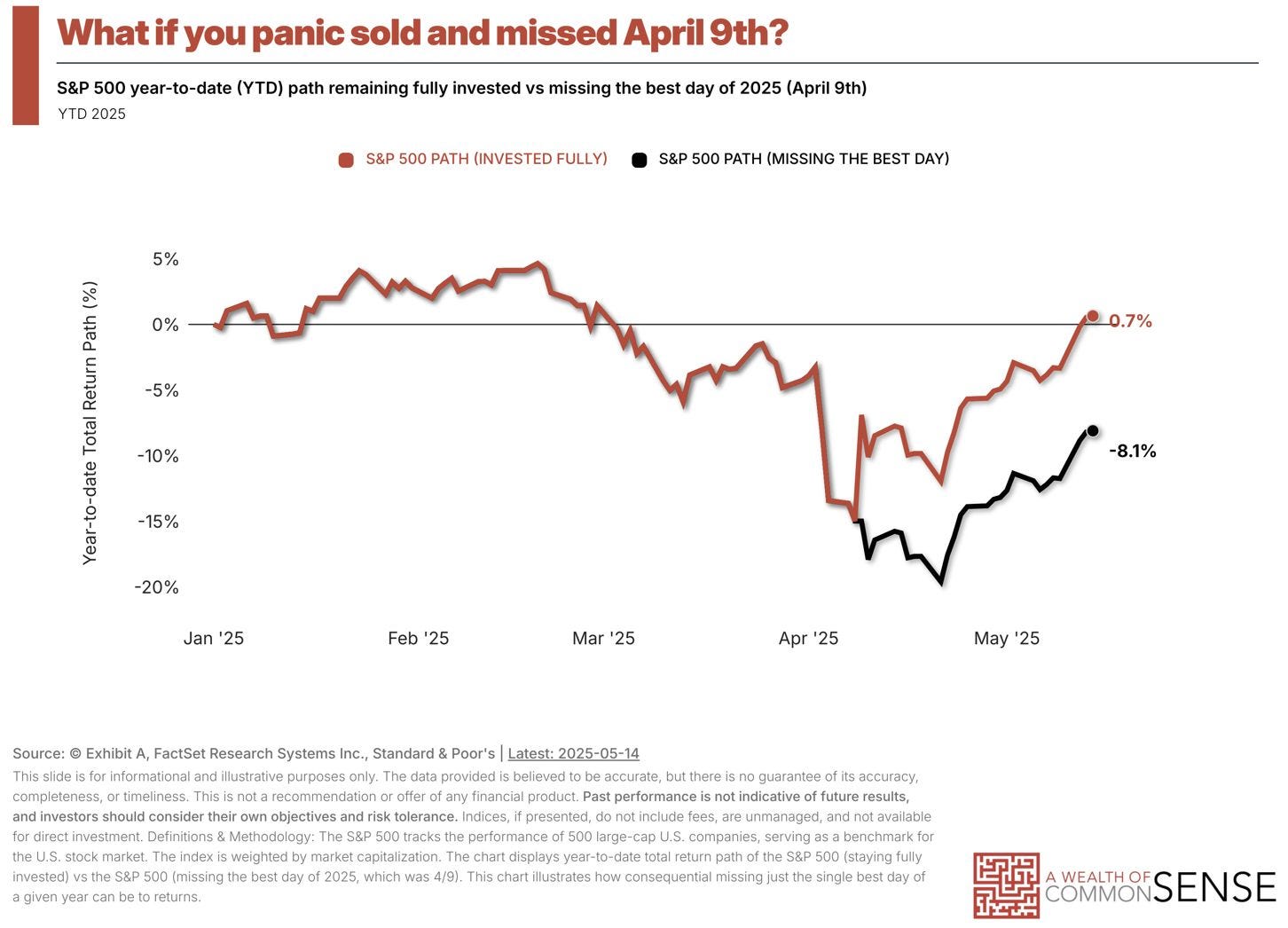

Let’s rewind for a second. Just a month ago, the market was down nearly 20% from all-time highs. Some names were cut in half. Sentiment was trash. Analysts were slashing price targets across megacaps. Everyone was calling for more pain. That was your correction. And now, just weeks later, we’re back within 5% of all-time highs… yet the doomers still want another crash.

What exactly do they want? Do they want a new financial crisis just because they missed the bottom? Because rooting for a collapse isn’t just about buying cheaper stocks… it’s also rooting for job losses, economic pain, and social instability. It’s like hoping for your neighbor’s house to burn down because you missed the homebuyer’s tax credit.

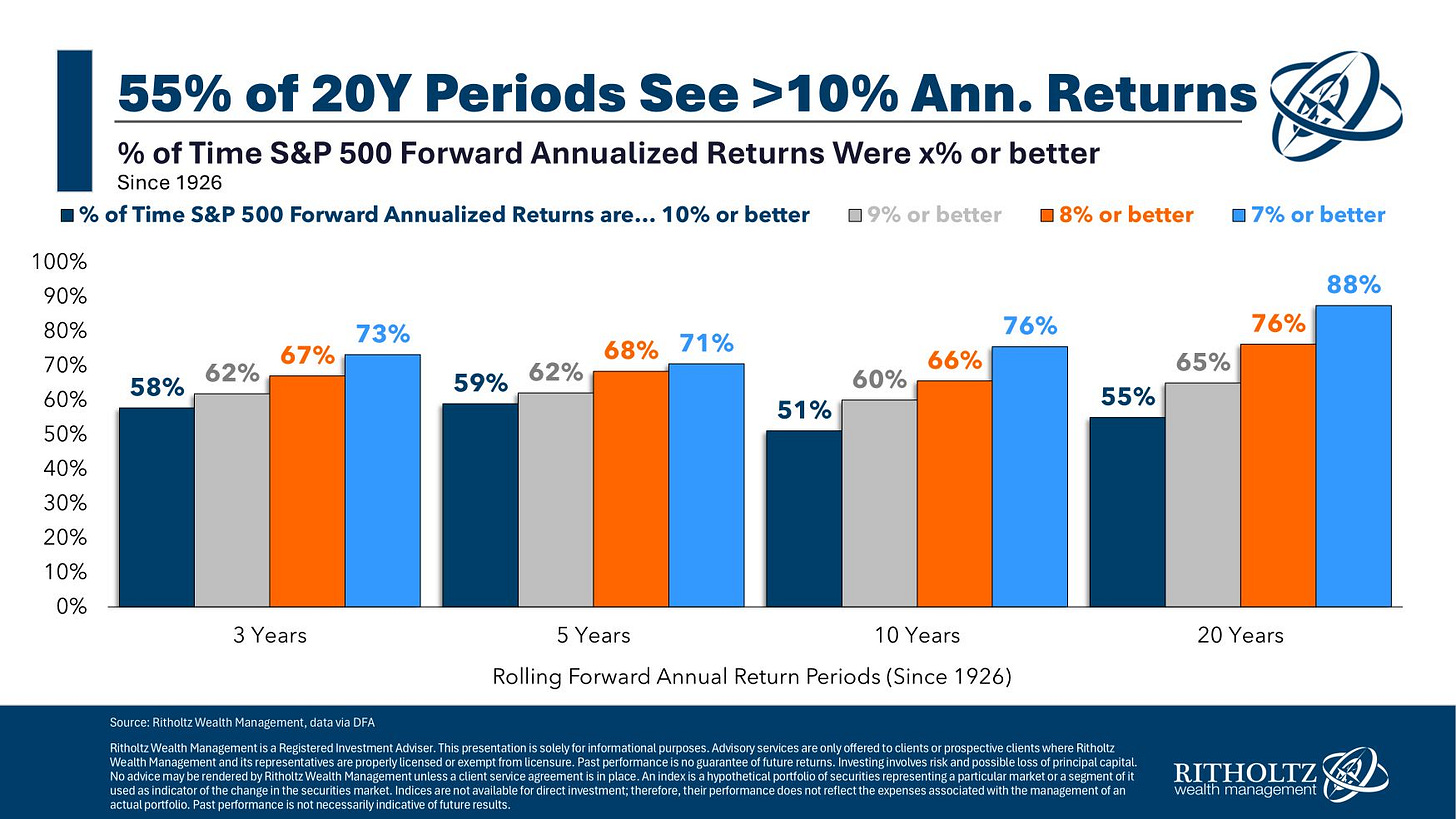

If you're thinking long term… 10, 20, 30 years… then current prices still make sense. The long-term trajectory of American innovation, productivity, and corporate earnings has not changed. AI is still coming. Efficiency is still compounding. Earnings are still growing. And if you're investing globally, you still want the U.S. to succeed, because it powers a huge chunk of global GDP.

So think about your timeframe. Are you investing for the next 30 days or the next 30 years? If it's the latter, block out the noise, hold strong, and buy the dip if it aligns with your thesis.

Because in the end, rooting for disaster rarely works out… for your wallet or for the world.

Thanks for reading.