RUNNING HOT?

There will be signs... word of caution.

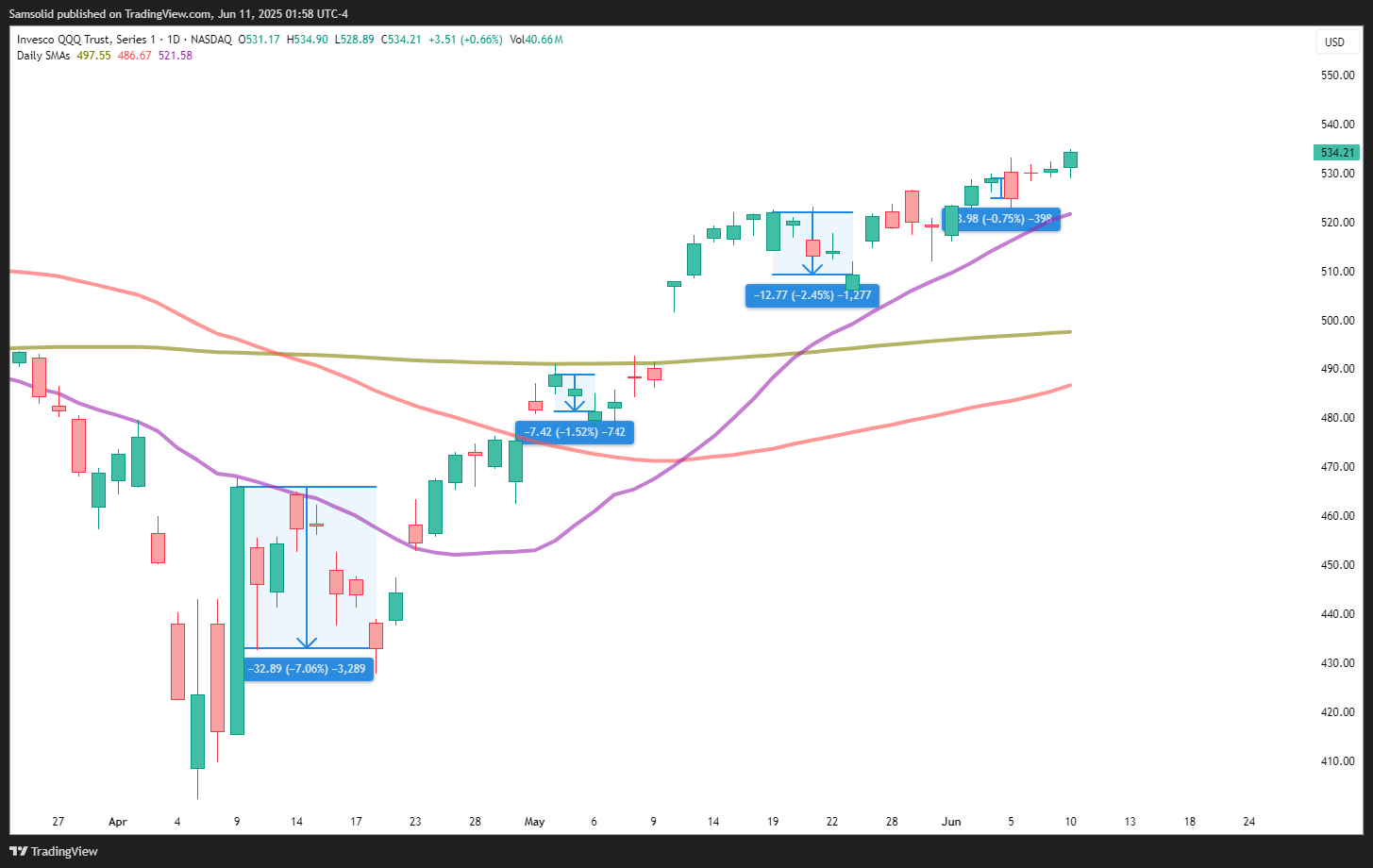

We're now pushing toward all-time highs, or at least inching closer every day, while a few tickers are actually hitting their all-time highs on a daily basis. It’s refreshing, honestly, to see such rapid returns on investment, especially considering we came out of the April lows, when everyone was panicking and talking about selling everything. There wasn’t a bull in sight back then, and now, here we are with people capitulating and buying into the market again, fueled by a bullish backdrop that includes optimism around trade deals and a generally risk-on sentiment.

Just a few weeks ago, many thought the market had topped… but clearly, it hadn’t. This is the rhythm of a bull market… bulls climb the wall of worry. They don't thrive on universal optimism. In fact, if everyone were bullish, there’d be no one left to buy. Bull markets need skepticism, they need reasons to sell. That constant churn of uncertainty keeps the market alive and moving higher. When the reasons to sell remain static, uncertainty fades… and ironically, that can stall a rally. Of course, a pullback will come eventually, but I don’t think it’ll be dramatic. The market has proven over and over that every dip gets bought with relentless energy.

Give Me an Example, Furu…

Take last Thursday as an example, the market fell over 1%, $TSLA was getting hammered, and over the weekend I saw plenty of people throw in the towel on their Tesla positions. They thought it was the end of the Elon Musk story.

But that bearish narrative got squashed almost immediately. That said, I wouldn’t say the bear case is dead. Tesla's auto sales are expected to decline, and free cash flow margins are under pressure. But Tesla isn’t just an auto company. It’s a bet on the future… on autonomy, robotics through Optimus, and even space travel. The real investment thesis is about removing humans from repetitive tasks and pushing civilization forward into more complex, value-driven roles.

What Does This Mean for People?

If you're in Tesla thinking it'll deliver on all of this by June 28, or even in the next five to ten years, you're playing the wrong game. $TSLA is a trader’s stock, a momentum play. If you’re in it for the long haul, daily headlines and price swings mean nothing. You’re betting on a future that’s not only relevant, but inevitable. Personally, I added to my Tesla position under $300. I even bought LEAPS when the sentiment hit rock bottom, because people lost sight of the bigger picture.

And if the market stays bullish, I wouldn’t be surprised if Tesla pushes back to $500. That would obviously be great for my LEAPS, but even if it doesn’t happen, the long-term vision remains intact. You can't stop autonomy, you can't stop robotics, you can't stop the expansion of humanity beyond Earth. This future is coming… with or without AI.

So at the End of the Day…?

Within five to ten years, the S&P has a high probability of trading much higher than it is today. If it isn’t, then something will have gone seriously wrong. But if technology continues to grow exponentially, so will the market. And people need to understand that today's market is not the market of 20 or 30 years ago. Everything moves faster. Information is instant. This isn’t the 1980s where you'd wait hours, or even days, for news to trickle in. In 2025, a tweet can spread a market-moving headline in seconds. That speed changes everything. It also means that even 20% drawdowns can get erased rapidly. Sentiment shifts on a dime. And while that can also mean deeper drawdowns are possible, the broader direction follows technological momentum.

The Main Portfolio

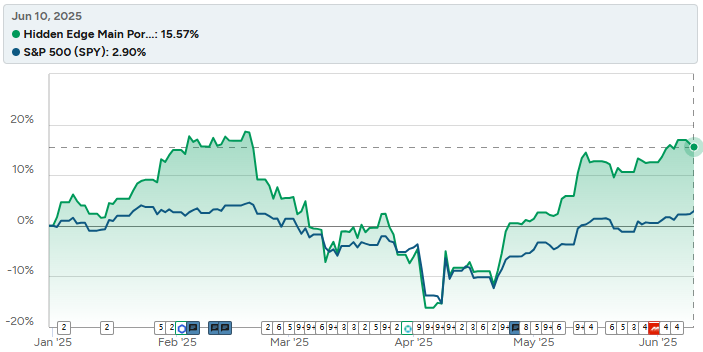

You can follow the Hidden Edge Main Portfolio on SavvyTrader HERE.

So yes, I remain bullish. My portfolio has surged back to near all-time highs, not just from luck, but because I capitalized on strength. I watched which tickers held up on red days. I used leverage where I saw asymmetric upside. $HOOD was one of the names that helped bring my portfolio above February highs. $PLTR, too, especially when I was buying calls in the $100-115 range.

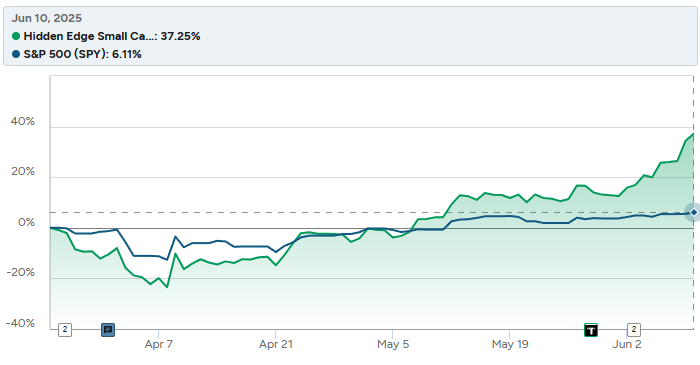

Small Cap Portfolio

Even small caps like $NVTS Navitas and $EOSE Eos added fuel to the fire. And $NBIS Nebius? That one’s been a massive winner over the past couple of months, shooting well beyond my expectations in a short time.

But let me issue a word of caution. Not because I think we’re about to enter a bear market, but because short-dated, leveraged call plays carry real risk. If we go sideways for a few weeks, or pull back even 1-2%, it could wreck those positions. So stay sharp, protect yourself. That said, my long-term portfolio remains intact, and we’re going to keep chugging along. Thanks for reading, and stay smart out there.