Nebius Group Targets a $260B Market

Backed by Nvidia, diversified portfolio of businesses, and growing at 400%+

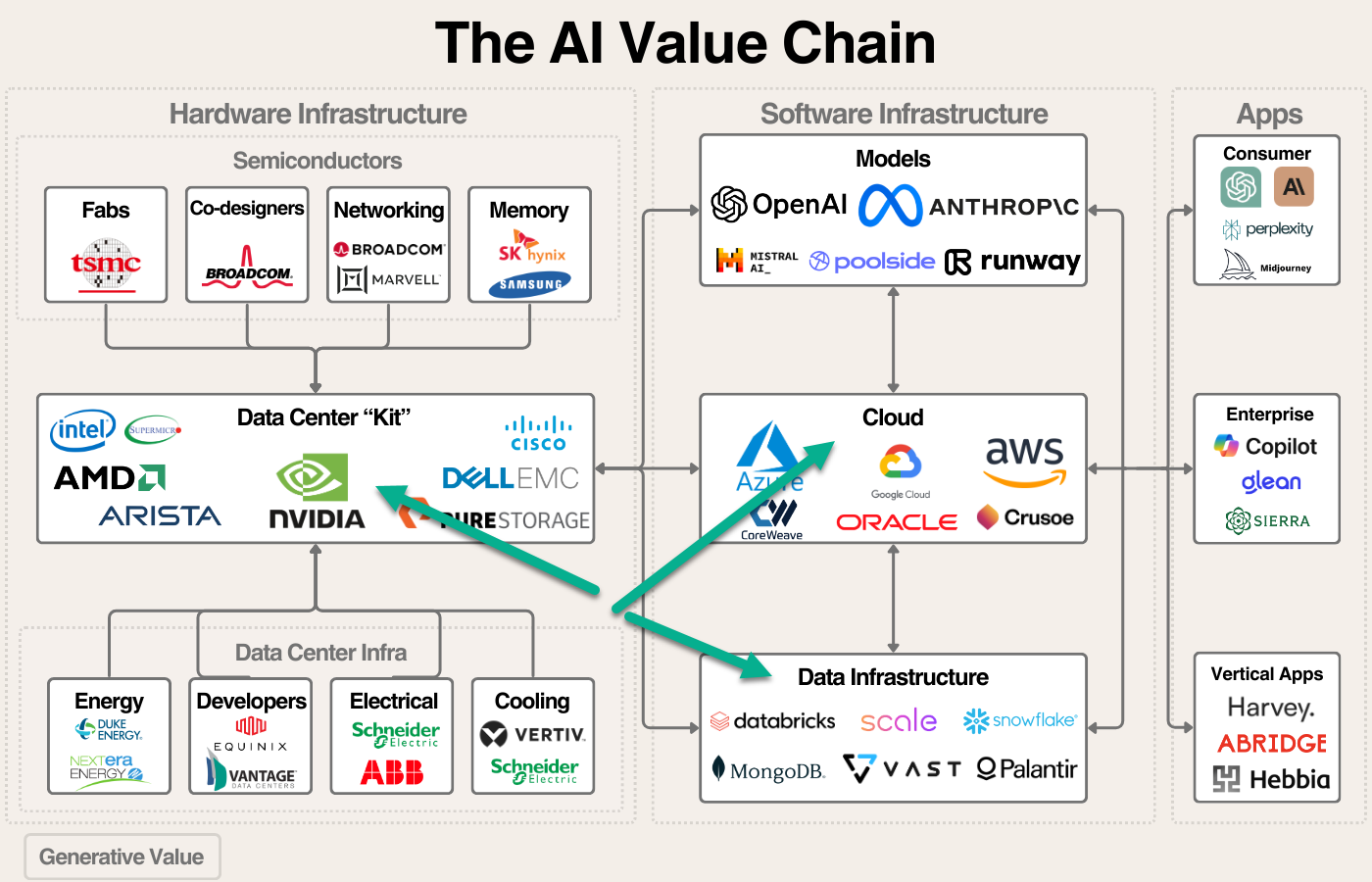

Out of all the companies I’ve been digging into this year, Nebius easily stands out as the most interesting one. It’s not just an AI infrastructure company—it’s a portfolio of high-growth businesses, all feeding back into making their core stronger. Each segment is scaling fast, targeting massive TAMs, and all of it is capital-efficient.

Nebius Cloud – Core Business, Growing 600%+ YoY

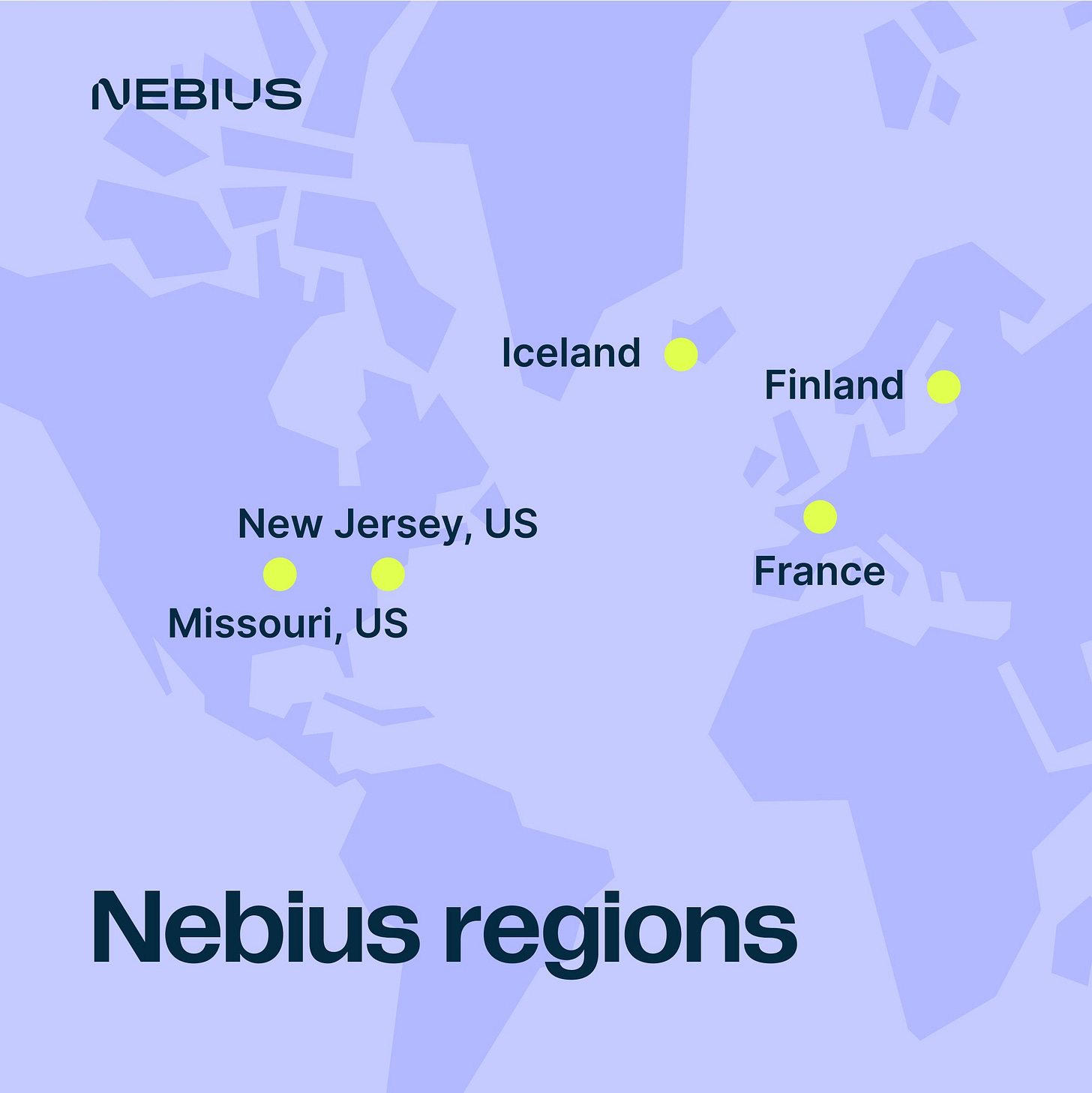

Nebius is focused purely on AI-first workloads. They’re not trying to be AWS or Azure. They’re scaling smart—building out GPU clusters in the U.S., Paris, and Iceland, with 22,000+ Blackwell and Hopper GPUs. Full-stack control from hardware to cloud platform gives them serious cost advantages. On top of that, they’ve got customer-facing hubs in NY, SF, Dallas, and engineering teams globally (Tel Aviv, London, Belgrade). ARR is already at $220M heading into 2025, aiming for $750M–$1B by year-end.

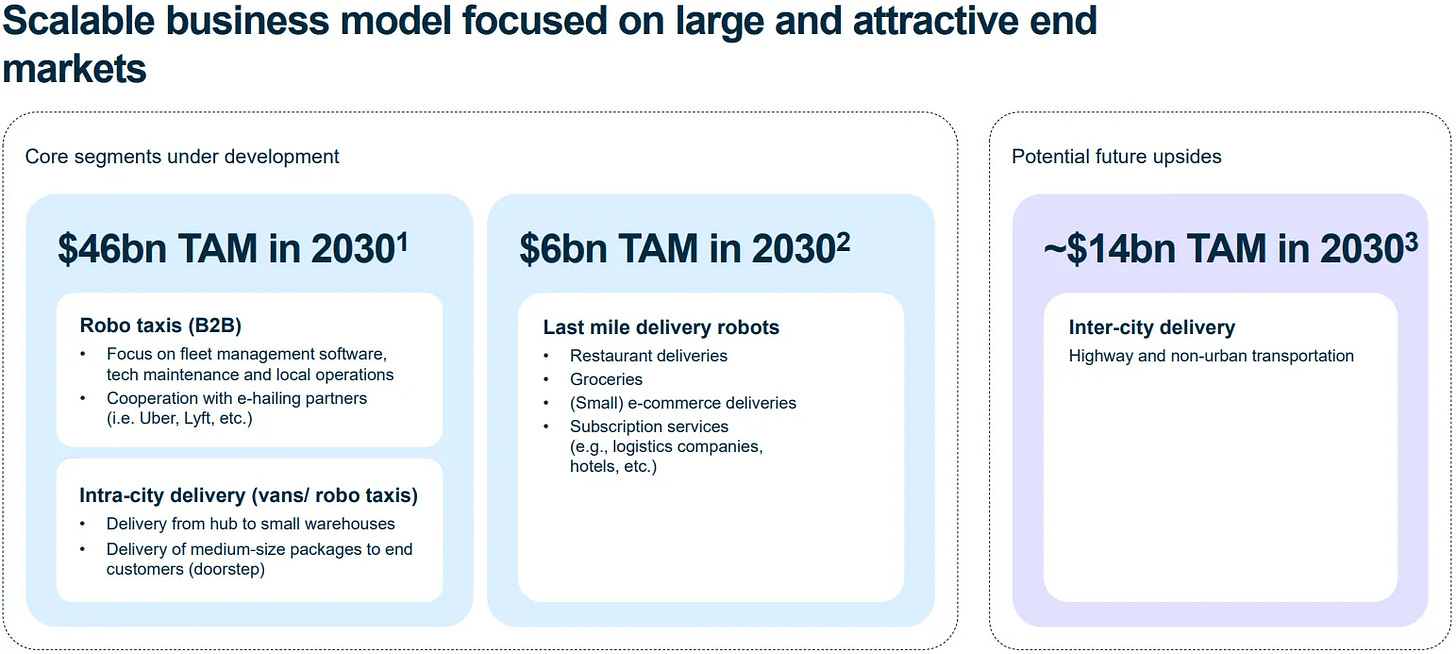

Avride – Full Autonomy for Ride-Hailing & Delivery

Avride is Nebius’ autonomous driving and delivery business, but it’s much more than just self-driving cars. They’re actually running full robotaxi services and last-mile delivery with no drivers or delivery people, and they’ve already got multi-year partnerships locked in with Uber and Grubhub. They’re live and operational in the U.S., Israel, and South Korea, with over 22M km driven, zero serious incidents, 47k+ passenger rides, and over 200k deliveries completed.

What makes Avride even more interesting is they’re not just offering the vehicles—they’re licensing out the tech stack, handling fleet management, and managing software and maintenance. TAM potential is big: $46B for autonomous vehicles and $6B for delivery robots by 2030. They’ve been operating for about seven years, are scaling fast, and Nebius expects them to hit breakeven contribution profit by 2025.

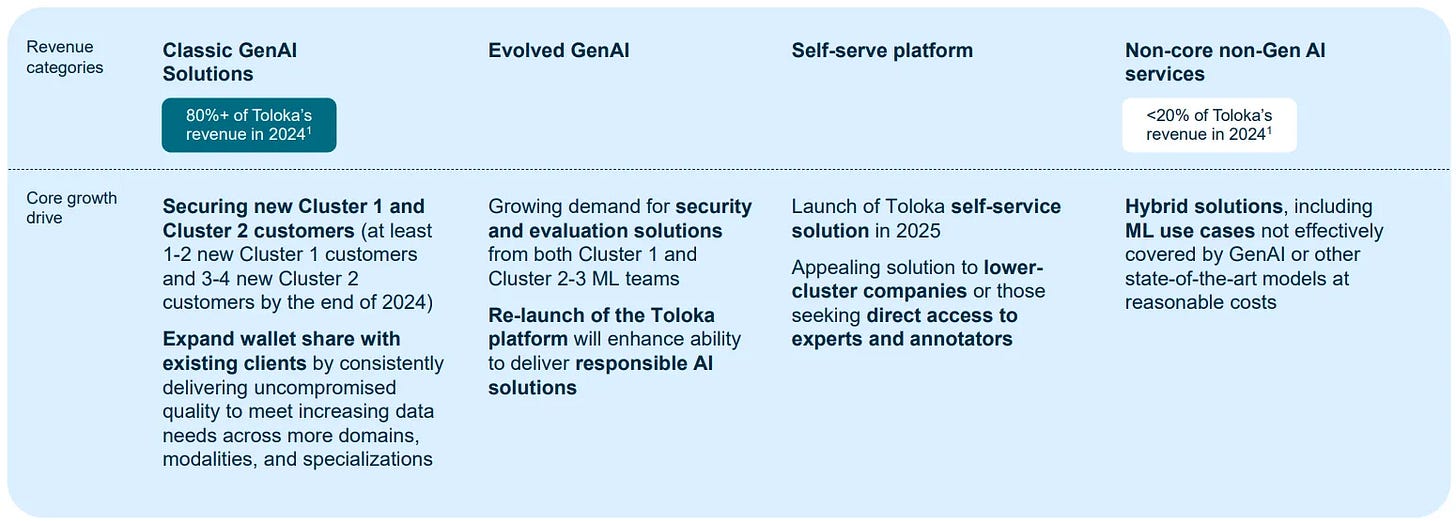

Toloka – GenAI Data Infrastructure

Toloka is Nebius’ crowdsourcing platform built specifically for AI and ML tasks. Think of it like Fiverr, but instead of freelancers doing logos or gigs, it's all focused on things like data labeling, RLHF, model evaluation, and human feedback loops. Over 80% of their revenue comes directly from GenAI clients—foundational model builders, LLM developers, the core players in AI.

They’ve got their eyes on a $17B TAM by 2030, growing at a 40% CAGR. What’s interesting is they're rolling out a self-serve platform in 2025, aiming to pull in smaller customers and expand wallet share from big names they already work with. Positioned perfectly to be a key piece of the AI data supply chain.

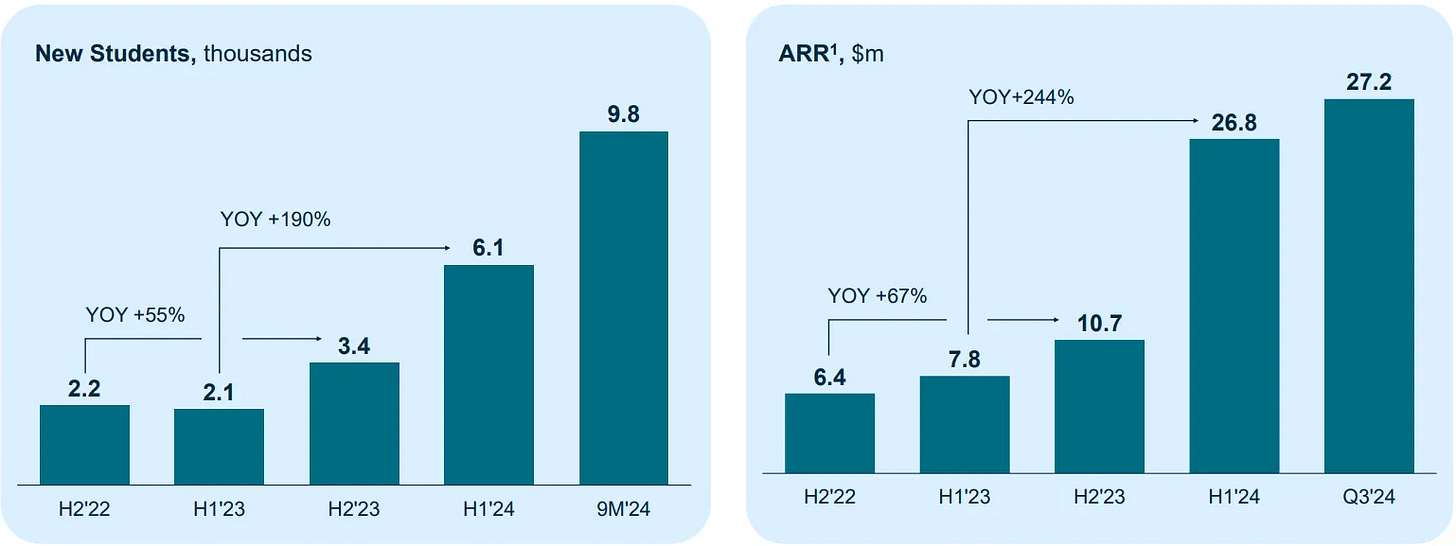

TripleTen – Efficient, Scalable EdTech

TripleTen is Nebius’ tech bootcamp platform designed to reskill individuals for high-demand tech careers. It’s similar to platforms like Udemy or Codecademy but with better outcomes—87% of students land jobs within six months. Right now, they’re focused on the U.S. market but plan to expand aggressively into LATAM, seeing huge potential in untapped markets. One thing that stands out is how efficient their model is—student payments fully cover CAC upfront, making scaling much more capital-efficient compared to competitors.

They’re targeting a $95B TAM by 2030, growing at +26% CAGR. Beyond B2C, they’re building out a strong B2B offering as more companies invest in reskilling their workforce, especially with the rise of AI-driven disruption. They’re continuously expanding their course catalog—recently adding Cybersecurity and planning to roll out a UI/UX Designer program soon. Plus, they’re integrating AI-powered tools to improve learning outcomes and reduce costs, positioning themselves as a leader in tech education both for consumers and corporate clients.

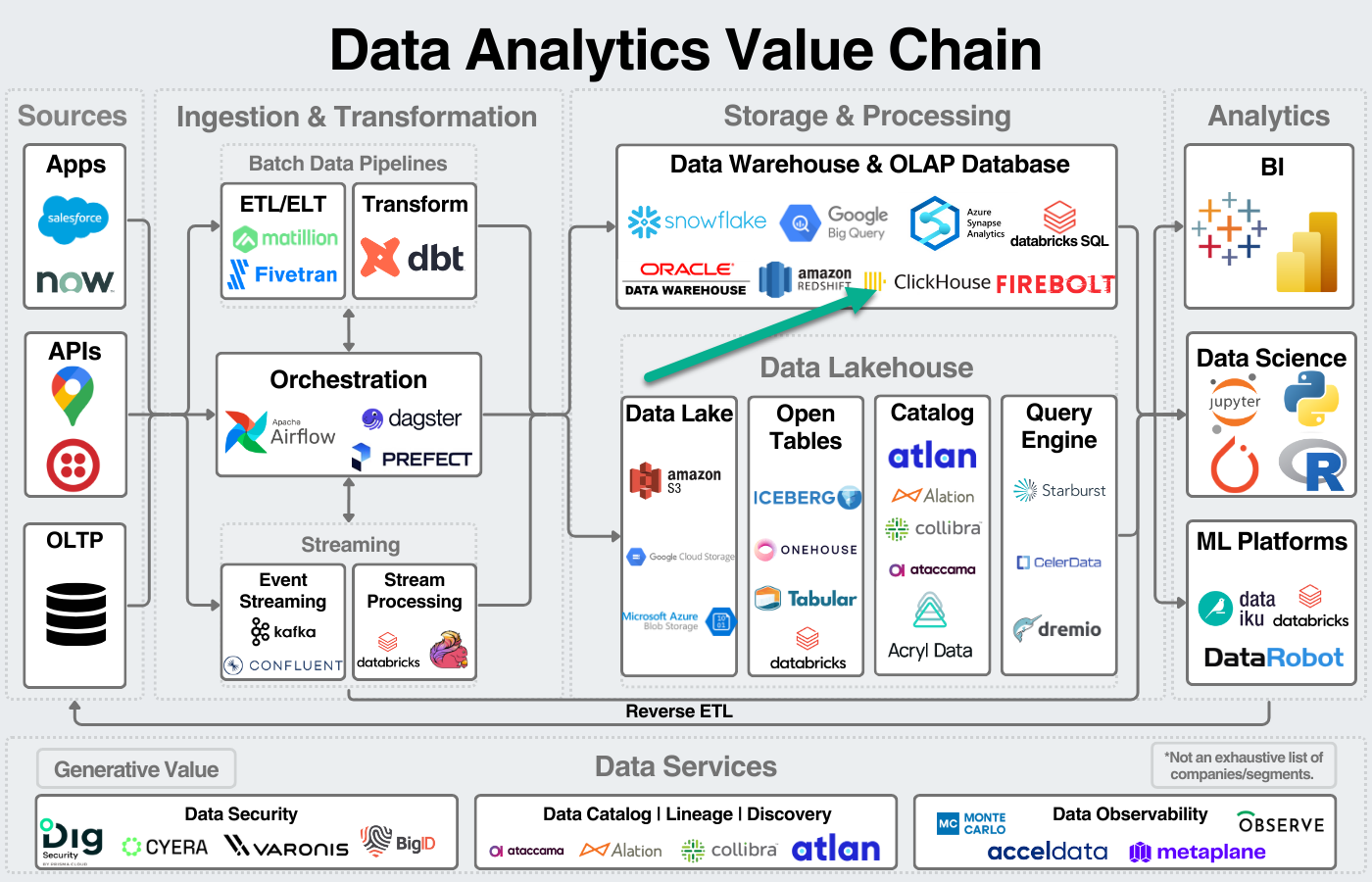

ClickHouse Stake

Nebius holds a 28% stake in ClickHouse, the open-source OLAP database known for high-speed analytics, positioned as a strong competitor to Snowflake and Databricks. Originally spun out of Yandex, ClickHouse was valued at $2B in 2021, though recent secondary market estimates suggest a current valuation closer to $530M, reflecting broader tech repricing. Altimeter Capital owns around 15%, but Nebius maintains the largest single stake. While ClickHouse isn’t a key revenue driver for Nebius today, it represents solid long-term optionality as the data infrastructure market grows.

Financials & The Bull Case

Nebius is sitting on $2.4B cash, no debt, giving them a ton of flexibility to fund growth without dilution risk. 2024 revenue hit $117.5M (+462% YoY), primarily driven by their AI cloud segment growing over 600% YoY. For 2025, they’re guiding for $500M–$700M revenue and $750M–$1B ARR by year-end, with plans to hit adjusted EBITDA breakeven in 2025. They’re deploying capital fast—$808M CapEx in 2024—focused on scaling GPU clusters globally, including U.S., Finland, and Paris data centers. GPU capacity is set to triple over the next year, supported by strong Nvidia ties and discounted Blackwell GPU pricing.

Big picture—Nebius isn’t just an AI infrastructure company. They’ve built an ecosystem where each business feeds the others: AI cloud, autonomous driving (Avride), GenAI data (Toloka), and tech reskilling (TripleTen). They’re focused, capital-efficient, executing globally, and undervalued relative to peers like CoreWeave. The optionality in assets like ClickHouse and Avride, plus their clear runway to $1B+ ARR, makes this one of the most interesting setups in the space.

I have notified Paid subscribers regarding my position in this company. To join the chat, click the link below to subscribe!