Moody’s Downgrade, Just Noise?

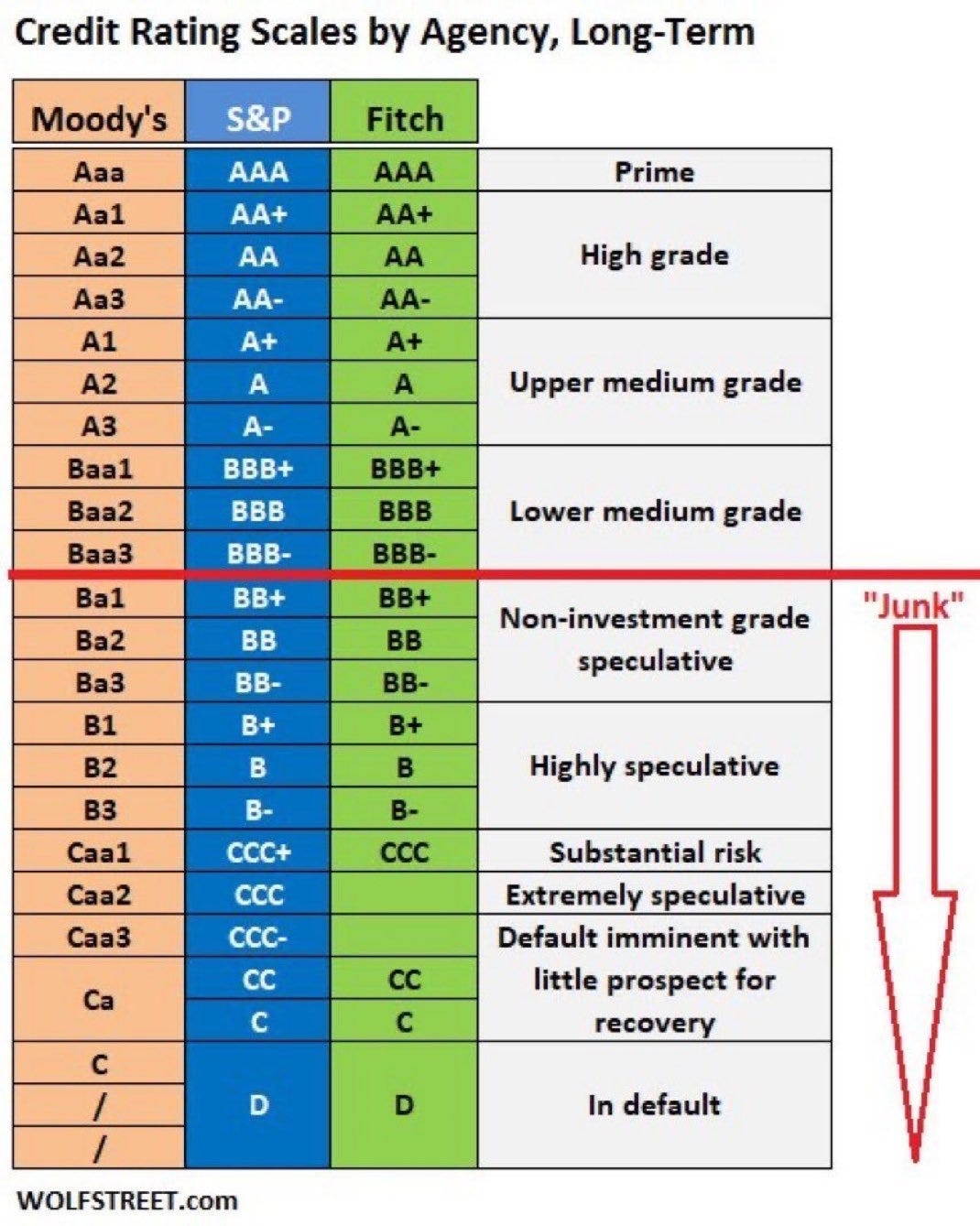

The third credit agency dropped U.S. Debt from AAA to AA1. Will a correction follow?

Something very interesting happened on Friday in the market. Actually, two things.

First, every dip has been relentlessly bought, and that’s been going on for weeks now. Second, after hours, the market got hit with a headline that led to a sharp 1% sell-off in just a couple of hours, wiping out all the intraday gains.

So, what was the news?

The Downgrade That Shocked No One

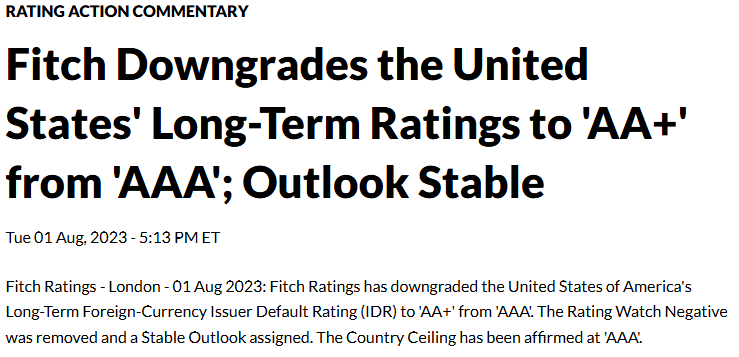

Moody’s downgraded U.S. debt from AAA to AA1, putting it in line with where S&P and Fitch already had the U.S. rated. That means all three major credit agencies now have the U.S. one notch below perfect, at AA+.

Moody’s cited tariff escalation and broader fiscal concerns, rising debt, interest payments, long-term deficits. They still acknowledged the U.S. can pay its bills, but uncertainty has grown.

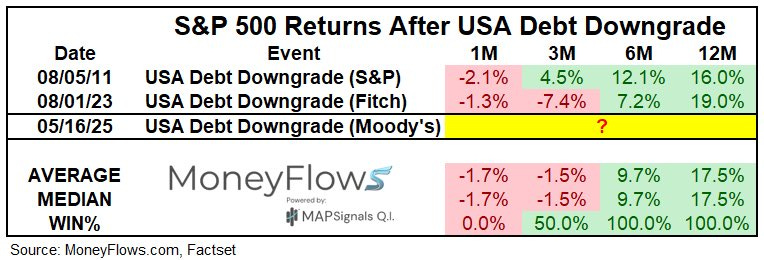

Naturally, the downgrade triggered a knee-jerk reaction. Fear started circulating again. People brought up 2011 when S&P’s downgrade led to a market slide, or 2023 when Fitch’s downgrade came during a broader correction.

But I think this time is different, and here’s why...

2011 Was Structural, Not Sentimental

Back in 2011, the S&P downgrade caused real issues. Many contracts, especially for collateral and fund mandates, required AAA-rated debt. Once the downgrade hit, those rules were technically violated.

That caused a forced sell-off. There was no framework in place to deal with a downgrade, so the system had to adjust on the fly.

Eventually, the rules did adjust. Instead of requiring a AAA rating, contracts were rewritten to accept U.S. government securities, regardless of the specific agency rating. The market adapted.

The U.S. didn’t become riskier... the paperwork just needed to catch up.

2023 Was Different Too

When Fitch downgraded the U.S. in 2023, markets initially dropped about 1% to 1.5% after hours. But if you looked closely, that wasn’t because of the downgrade alone.

There were multiple factors at play... fears of a recession, profit-taking after a strong rally, stretched valuations. The downgrade may have been the headline, but it wasn’t the reason.

It was normal market rotation, not panic about creditworthiness.

2025: Moody’s Is Just Catching Up

Now in 2025, Moody’s is simply the last one to show up. This wasn’t unexpected. It made headlines, but it didn’t change anything.

The rules have already been updated to allow for AA+ ratings. Split ratings are now the norm. Nothing really changes in practice.

Yes, the market dropped 1% after hours... but by the weekend, it had already bounced back and retraced half the move. That tells me this isn’t about credit risk. This is about headlines and reflexive selling.

If there’s more downside, it won’t be because of Moody’s. It’ll be because of yields, bond volatility, or broader macro noise.

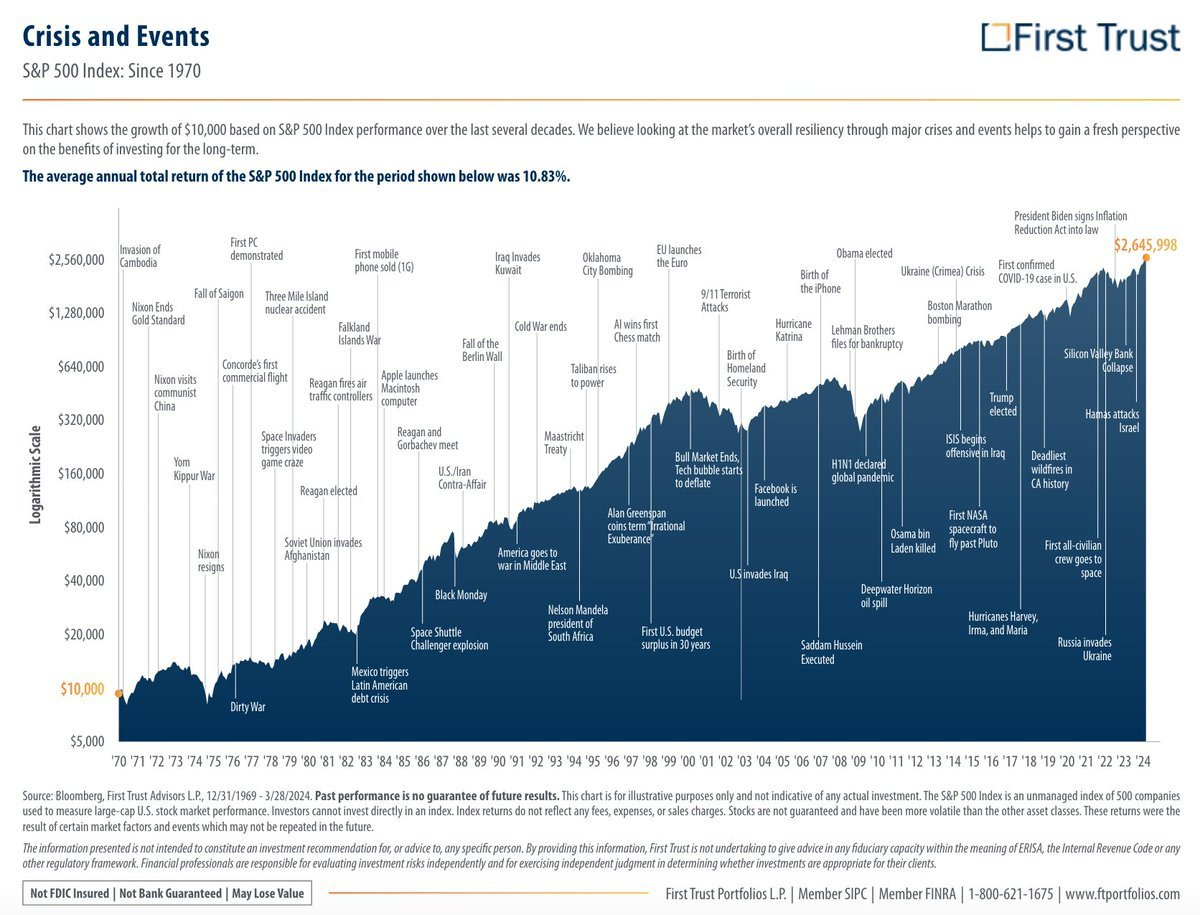

The Bigger Picture

Let’s zoom out.

We just came off one of the fastest bear markets since COVID. And it wasn’t driven by collapsing fundamentals, it was front-running fear over tariffs that didn’t end up being as bad as advertised.

The rebound since has erased most of that fear.

So did this downgrade introduce fresh uncertainty? Maybe a little. Bonds dipped, sure, but they found support near Thursday’s lows. If yields spike again, we could see more pressure... but if they stabilize, where’s the risk?

Don’t Let the Fear Win

If you think a second wave of pain is coming solely because of this downgrade, you’re not trading on new information... you’re reacting to fear.

A 1% drop after a 25% rally isn’t a trend-changer. It’s noise.

Since the April lows, bears have been calling for another leg down. If you listened to them, you missed a monster rally. So ask yourself... are you going to listen again? Are you going to sell everything now because of a downgrade that was expected for months?

I’m not.

At most, I might trim or rotate a few positions to manage risk. But I’m staying invested. Not because I know what’s coming next, none of us do, but because I believe this downgrade isn’t the top.

Probability Over Emotion

We make decisions based on probability, not panic.

If you’re selling now, ask yourself... are you trading facts or trading headlines?

A 1% dip on stale news isn’t a signal. It’s noise.

So no, I’m not going all cash. I’m not flipping bearish on a downgrade that’s already priced in. If I’m wrong, so be it... I’ll adjust.

But I’d rather stay rational than reactive.

Let’s keep watching.

I like your writing style!

Great article Samsolid 👌 we share the same thoughts