NuBank: Brazil Macroeconomics [2/3]

NuBank is a fundamentally strong company that sets up for a bullish narrative in 2025.

Beyond Nubank's fundamentals, Brazil's macroeconomic conditions are fostering negative sentiment. Concerns about accelerating inflation and slowing GDP growth are dominating the narrative as 2024 ends and 2025 begins. Economists are forecasting an increase in inflation for December, up from November 2024's rate of 4.87%. However, according to Trading Economics, inflation is expected to decelerate in 2025. On the other hand Brazil Central Bank sees inflation at 4.9% in 2025 followed by deceleration in 2026 into 2027.

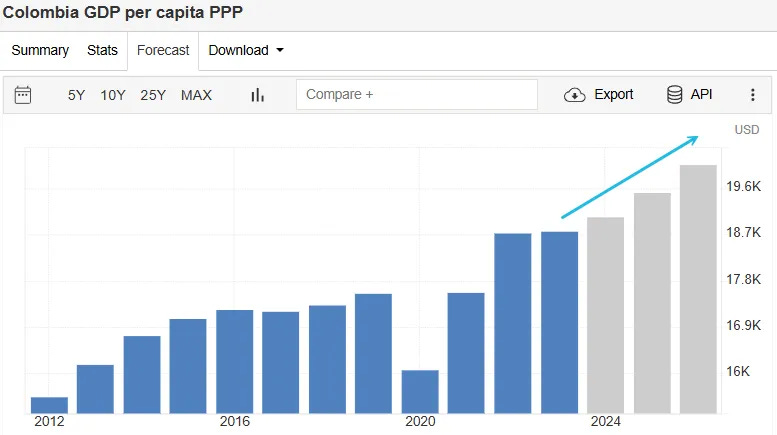

Brazil, Columbia, and Mexico GDP

Let's examine GDP more closely. While GDP is measured in a country's local currency, it isn't useful for comparing GDP across different countries. To make meaningful comparisons, we need to look at GDP per capita at Purchasing Power Parity (PPP). This metric adjusts GDP per capita for spending power, accounting for the different costs of living in each country.

Gross Domestic Product (GDP) serves as the productivity growth rate for most nations. However, we have observed that every country where NuBank operates is not only growing but also projected to either sustain or reaccelerate this growth. Concerning pricing power, it has shown a consistent rise over time, aligning with Pricing Power Parity.

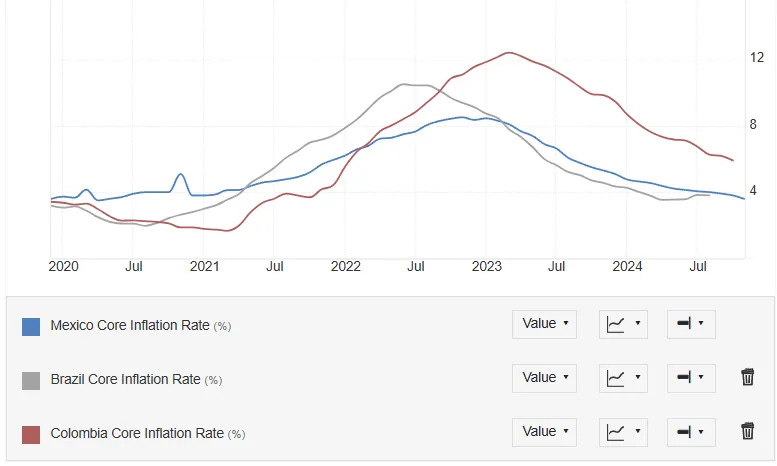

Inflation Trending Down

Monetary policy is quite complex. To combat inflation, central banks typically tighten monetary policy or hike rates to counteract price increases that surpass wage growth. We've seen this recently with Brazil. Higher rates aim to curb price increases, which in turn can diminish the power of the local currency. For instance, if a gallon of milk cost $2 last year and now costs $3, that's a 50% increase in inflation for milk. If your salary only increased by 25%, your purchasing power for milk only went up to $2.50. Thus, you end up paying $0.50 more for the same gallon of milk. This example, when applied to an entire population with many more variables, has a much more significant effect than one might realize, and markets react in real time as new data emerges.

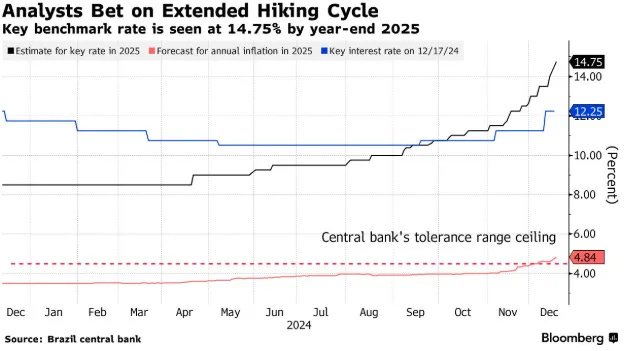

Brazil Monetary and Fiscal Policy for 2025

Currently, Nubank derives nearly 80% of its revenue from Brazil, making it a focal point for the company's operations compared to Colombia and Mexico. Since August 2024, Brazil has experienced a rise in inflation, prompting the Central Bank to increase interest rates by 100 basis points, from 11.25% to 12.25%. Financial analysts in Brazil predict that rate hikes will conclude at 14.75% by December 2025.

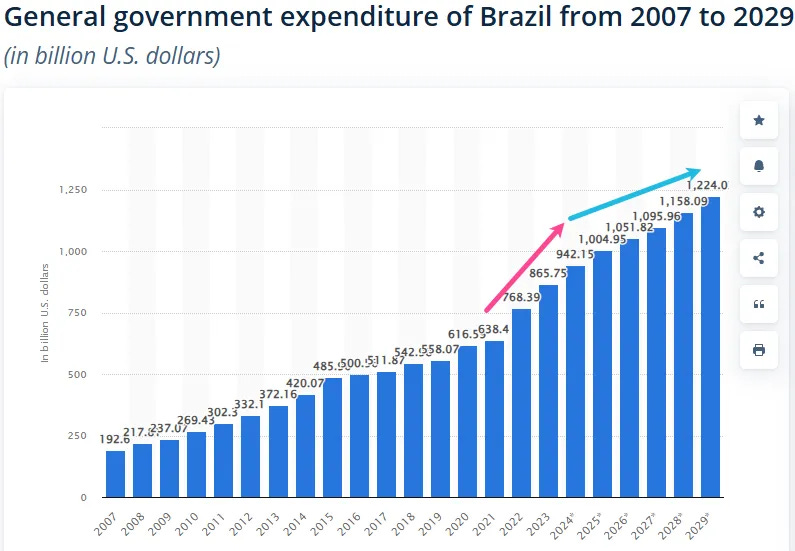

Brazil Government Expenditure Cuts

Additionally, Brazil's fiscal policy under President Lula has been geared towards increased spending to counteract a potential economic slowdown, while the Central Bank combats inflation with higher interest rates. This situation is more pronounced than what was experienced in 2022. However, it resembles mid-2023 when there was speculation that the Federal Reserve would continue raising rates, culminating in their latest hike in July 2023. We might have seen the final rate hike in Brazil, or there could be a deceleration in monetary policy tightening moving forward. This would create a more favorable environment for spending, wage growth, and overall economic expansion.

Brazil Central Bank Presidential Changes

Gabriel Galípolo, the new Chair of the Brazil Central Bank, assumed his position on December 19. Known as President Lula’s “Golden Boy,” Galípolo has connections with both the left-wing government and the private sector. Despite recent interviews suggesting he might raise rates to 15.5%, his ultimate aim is to foster a continued expansionary environment for Brazil. His goal is to cut rates in 2026, providing a short-term boost in growth.

Summing Up the Macro Bearish Narrative

Overall, the outlook for 2025 has shifted as inflation remains persistent, but spending has decelerated. It's important to remember that the market anticipates future events. Based on multiple news sources and market price movements, much of this seems to be already factored in. There is a potential for further declines, but the significant pullback in the Brazilian Real and Bovespa Stock Market has entered fear territory.