NuBank: Best Setup for 2025 [1/3]

NuBank is a fundamentally strong company that sets up for a bullish narrative in 2025.

NuBank History and Financials

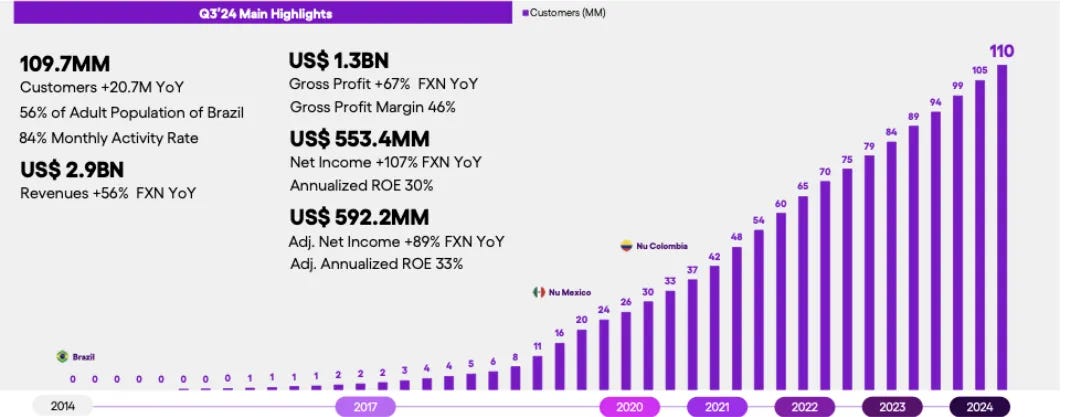

NuBank is a Brazilian neobank founded in 2013, offering digital financial services like credit cards, personal loans, and digital payments through a mobile app. Headquartered in São Paulo, it has grown rapidly to become the largest fintech bank in Latin America, serving over 100 million customers across Brazil, Mexico, and Colombia. NuBank went public in December 2021, achieving a valuation of $45 billion. The company continues to expand its services and explore new markets, aiming to become a global leader in digital banking.

Accelerated Growth for Deposits and Loans

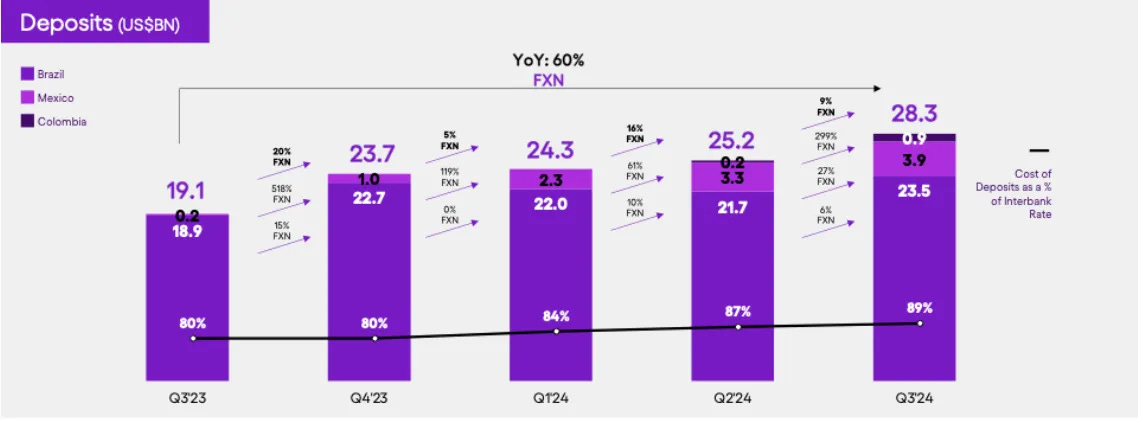

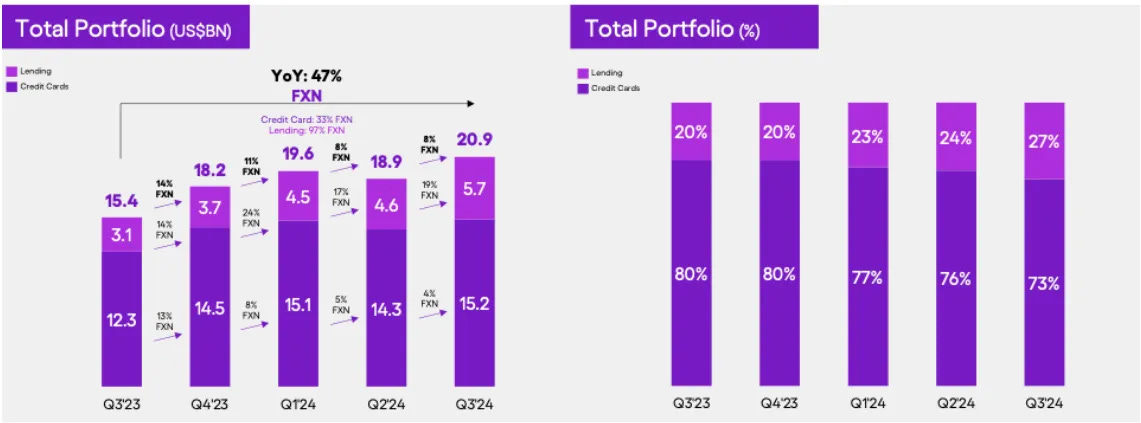

Overall, the bank has experienced rapid growth, reaching 110 million customers as of September 2024, up from 41.1 million in Q4 2021. Its credit portfolio, primarily consisting of credit card loans, is nearing $21 billion, reflecting a 47% year-over-year increase. Personal loans make up nearly a quarter of its total loan portfolio, showcasing its expanding financial services.

Brazilian Dominance and Cost

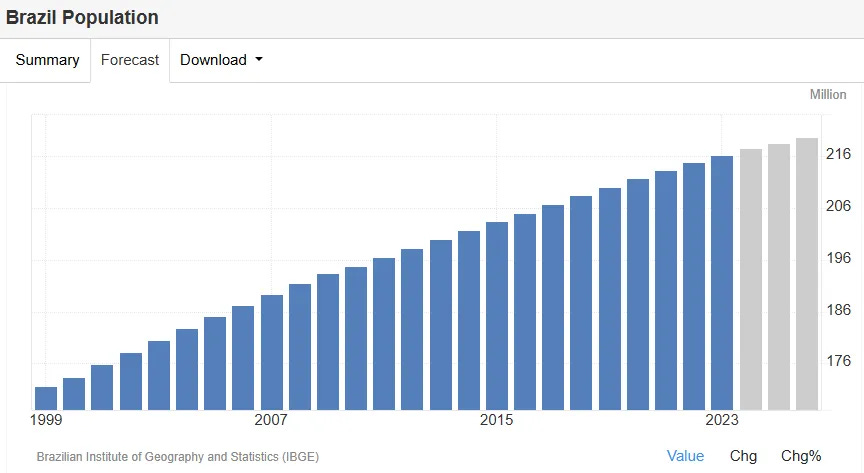

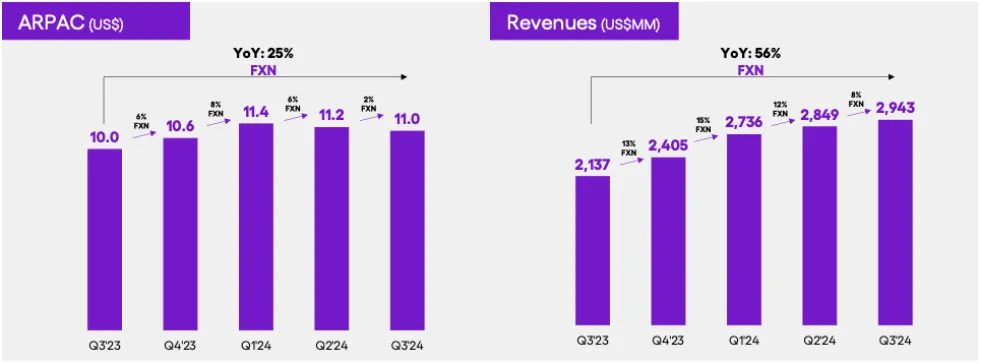

As of September 2024, NuBank captured 54% of the adult Brazilian population as clients. Brazil's population continues to increase, leading to a rising Total Addressable Market (TAM). Monthly active users are at 84%. The average revenue per acquired customer (ARPAC) is $11, with a year-over-year increase of 25%. However, ARPAC has decreased sequentially over the last two quarters due to rapid expansion in Mexico and Colombia. Since ARPAC is a monthly average, newly acquired customers initially bring the average down until their revenue ramps up. Despite this, the cost to serve each customer is only $0.80 and has also decreased sequentially.

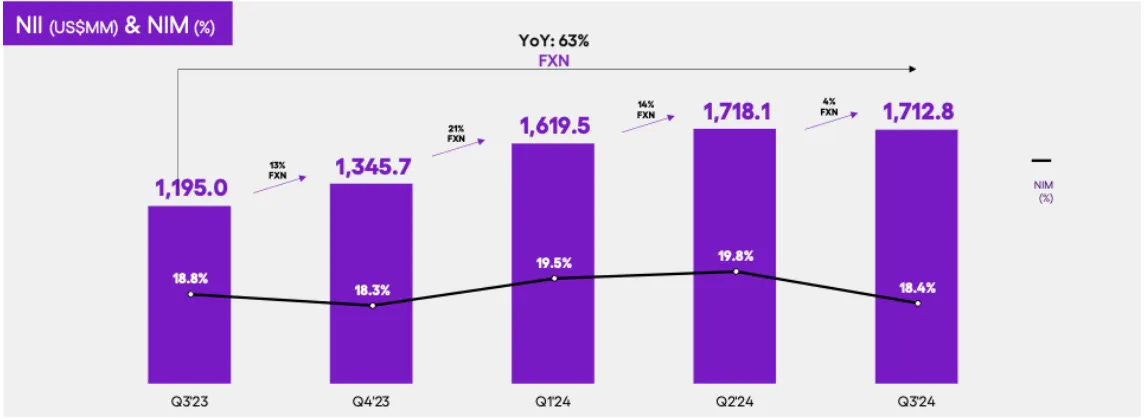

Interest Income and Margin

Net Interest Income (NII) represents the difference between the interest earned from NuBank’s lending portfolio and the interest paid on its deposits. This metric reflects how effectively a bank leverages its client deposits. NuBank reported an NII of $1.7 billion, which grew by 63% year over year. However, the Net Interest Margin (NIM) declined from 19.8% to 18.4%. This decline was partly due to customers improving their creditworthiness, making them eligible for loans with lower interest rates.

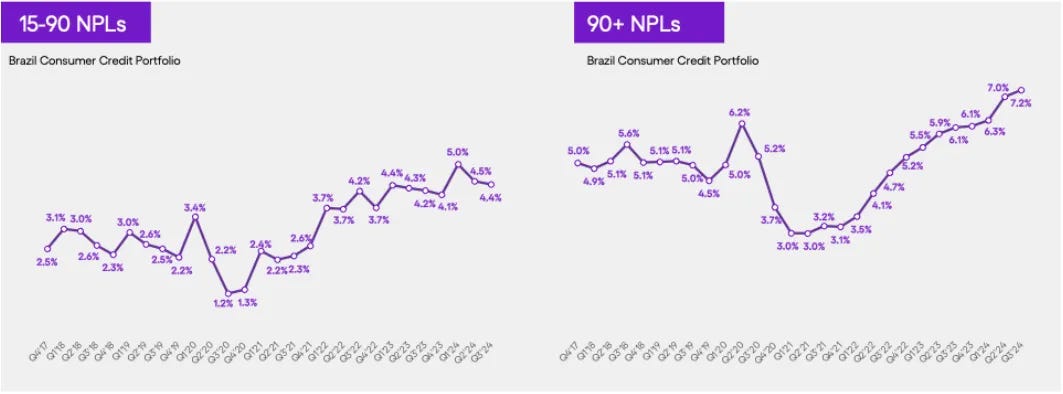

A notable risk to keep an eye on is the uptrend of 90+ day Non-Performing Loans (NPL). Analysts have scrutinized management, and the strategy was to reduce the growth of their credit portfolio. On the other hand, NuBank has an excess of deposits to their loan book in addition to a healthy balance sheet of nearly $8B in cash and $3B in long term debt.

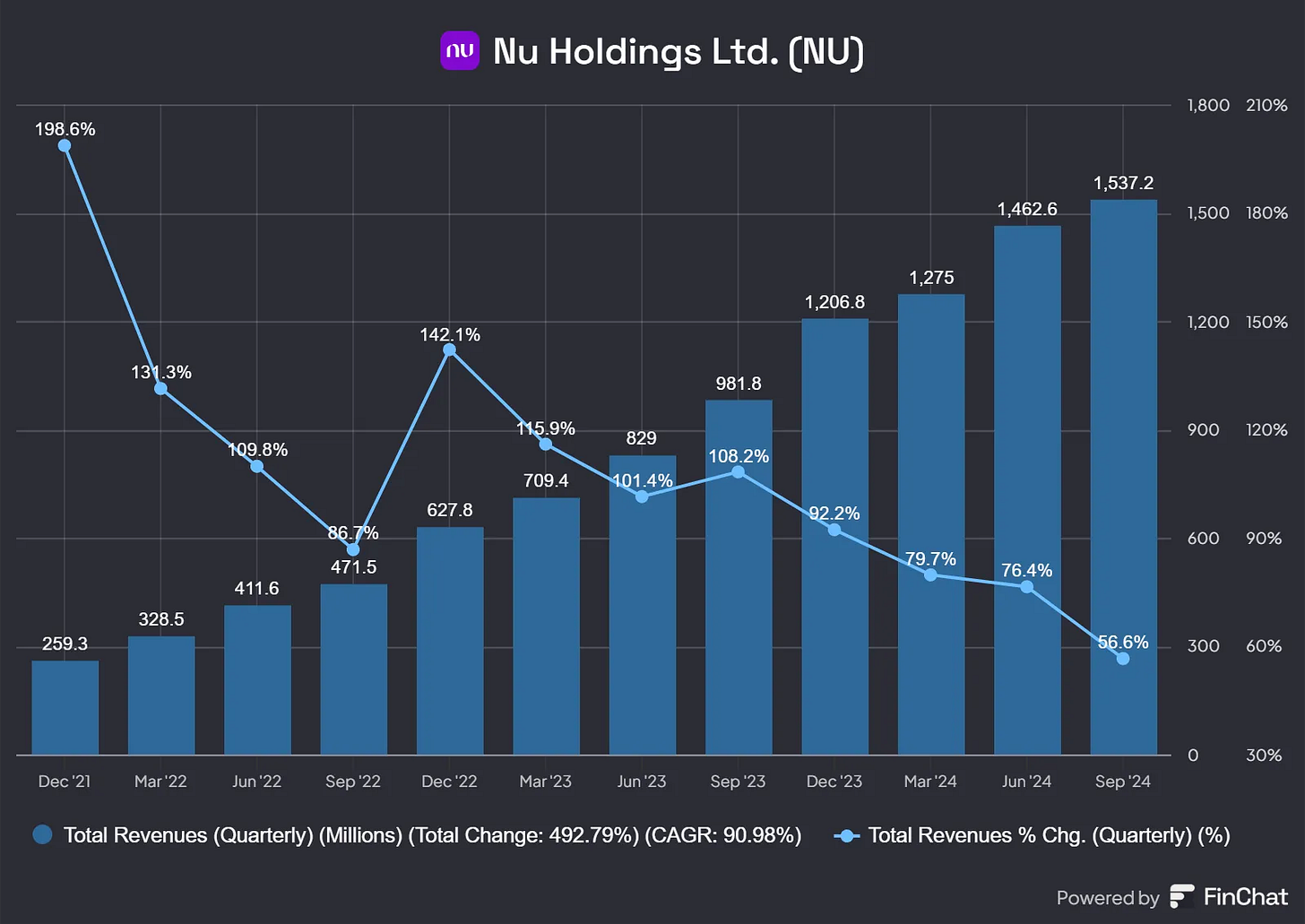

Revenue and Margins

In the latest quarterly earnings, Nubank reported $2.94 billion in revenue, marking a 56% year-over-year increase compared to FY2023 Q3. However, revenue growth decelerated considerably due to the previously mentioned factors. For a company of this size, sustaining high double-digit growth over an extended period without sacrificing margins is challenging.

Gross margins for the last quarter were 46%, translating to $1.3 billion, a 67% year-over-year increase in absolute terms. Profit margins stood at 19%, growing 108% year-over-year in absolute terms to $553.4 million.

Presence in Latin America

Since its inception, Nubank operated exclusively in Brazil until it expanded to Colombia and Mexico in 2020. The secular growth in digital banking during COVID-19 enabled Nubank to rapidly gain market share. The company's plans for Mexico were outpaced by the rapid growth in this previously untapped market. Before Nubank's entry, over 66 million people, or 50% of the population, were unbanked. Today, analysts speculate that Nubank might expand into neighboring Latin American countries. CEO and Founder David Vélez has hinted at potential expansion into Argentina in the future.

Stay Tuned for Part 2

In Part 2 of the NuBank 2025 Setup series, I will review macro fundamentals of Brazil as this sets up a sentiment reversal for NU 0.00%↑ and MELI 0.00%↑. Finally, Part 3 will conclude with the technical setup, 2025 and 2026 price targets, and how I am positioned.

NuBank really seems to be setting itself up for a big 2025. With its solid customer base in Brazil and the expansion into Mexico and Colombia, it’s definitely positioning itself well for further growth. The increase in customers, especially in untapped markets, shows how much potential there is. Curious to see what the next parts of the series reveal!