STABLECOIN: IS TOM LEE RIGHT ON ETHERUM?

Why Ethereum’s Staking Layer Could Be the Backbone of Global Financial Automation

Stablecoins are forming the foundation of a new financial stack… operating in a self-contained system that’s not driven by Bitcoin’s price. This isn’t just another crypto trend... it’s Fintech 2.0. Companies like SOFI 0.00%↑, PYPL 0.00%↑, TOST 0.00%↑, and XYZ 0.00%↑ (possibly Bitcoin, but cryptocurrency nonetheless) are already integrating stablecoin infrastructure. And if Tom Lee is right, this is only the beginning of a decade-long shift.

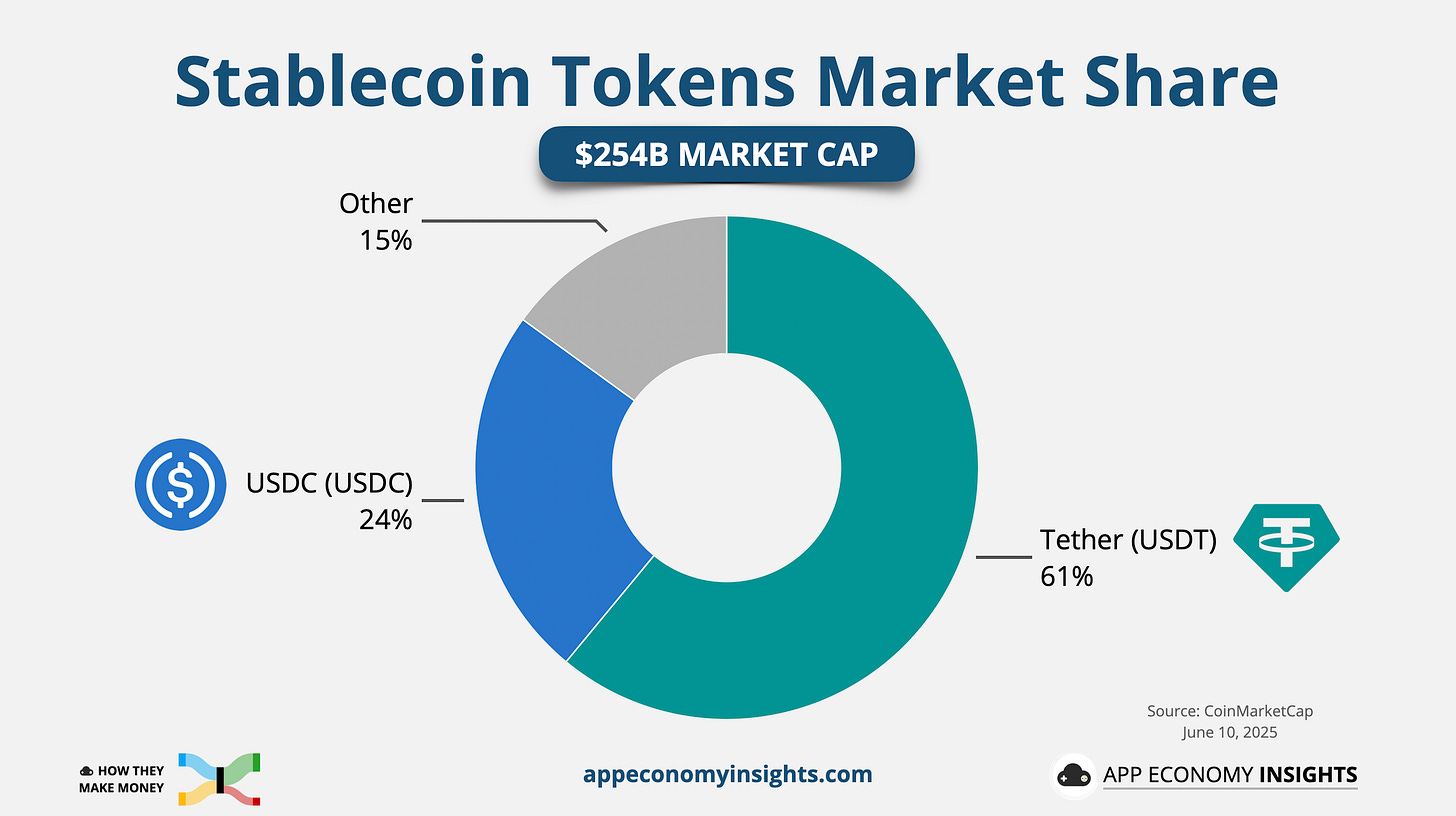

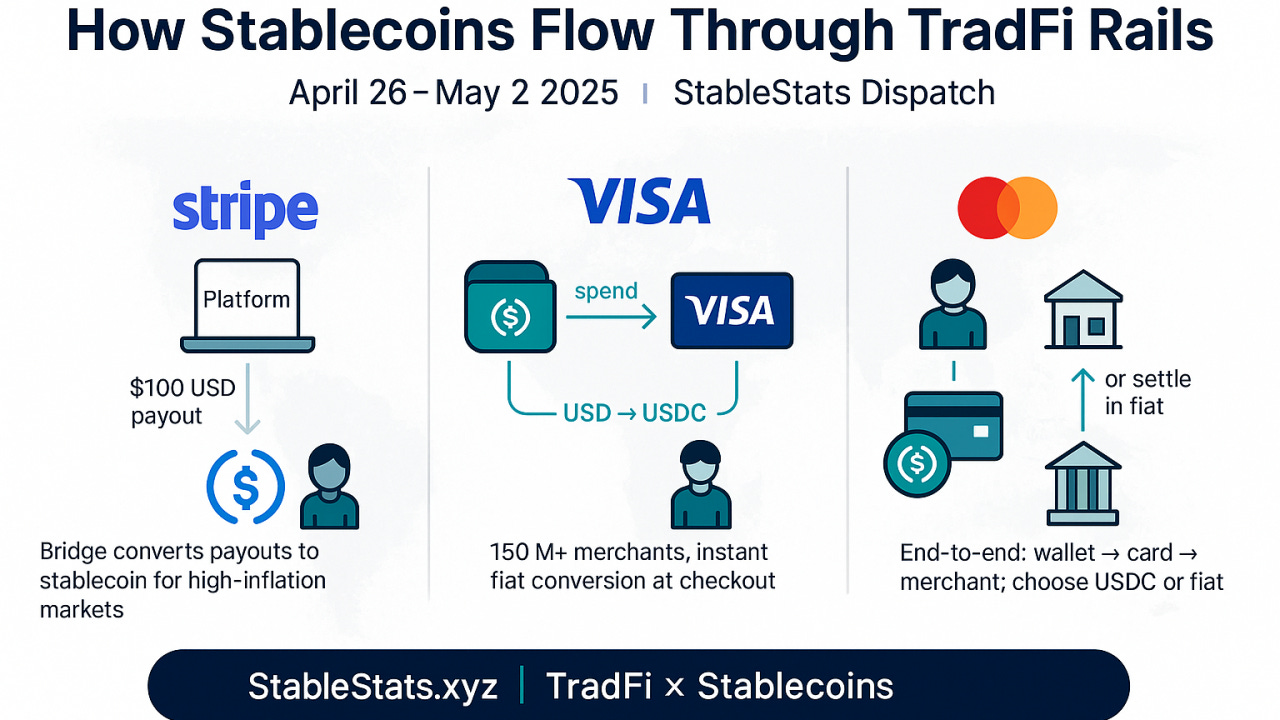

Stablecoins as the New Rails

We’re entering an era where stablecoins function less like crypto tokens and more like automated clearing rails for global commerce. The future isn’t about buying coffee with USDC or USDT (Tether)… it’s about real-time payroll, T+0 settlements, and composable payments with no intermediaries.

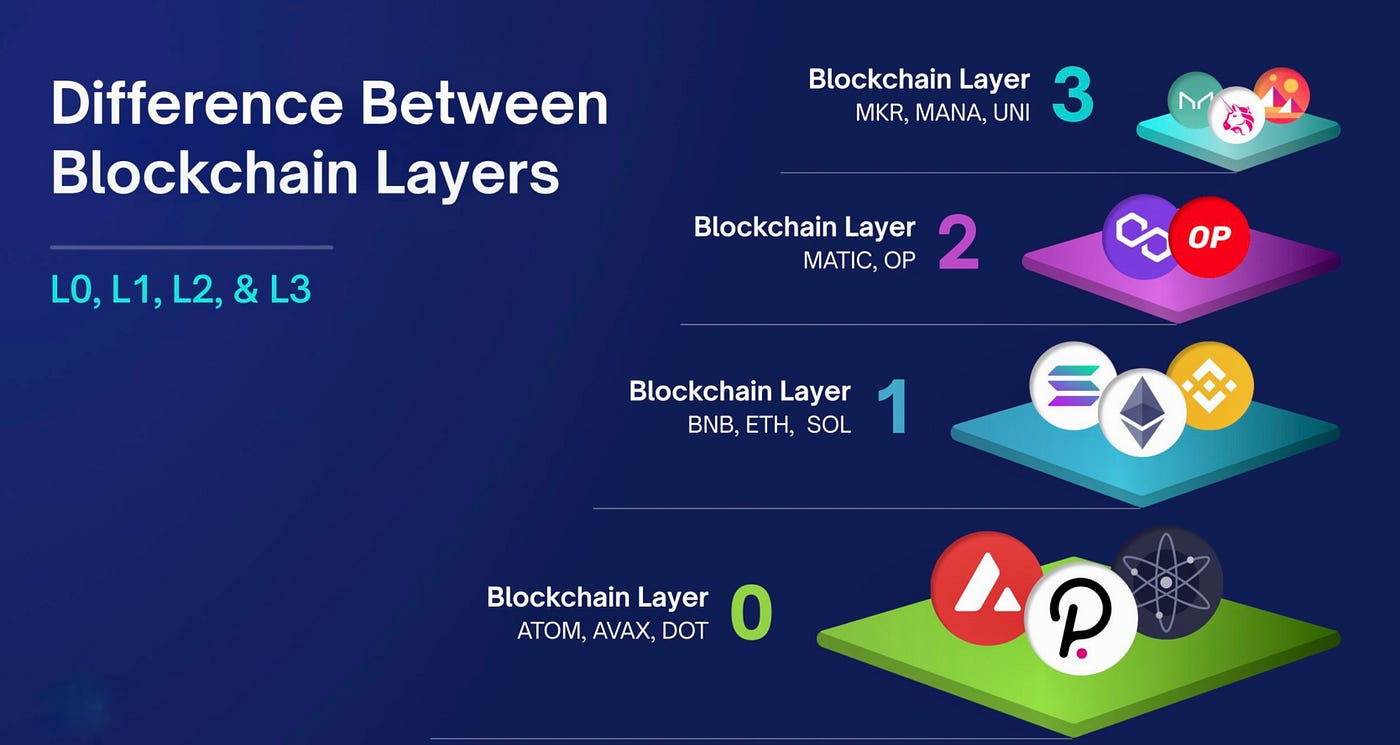

Stablecoins like USDC and protocols like Ethereum are may be the groundwork for this shift. BMNR (Bitmine) is steadily accumulating Ethereum, aligned with Tom Lee’s conviction that will serve as the foundational settlement layer for global stablecoin adoption. The company sees Ethereum not just as a smart contract platform, but as the financial internet backbone… ideal for bridging TradFi with compliant, programmable money.

Other stablecoin players like CRCL 0.00%↑, Stably, and Mountain Protocol are similarly targeting enterprise-level solutions, not retail speculation. The endgame? Embedded, invisible infrastructure that saves time and money.

Companies already moving:

$PYPL: expanding its stablecoin integrations

$XYZ: deploying on-chain invoice automation

$SOFI: primed to integrate stablecoin-backed payroll and savings

This is the fiber optic layer of finance… fast, frictionless, programmable.

SoFi and Paychex: A Strategic Stack Play

Let’s look into $SOFI’s recent move with Paychex. It may look like a simple partnership, but it’s a sneaky infrastructure play.

Paychex brings:

Payroll

Worker’s comp

SMB reach across millions of businesses

SoFi brings:

Galileo (API-based banking)

Embedded 401(k), savings, and lending

Potential integration of real-time stablecoin settlements

Together, they could embed financial automation where it matters most: inside the systems that cut checks and manage benefits. This is how SoFi moves beyond flashy fintech and into embedded B2B banking… without needing to own the last mile.

Toast and the Death of Interchange

TOST 0.00%↑ is one of the most overlooked players in the merchant finance revolution. They’re not just offering POS systems… they’re creating a closed-loop payments ecosystem inside restaurants.

With full control over:

Hardware

Software

Payment processing

Financial services

Toast is perfectly positioned to adopt stablecoin rails for merchant settlement. Imagine a future where stablecoins replace $VISA and ACH entirely… eliminating 2-3% fees, reducing chargeback risk, and giving merchants instant access to capital.

Once legislation or enterprise demand normalizes stablecoin use? Toast can flip the switch.

The Rise of Fintech 2.0 Infrastructure

We’ve graduated from slick UIs and “neobank” branding. Fintech 2.0 is infrastructure-first. And we’re watching it take shape in real time.

What’s being built:

Stablecoin-based clearing layers (Circle)

Embedded finance APIs (Galileo, Synapse, Modern Treasury)

AI and data-driven underwriting (UPST 0.00%↑, $SOFI, possibly HOOD 0.00%↑ in the future)

The new stack is forming where the boring stuff lives… in compliance layers, automated treasury ops, smart contracts for B2B payments. That’s where the margin is. That’s where the moat will be.

Final Thoughts

The future of finance won’t look like another flashy app.

It’ll look like programmable money moving in milliseconds.

And no one will even notice… because it’ll be embedded into everything.

Fintech 2.0 is here… and it’s running on stablecoins.

That said… maybe we’re still early in this part of the cycle.

The market has likely already priced in the assumption that “digital finance rails” are inevitable.

Now it’s waiting for meaningful proof. Real traction, real margin, real product-market fit.