SPACE: THE $1 TRILLION TAM

A dive into a rapidly growing market, $ASTS $RKLB and Starlink!

The space economy is emerging as the new landscape for infrastructure investment, a market that stretches far beyond traditional terrestrial assets. Recently, during a stream with Couch Investor Neil, we delved into why this is such a transformative sector, noting the massive potential of low Earth orbit (LEO) and beyond.

You can catch that LIVE discussion on the Hidden Edge Pod YouTube Channel below! We regularly release deep dives and podcasts. Be sure to subscribe!

What makes this market so unique is that it doesn’t rely on land, physical buildings, or the overheads tied to constructing towers around the globe. Instead, the infrastructure here involves launching satellites and building a logistics platform in space… a network that can be scaled globally, directly serving consumers, businesses, and governments. This is an opportunity in the infrastructure world, and one company that's positioning itself to lead this shift is $RKLB Rocket Lab.

Rocket Lab: The End-to-End Space Platform

Rocket Lab is an incredibly compelling player in this space, not only because it provides payload launches through its Electron and Neutron rockets, but also because it's creating an end-to-end space platform. With launch facilities in New Zealand and Virginia, Rocket Lab is expanding its capabilities to launch into markets across the world, including the European Union. What makes them particularly interesting is their acquisition of Mynaric, a company that specializes in satellite connectivity using laser beams.

This move puts Rocket Lab in direct competition with $ASTS AST SpaceMobile and $TSLA Starlink, and indicates that the company might soon tap into the mobile connectivity sector… a critical area for the future of satellite infrastructure.

Beyond just launching payloads into space, Rocket Lab’s vision is to develop a scalable, reliable infrastructure in orbit. This is about more than just bringing payloads to space; it’s about creating a logistical platform that can sustain billions of data points and communication between satellites, businesses, and consumers. This vision of space as an infrastructure platform is becoming a reality.

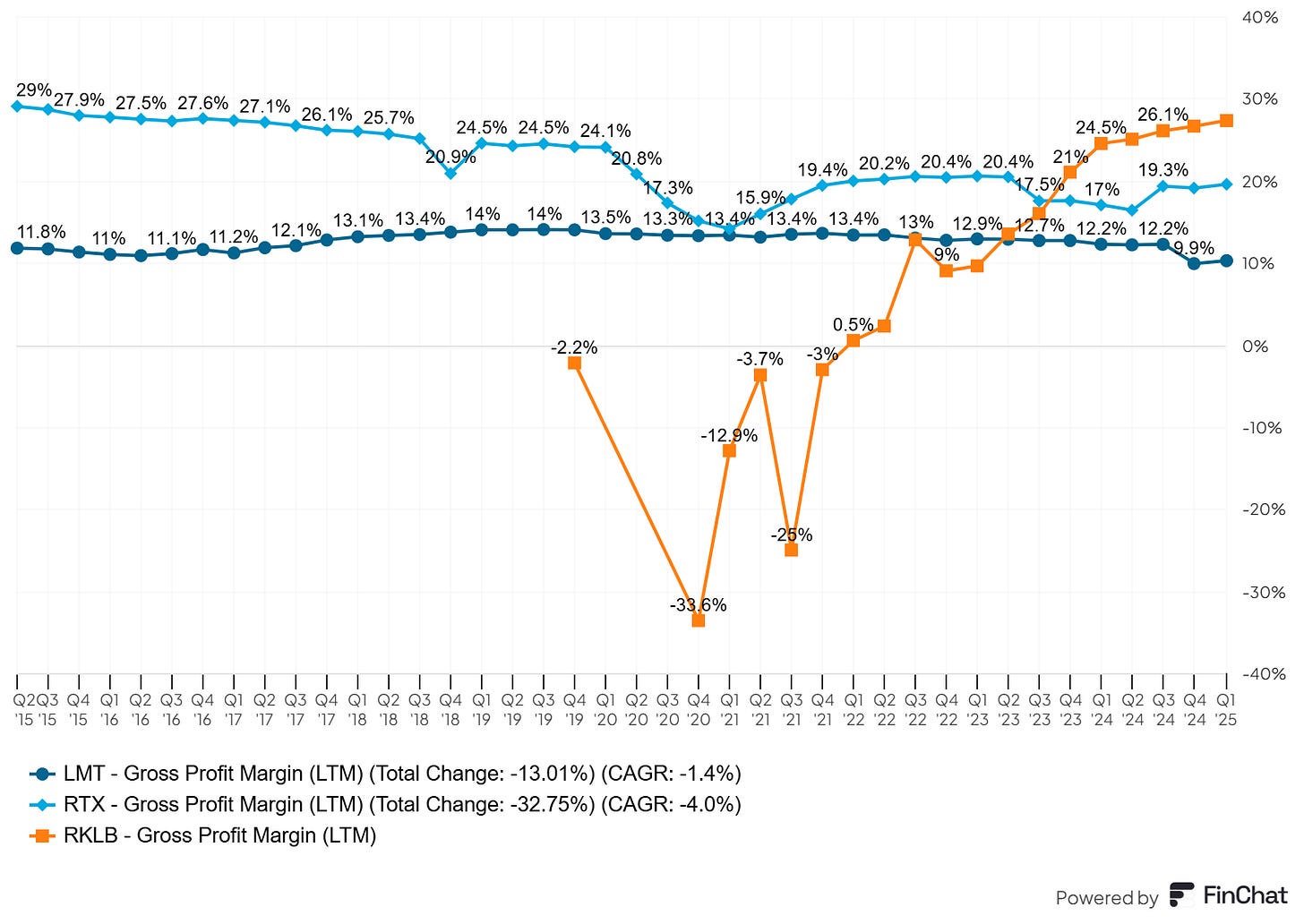

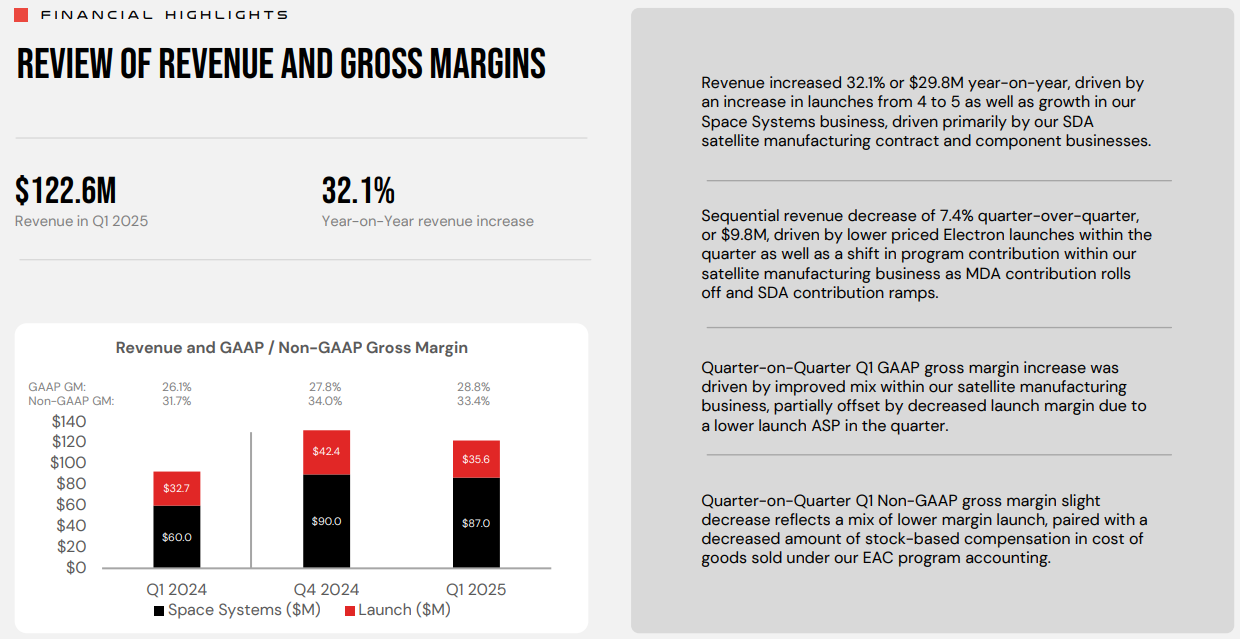

In addition to a unique business, Rocket Lab had a strong Q1 FY2025 with GAAP Gross Margins at 27.3%. Wide margin expansion over last few year and, more impressively, way ahead of what we typically see from $LMT Lockheed Martin (10.2%) and $RTX Raytheon (19.5%).

That’s wild considering how capital-heavy this industry is. The edge comes from Rocket Lab’s vertical integration and dual-engine revenue model, launches and space systems… which give it way more margin flexibility than traditional defense contractors. It’s lean, scrappy, and clearly playing a different game than the legacy primes.

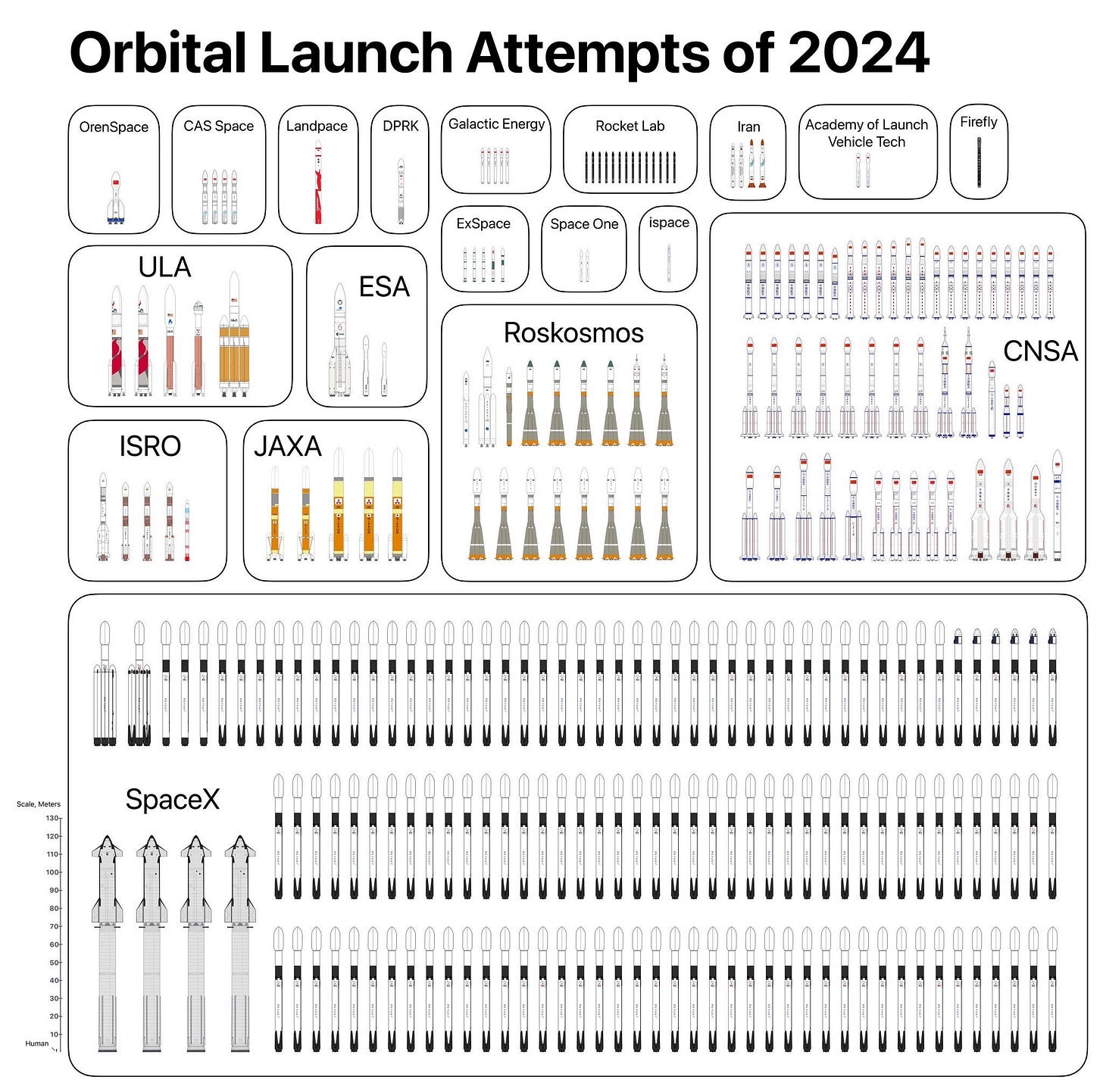

The Cost Revolution in Space Launches

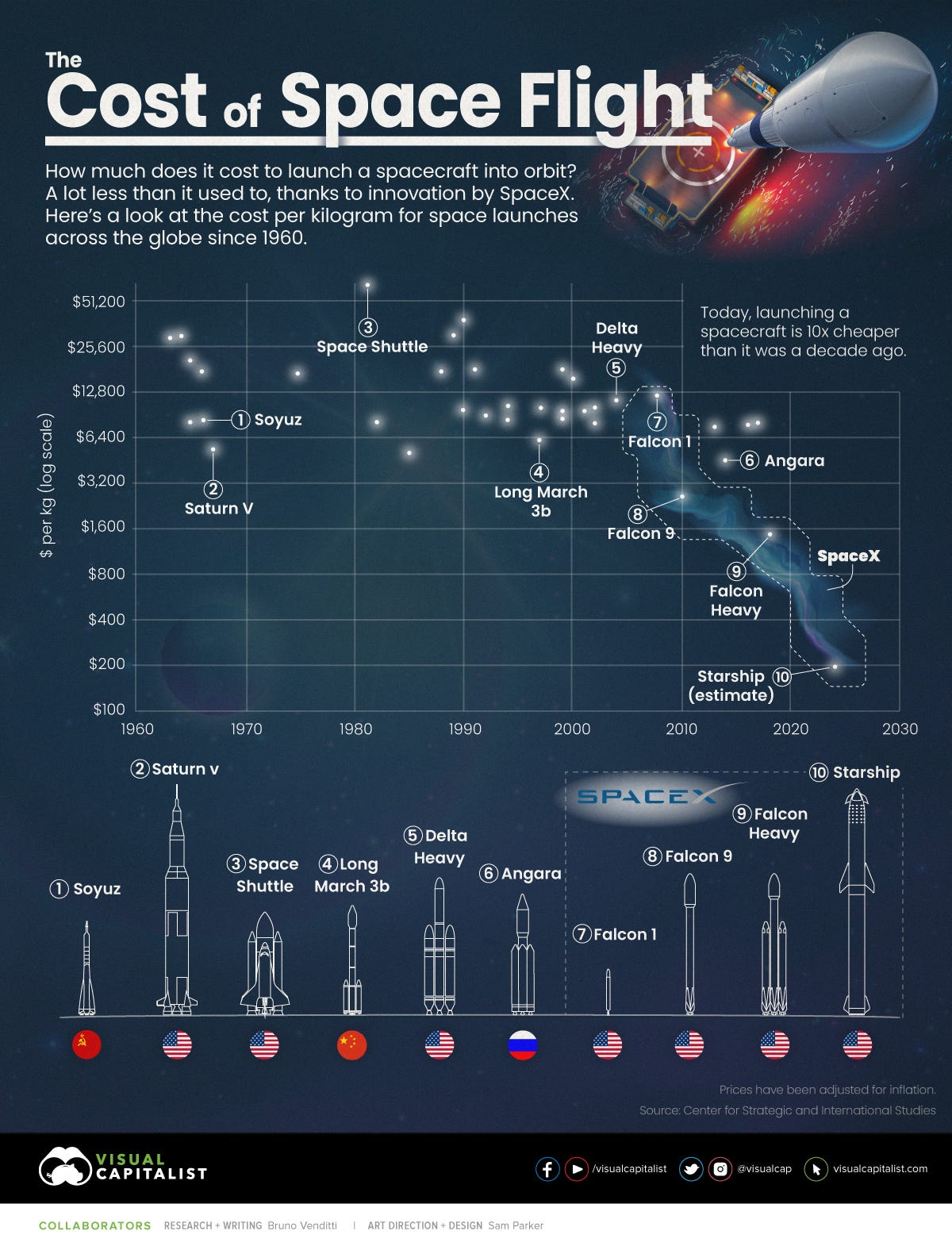

Historically, sending payloads to space was prohibitively expensive… around $52,000 per kilogram in the 1980s. However, the cost of launching payloads has dramatically decreased to about $200 per kilogram estimated this year, according to recent data.

This significant drop in pricing is expected to drive a massive increase in the number of launches, making space more accessible than ever before. The infrastructure we see in space will enable a new kind of connectivity… one that doesn’t rely on terrestrial towers or land leases. Instead, companies can launch satellites into LEO, interconnect them, and provide direct communication with businesses, mobile network operators, or consumers globally.

This shift has major implications for internet access, particularly for people in regions with inconsistent or limited internet coverage. By deploying satellites in orbit, companies can provide internet access to consumers who previously couldn't be reached by traditional infrastructure. This opens up enormous opportunities for satellite-based internet, with companies like AST Space Mobile playing a key role in connecting billions of underserved people.

AST Space Mobile: Connecting the World

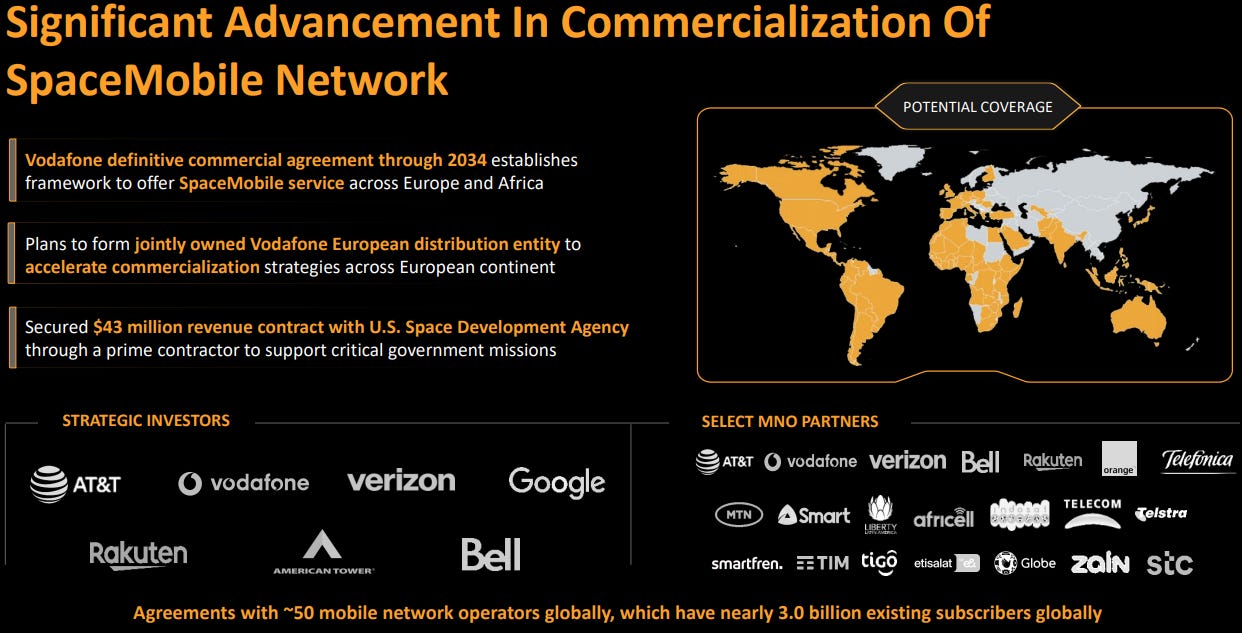

AST Space Mobile is at the forefront of this transformation. Already partnered with major global mobile network operators like Vodafone, Verizon, and AT&T, the company is building a satellite-based mobile connectivity network.

AST Space Mobile's technology will enable direct communication between satellites and mobile devices, eliminating the need for ground-based infrastructure. This technology is already being applied to government contracts, such as the Golden Dome project… an initiative designed to expand secure communications networks.

The integration of AST’s technology into government projects adds a layer of revenue stability that many space companies are participating in. The increasing importance of secure, reliable communication networks, both for consumers and government entities, ensures that AST Space Mobile has a valuable and growing market to tap into.

Starlink: The SpaceX Giant

While Rocket Lab and AST Space Mobile are rapidly growing, Starlink (part of SpaceX) is the leader in space-based internet connectivity and launch platforms. SpaceX has launched countless payloads into orbit, often with weekly missions. The Falcon 9 rockets continue to be the backbone of the company's operations, and the Starlink project, which aims to provide global broadband service, is already delivering on its promises.

SpaceX is a massive force in the space industry, and although retail investors can’t directly invest in SpaceX, $TSLA Tesla offers a proxy for exposure. Elon Musk’s vision for SpaceX is intertwined with the future of the company, and as his focus on space intensifies, it’s likely that Tesla’s valuation will continue to benefit from the underlying technological advancements driven by SpaceX.

The Risks: Is Space Infrastructure Viable?

As with any emerging industry, there are risks. We are still in the early stages of space infrastructure development, and there’s a chance that some of these projects may not reach fruition. However, the asymmetric opportunity presented by the space economy is worth considering. The potential returns on investment in space-related infrastructure could far outweigh the risks. With the dramatic reduction in launch costs and the increasing demand for global connectivity, the space economy is poised to expand rapidly over the next decade.

My Investment Thesis

Given the vast potential of space infrastructure and satellite-based communication, I still think AST Space Mobile is an attractive opportunity at $25, which is below my cost basis. The company is still in its early stages, but it has solid partnerships and a unique technology that could give it a significant advantage over competitors. The government contracts, such as the Golden Dome project, can offer a steady revenue stream that should help the company scale.

In comparison, Rocket Lab is a more mature company with recurring revenue on its balance sheet and a more established path toward profitability. As a result, Rocket Lab presents less risk but also doesn’t offer the same runway for growth that AST Space Mobile does. While Rocket Lab’s position in the satellite launch market is strong, AST Space Mobile’s mobile connectivity technology could prove to be a key differentiator in the space industry.

Finally, for retail investors looking to gain exposure to SpaceX, Tesla remains the only viable option. While it’s not directly linked to the satellite or space infrastructure markets, Tesla’s growth is closely tied to Musk’s vision for SpaceX, and there’s potential for synergies to drive both companies forward.

Conclusion

The space economy is a frontier that’s just beginning to be tapped. Companies like Rocket Lab, AST Space Mobile, and Starlink are leading the charge in building a new infrastructure in space… one that could fundamentally change how we think about connectivity, communication, and the broader internet ecosystem. While there are risks in the early stages of this market, the opportunity to invest in space infrastructure offers a unique chance to get in on the ground floor of a multi-trillion dollar industry.

Hey Sam I enjoyed this article on Space TAM and thought you might like my most recent one about Stoke Space - https://optimistictech.substack.com/p/optimistic-tech-newsletter-stoke