Snowflake FY2025 Q3 Earnings Review

An inflection point for $SNOW - Major Data Analytics Leader

Snowflake $SNOW FY2025 Q3 Earnings

FY2025 Q3

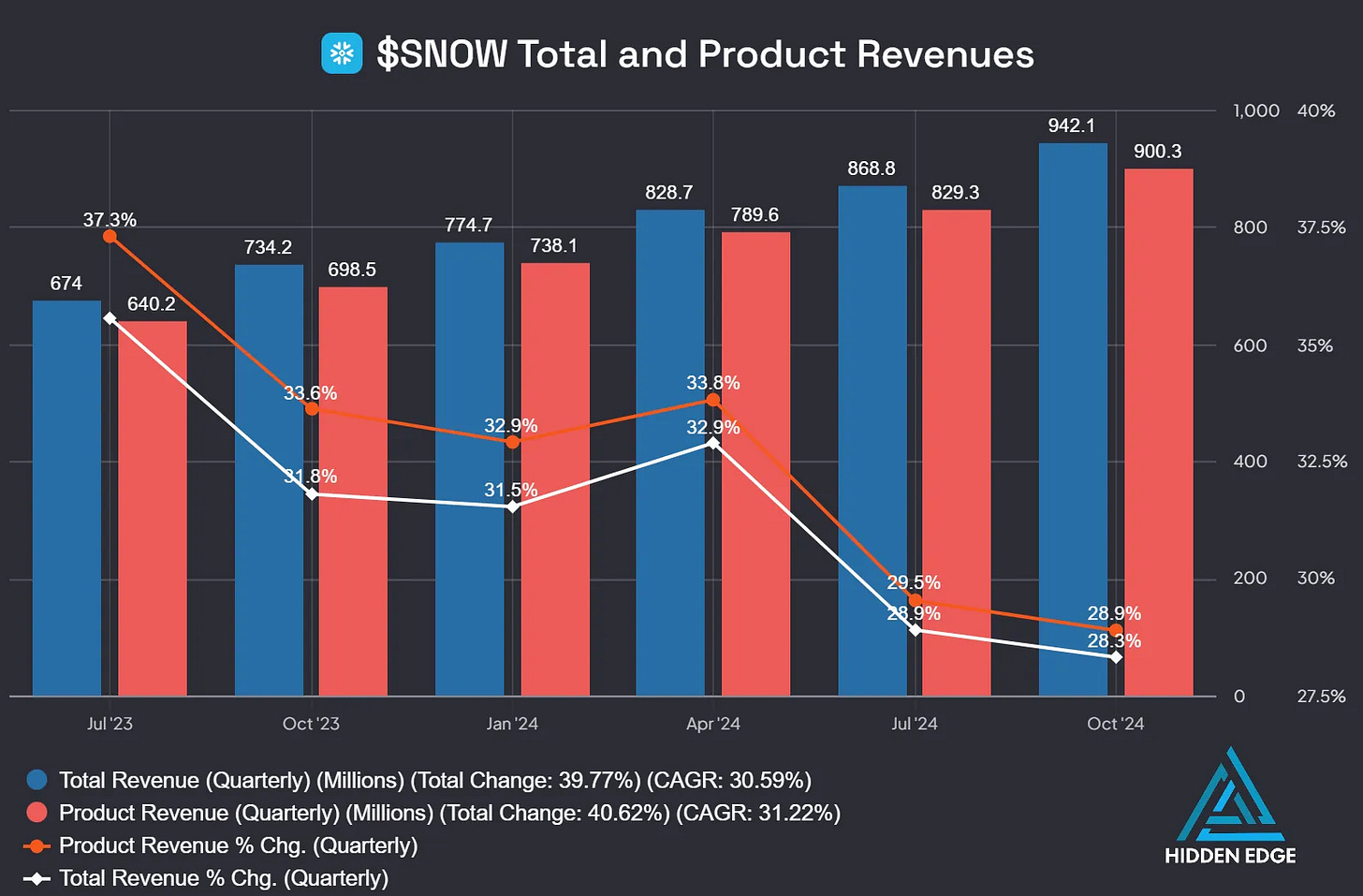

✅Revenue: $942M vs $894M est (+28.3% YoY)

✅Product Revenue: $900M vs $848M est (+29% YoY)

✅Adj. EPS: $0.22 vs $0.15 est

✅Adj. Net Income: $73.3M vs $50M est

FY2025 Q4 Guidance

Product Revenue: $906-911M (23% YoY)

Adj. OpM: 4%

FY2025 Full Year Guidance

✅Product Revenue: $3.343B vs $3.356B previous quarter (29% YoY)

✅Adj. OpM: 5% vs 3% previous quarter

📈 Closing Price Before Earnings: 129.12 [-0.86%]

📈 After Hours Price: 154.70 [+19.81%]

Day After Closing Price: _ [_%]

Earnings Review

Revenues: Product Revenue and Total Revenue slightly decelerated on a sequential basis. However, almost 30% growth YoY for both.

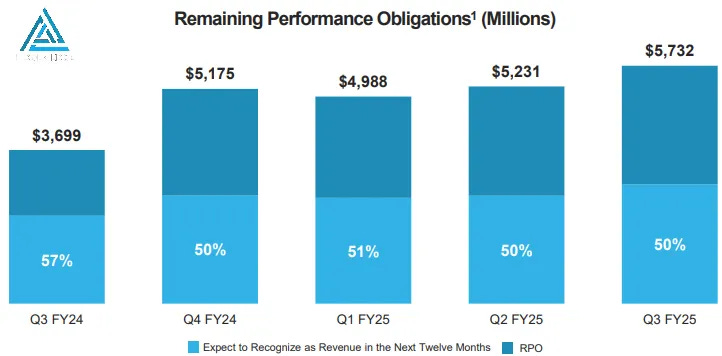

Remaining Performance Obligations: Reaccelerated expected revenue in the next twelve months through high than expected RPO

Net Retention Rate: Quarterly NRR was above wall street expectations at 127% vs 124% est

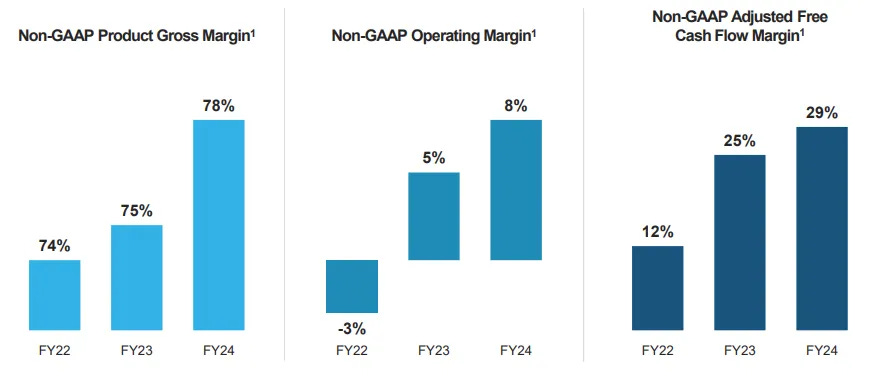

Operating Margin: Margin expansion on a sequential and annual basis beating wall street expectations.

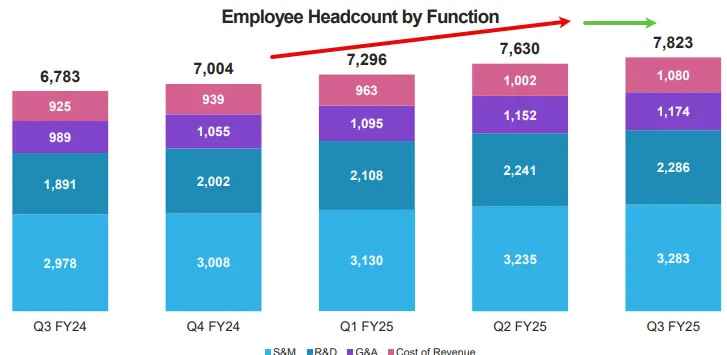

Headcount: Decelerating headcount and hiring across the board.

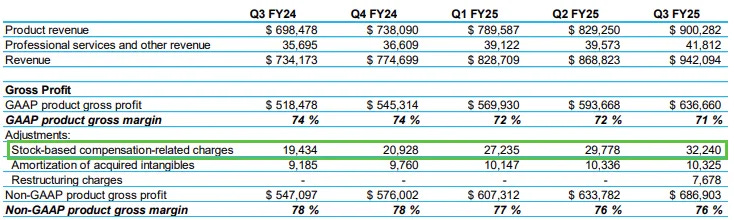

Stock-Based Compensation (SBC): As headcount and hiring is kept under control, Stock Based Compensation continues to decelerate sequentially with commentary leading to further reduction is costs and increased profitability.

Summary of Cloudflare Q3 '24 Earnings Call

Positives:

Focus on Controlling Costs: ”I'm particularly proud of the team for driving efficiency throughout our business. This operational rigor is now a way of life for us, enabling us to improve profitability while aggressively investing in our innovation and go-to-market engines.”

Additional Major Partnerships: ”We're also partnering with Microsoft and ServiceNow to increase data interoperability making it easier for our customers to bring data in and out of Snowflake to build and run applications faster.”

Net Revenue Retention Stabilizing: “Net revenue retention rates stabilized at 127%. New product initiatives are beginning to contribute to growth. As Sridhar mentioned, Snowpark is well on track to represent 3% of product revenue and growing nicely.”

Buybacks Already Positive Returns: “Year-to-date, we have used $1.9 billion to repurchase 14.8 million shares at a weighted average price per share of $130.87. We have $2 billion remaining on our authorization through March 2027.”

Restrictive Hiring and Consolidation: “we really looked across the company combining teams together where possible, and we're not replacing backfills”

Negatives:

Issued Senior Notes in Q3: ”we issued $1.15 billion and 0% convertible senior notes due in 2027 and $1.15 billion and 0% convertible senior notes due in 2029.”

Final Remarks and How I am Positioned

Snowflake was once a Wall Street favorite in the software sector, particularly in data analytics. It led the field and commanded valuation premiums. However, since former CEO Frank Slootman's departure, costs have risen dramatically, margins have compressed, and sentiment hit rock bottom. For the first time in years, SNOW traded at fair valuations. This quarter, things turned around with a trifecta: beating revenue, earnings, and guidance. Additionally, we saw margin expansion and received positive commentary on the call. Sridhar sounded more optimistic than ever on the earnings call, which is a positive tailwind for Snowflake.

Historically, Snowflake has consistently beaten top and bottom-line estimates, with only two EPS misses in the last 17 quarters. Given that guidance was slightly higher than last quarter, we can expect a strong beat next quarter. More importantly, guidance for the Adj. Operating Margin increased from 3% last quarter to 5% for FY2025.

It's no secret that SNOW has been a big loss for me over the past year. With an average cost basis of less than 150 before its recent 52-week high, I purchased call options as the price dropped below 180. As the price continued to fall, I resisted the urge to average down. The story was fundamentally changing, and I didn't like what I saw, especially with Frank Slootman's departure as CEO. However, I held onto my position and locked in a loss on the leaps when SNOW was around 142. This is risk management.

SNOW bottomed out around 107, and I continued to hold my shares. After the analyst call with CFO Mike Scarpelli, who mentioned they would no longer buy NVDA chips, I saw this as an inflection point. I kept an eye on other software companies for changes in spending habits from CIOs. We heard that reduced spending cycles had bottomed out, and guidance started to look good for software companies, including AMZN, MSFT, and GOOGL, with reacceleration in Cloud Services.

Combining this with greater inflows and outperformance of the IGV software ETF versus the QQQ and SMH semiconductor ETF since July, it seemed that software stocks were making a comeback as the AI theme and narrative shifted from picks and shovels to applications.

At this point, I decided to sell my shares and buy SNOW 2027 options when the price was around 122 recently. I'm very happy I did. Tomorrow, I will lock in some gains as part of a solid risk management process through additional option strategies. There was an asymmetric bull case for SNOW. Now that Wall Street sees the story unfolding, I believe SNOW could trade above 200 if the market stays bullish during 2025.