Sell Signal or a Buy the Dip?

Record Largest Drop in the Market Since 2020

One valuable lesson I've learned from the greatest traders and investors is the importance of keeping a journal. I regularly pour all my thoughts and reflections into a notebook, almost daily, particularly when my mind is full of conflicting ideas. Here’s the note I wrote to myself yesterday.

I've been considering this for a while, and it's time to either downshift many positions or convert them to shares. A lot of easy money has been made over the last two years. It's probably time to be patient, increase income positions, add short legs to all calls, and look for 2027 options only or downshift for a tighter spread.

It's fine to remain exposed, but long-term spreads or shares can allow for leveraging up later if opportunities arise while also exposing to upside potential if things continue to run.

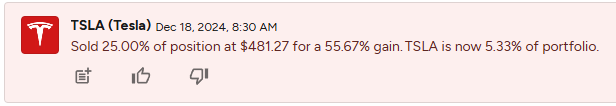

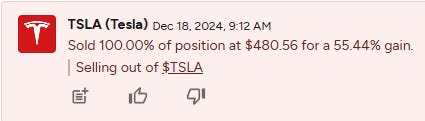

This morning, I took action based on these thoughts. I sold all my TSLA call debit spreads from the low 200s, reduced risk in many short-term options, and built a solid cash position. I wouldn't call it timing but rather a result of ongoing reflection on my portfolio. Over the past few weeks, I've been taking profits on some short-term swings and reallocating cash to high-dividend stocks and assets. Here are some of the moves I made in my SavvyTrader portfolio today (December 18, 2024).

Hidden Edge SavvyTrader Portfoliio - Subscribe to SavvyTrader

In addition to closing short-term swings, most of which were profitable, I also opened hedges. Currently, I hold about 12% cash, excluding income assets like preferred shares or short-term bond ETFs. Did I anticipate this? Perhaps, but I certainly didn’t know when it would occur. There were many signs, but I could have been more defensive. Like many others, I was caught off guard today. I'm not perfect. However, for the last two weeks, my system indicated that we were nearing a top.

By "top," I don’t mean an absolute peak in the stock market, but rather a point where the risk outweighs the reward significantly. Imagine if I told you I would give you $100 if you gave me $20, but you had to roll a die and avoid rolling a 6. There's a 5/6 or 83% chance you’d win four times your risk. That's an asymmetric opportunity in your favor.

Now, what if I told you that you’d only win if you rolled a 6? That gives you just a 16% chance to win four times your reward, meaning there’s an 83% chance you’d lose $20. No one would take that bet unless they were extremely reckless.

One of the best books I've read is "Thinking in Bets" by Annie Duke. It changed my mindset about stock market outcomes. We need to find opportunities where good companies or assets are mispriced for low risk and high reward. Duke, a former professional poker player, emphasizes this approach.

How does this apply? Consider the upside for many companies right now. They're pricing in many years of future revenue into today’s prices. The S&P 500 is pricing in over 25 years of earnings at today’s levels. This is historically above the mean and closely correlated with local market tops.

Do you want to keep buying in these conditions? We’re well ahead of historical forward earnings at 24.13x. Personally, I'm 88% long and never hold more than 15% cash. I see opportunities today, but not at current market valuations. I'll wait patiently, even if it means delaying investments in $NU or $MELI.