SentinelOne: Are You IN or OUT?

Historically CHEAP, Review of $S FY2025 Q4 Earnings... but what is the catch?

Introduction

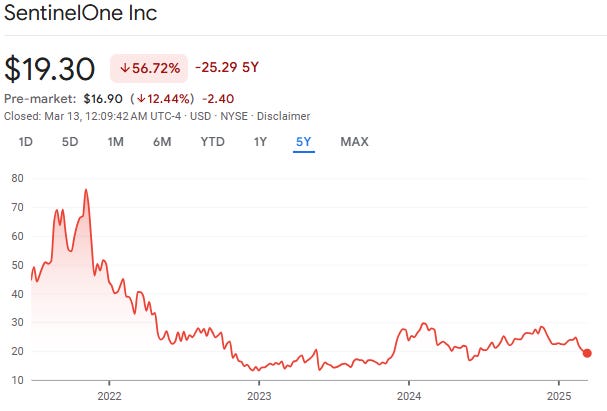

Ok guys.. I have some good news and some bad news. The bad news is, I am a shareholder of $S. The good news is... I just saved 15% on my car insurance by also owning $CRWD CrowdStrike. But seriously... I have owned SentinelOne for almost a couple of years now. And my position has basically gone NOWHERE since 2023. So am I staying in? Or am I selling? Let's break it down one step at a time.

Earnings Review for 4th Quarter

Let’s break down what happened in Q4. SentinelOne missed on Net New ARR. However, revenue still grew 29% YoY, and ARR grew 31% YoY.

Without a doubt, last quarter showed solid growth with margin expansions on a Non-GAAP basis. But that’s just it—Non-GAAP. This is something everyone has to get used to with software companies. They tend to report profitability ahead of time by adjusting for SBC expenses.

Side note on software companies: SBC makes up a huge portion of operating expenses for all software names. Top talent isn’t cheap—any engineer can walk into the Mag 7 and secure a massive paycheck. Also, go-to-market sales teams need big rewards to be motivated to close deals. A great product means nothing if it doesn’t sell.

Now back to product growth…

- Singularity (their primary product) is selling exceptionally well.

- Customers with ARR over $100k grew 25% YoY.

- Total customers grew 200% in the last 24 months.

- 40% of customers have 3+ modules, and 20% have 4+ modules.

This shows sticky product adoption.

Also, Non-GAAP gross margins are now near 80%, and they achieved FCF profitability for the first time. It’s just 1%, but profit is profit.

That’s really all we need to sum up for past performance. Now let’s dive into guidance... the real showdown.

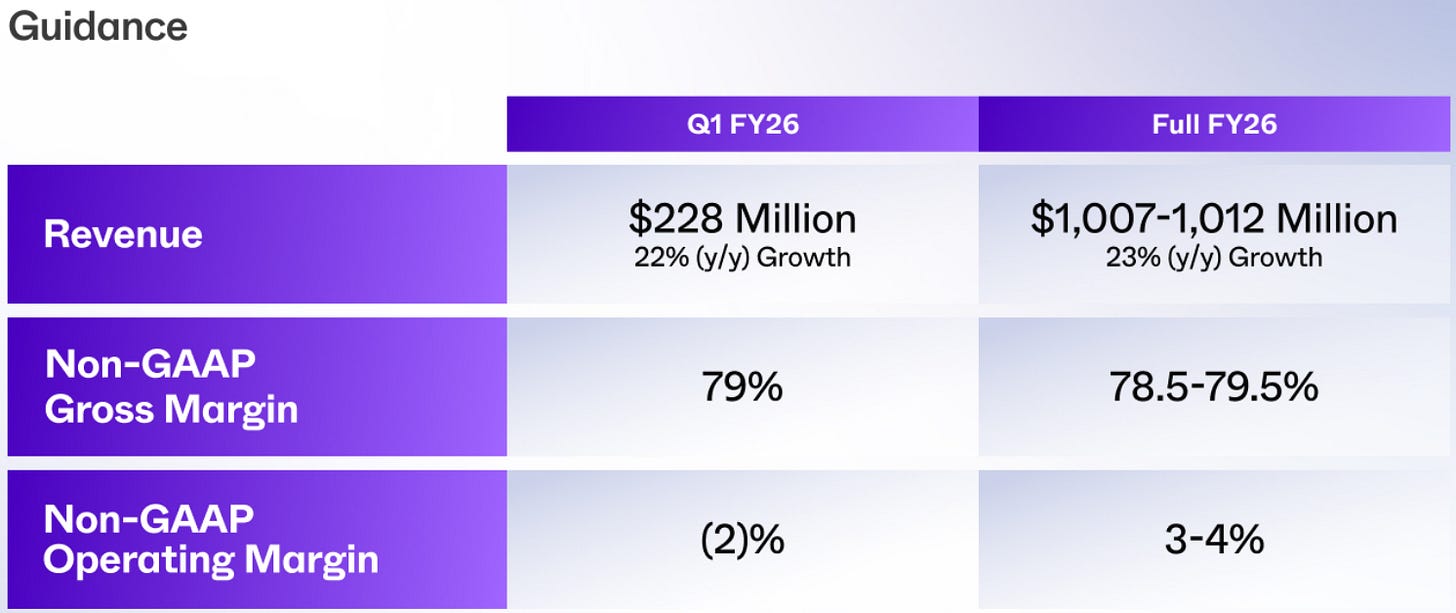

FY2026 Full Year and Q1 Guidance

Misses across the board. Slower growth, margin contraction.

What makes it all very, very bad at a high level? Flat Net Retention Rate (NRR) growth.

NRR measures how much a customer from 12 months ago pays today vs a year ago. A bad metric to miss on. But why the miss?

SentinelOne retired its legacy Deception solution (which used decoys to detect cyber threats) to focus on AI-driven security, cloud, and data solutions. This caused a $10M ARR hit for FY2026, with half of that impacting Q1.

However, management expects mid-to-high single-digit Net New ARR growth excluding Deception’s impact, driven by increasing adoption of AI-powered security solutions like AI SIEM and Purple AI. But with this impact, they guided for flat Net New ARR YoY in Q1 FY2025.

Barbara Larson on Deception’s Impact on NRR:

“There was no, I would say, material impact on Q4 NRR. We do expect that that's going to be a headwind to NRR, the Deception end-of-sale, specifically in Q1. And I think once we clear that headwind, I think you'll see it in a more healthy place.”

In addition, FCF is expected to go negative again next quarter due to increased expenses, though margins are expected to recover after a couple of quarters.

Also, an analyst asked about slower growth at 23% for next quarter. CEO Tomer Weingarten responded:

“We're mindful of the macro as well. It's not extremely different than what we've seen recently. It just continues to persist, it's still volatile. It's almost like it's the new normal. But we do believe this is the right starting point for this year.”

Translation: Spending contraction is real. This aligns with what we’ve seen across other software names. Tomer is focused on profitability and margin expansion.

Is This Thesis Breaking?

TL;DR: No. Let me explain.

1. SentinelOne is a leader in EDR (Endpoint Detection and Response)—securing phones, laptops, computers, servers, etc. It’s a cheaper alternative to CrowdStrike and Microsoft, targeting SMBs that need solid protection without best-in-class pricing.

2. SentinelOne has $1.1B in cash (according to the press release) & investments with very little debt. They don’t need to raise cash anytime soon. But I do think they make an attractive acquisition.

3. Cybersecurity is an indefinitely growing TAM. AI-powered threats and hackers are evolving. Even George Kurtz keeps warning that AI-driven threats are rising. Cybersecurity budgets rarely get cut in top-tier corporations.

SentinelOne says their TAM is $50B. CrowdStrike says their TAM will be $250B by 2029. Gartner and others estimate 21%+ CAGR growth in global cybersecurity spending. Cybersecurity is one of the fastest-growing sectors, period.

So What Am I Doing?

After hours, SentinelOne is trading at $16.80. With 322M diluted shares, $1.01B in cash, and almost no debt, the company is valued at 4.3x EV/NTM Sales, which is historically the cheapest it’s ever been.

Pair that with my bullish case for SentinelOne and Cybersecurity, and I am holding.

Am I adding? I answered that in the chat.

So what about you?

Are you buying more? Selling? Are you IN or OUT?

Nice review. I own PANW but I don't own S. I'm more interested in CRWD if I can get the right price at the right time. I do think S is an attractive takeover target but they've also been that for a long time so it might take a while for that to play out. That does seem to be the most likely outcome for this company. Good luck to S shareholders but I'm most likely sitting this one out.

Great review!