NuBank: Valuation and Price Targets [3/3]

A medium to long term opportunity with positioning and price targets.

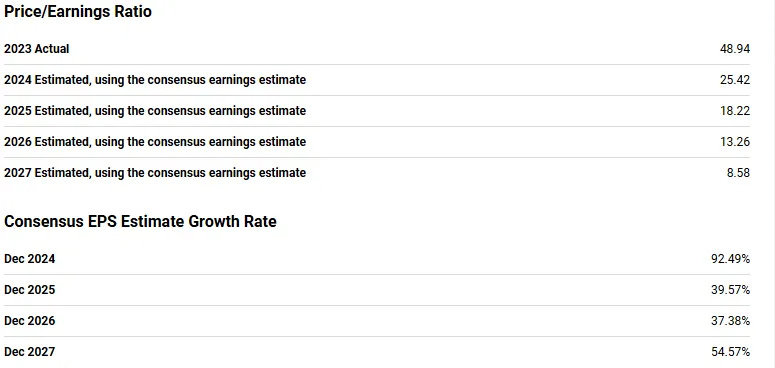

Nubank's FY2024 Q3 earnings revealed the stock trading at $10.33 per share, with a trailing P/E ratio of 25x. The forward P/E for 2025 is projected at 18x, and for 2026, it stands at 13x. Nubank is estimated to grow its earnings per share (EPS) by 40% in CY2025 and by 38% in CY2026. Interestingly, analysts forecast a 55% growth in EPS in CY2027.

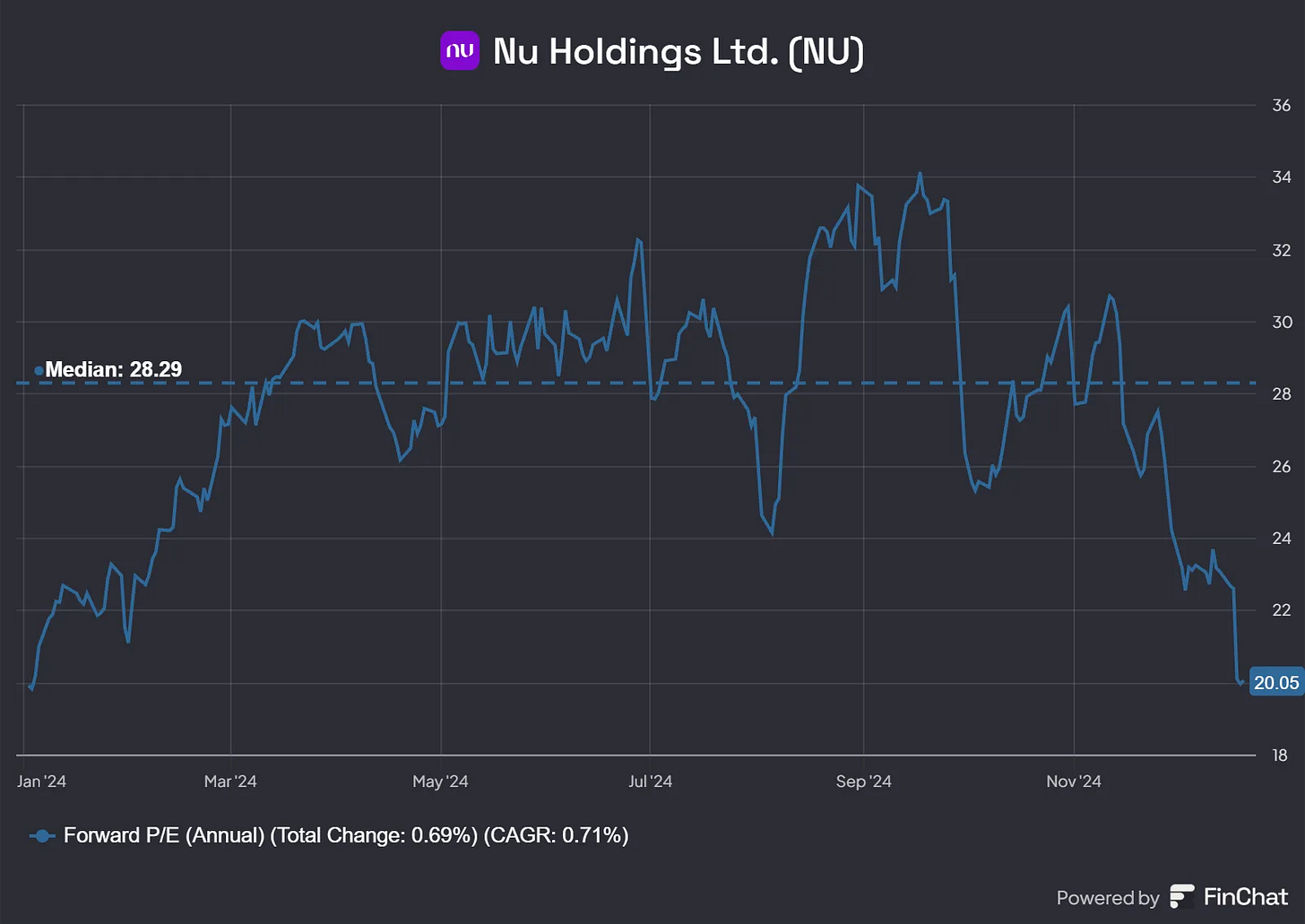

NU historically traded at around 28x forward P/E. Currently, the forward P/E is approximately 20x, which includes the period from FY2024 Q4 to FY2025 Q3. The lower forward P/E for 2025 indicates a cheaper valuation, as it extends another quarter out, suggesting that the market anticipates significantly higher EPS in FY2025 Q4 compared to the previous quarter. Notably, NuBank has consistently met or exceeded analysts' earnings estimates, with the only exception being FY2022 Q4.

On November 11, 2024, NU reached an all-time closing high of $15.83, just two days before its FY2024 Q3 earnings release. Currently, NU is trading at $10.33, which is 34.74% below its all-time high, marking the largest drawdown in the last two years since the 2022 bear market.

NU is trading below all of its moving averages for the 20-day, 50-day, and 200-day periods. The Relative Strength Index (RSI) indicators are 42 on the daily chart, 40 on the weekly, and 51 on the monthly. Historically, NU has experienced significant rallies when trading below a daily RSI of 30. Since tagging a daily RSI of 25, there was a high probability that NU would either trade sideways or see a considerable number of green days shortly after. This presented a bullish technical setup for NU.

Today, we are witnessing a macroeconomic deterioration that is presenting an opportunity for medium to long-term trades. The dollar's appreciation (near 110 levels) and the Brazilian Real's decline are amplifying negative sentiment towards emerging markets and growth assets. As growth investors, this scenario provides us with a unique chance to capitalize on a long-term scale. Although there are numerous near-term risks that could take months to unfold, positioning ourselves for a recovery while filtering out short-term noise is where the true alpha lies in this setup.

Here is how I am positioned in NU:

10% Position Size in Shares - Cost Basis 8.4

3% Position Size in Options - NU 01/2027 15/25c

I currently have about 4% cash. I am willing to allocate more capital to this trade is we break below 9.75 on NU.

My EOY 2025 Price Target is about 16.50 and EOY 2026 is 20. These are conservative estimates based on existing valuations and projected growth priced in from analysts estimates. These targets will put NU at fair value based on the historical TTM P/E at about 26x. However, we know that the market tends to swing the pendulum from one side to the other, so it is possible to overshoot either end.

Thank you for reading!

solid analysis! little feedback, the blue on the backround makes it a bit difficult to read. hope it helps. keep it up!

Do they buy Wise at some point? Might be a cool way to backdoor into some acquisitions around the world. If Trump opens up the Canadian bank market then EQ bank might be attractive way to enter that market!