NEVER SELL WHEN VIX IS 50

Why the market keeps climbing despite bearish headlines... and what it means for your next move.

We’re only a couple of days into the week, and already the market feels like it’s doing that slow, steady melt-up that catches everyone off guard. It’s something I’ve been flagging for a while now: the market, especially in the short to medium term, is driven much more by positioning and sentiment than it is by traditional fundamentals.

From Euphoria to Panic, Back to Euphoria?

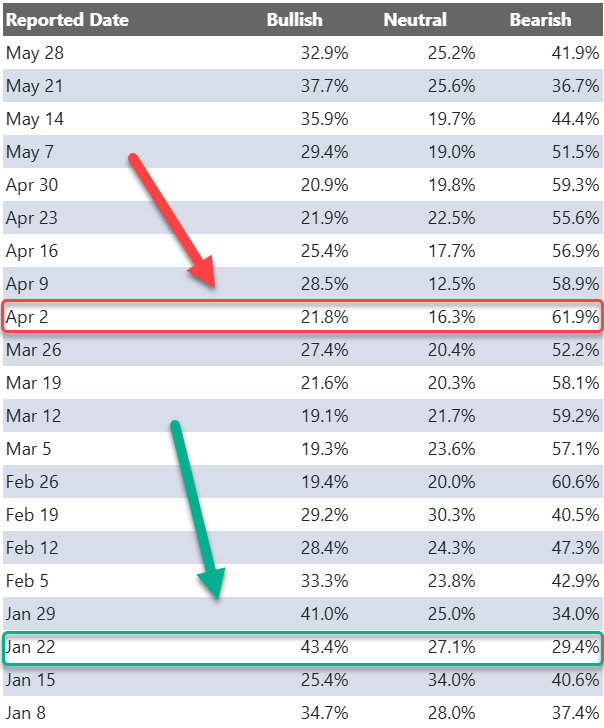

Let’s rewind to earlier this year. January into February, positioning was heavy and sentiment was bullish. Hedge funds, asset managers, retail… all were leaning in. Futures positioning was stretched, and the AI trade had sentiment indicators screaming optimism. Surveys like the AAII and CNN Fear & Greed Index were firmly in the "greed" zone. Even the NAAIM exposure index, which tracks fund manager equity exposure, was elevated.

Then came the pullback. The S&P 500 dropped over 20% intraday, the Nasdaq and Russell 2000 went into bear market territory. Analysts slashed price targets. Mega caps were downgraded. And suddenly, everyone flipped bearish. Positioning got defensive. Rates spiked, gold rallied, and the dollar wobbled. Macro panic set in.

The Trump Pivot and Repricing Risk

Then something changed. April 9 became a pivotal moment. On the same day retaliation tariffs were in effect, Trump announced a 90-day pause on retaliation tariffs for every country except China. The market exploded higher. Since then, we've seen a slow, grinding rally… one that’s left many investors flat-footed.

Everyone kept waiting for a retest of April lows, but it never came. Now the narrative is "we’ll get a correction... eventually." Maybe now. Maybe after another 10% move higher. The truth? Nobody knows. Meanwhile, U.S. indices are catching up to global peers, and risk appetite is back. Even as the Magnificent 7 lag slightly, they still drift higher.

Sentiment Reset, But Not Frothy

Despite the rally, we’re not in an overly bullish environment. Fund manager positioning is near average. Some S&P targets have been revised higher, but plenty remain conservative. On social media, sentiment is still split. But as always, price action is the ultimate sentiment shifter. As markets move up, people start to believe again.

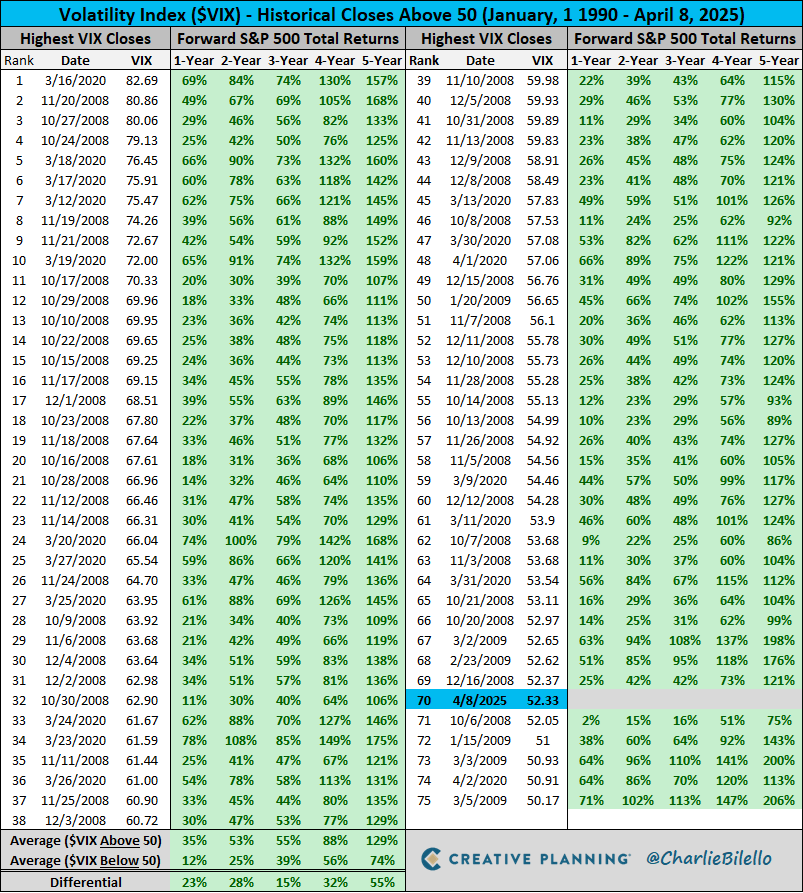

And let’s not forget the VIX. It’s sitting at 17 now. Just six weeks ago, it was over 50. That’s a signal. Historically, a VIX at 50 has a 100% win rate on forward 1-Year S&P returns. You don’t sell into that. You buy. That’s a setup you act on.

When Everyone’s Cautious, Who’s Left to Sell?

The most ironic thing about bearish positioning? It actually becomes a support level. When everyone is defensive, there’s nobody left to capitulate. Pullbacks get bought because the weak hands already left. So the market grinds higher… not because everything is perfect, but because selling pressure has dried up.

Trying to time the top is a losing game. As one great quote puts it, “It is usually a much simpler matter to forecast a bull market than to call the turn at its end.” Recession forecasting is hard. If top economists with million-dollar models can’t do it, what makes you think you can?

Algos Have Already Priced It In

Algorithms dominate price action. By the time you see a news headline, it’s already reflected in the tape. AI models ingest the data and front-run the reaction. The moment your favorite Twitter account posts the news, it’s already old.

So what’s left for retail? Probability and positioning. Long-term investing works because it ignores noise. But even traders can take advantage of repeatable setups. When we broke the 200-day moving average, retested it, and launched? That was a textbook trade. And right now, many charts are flashing textbook cup-and-handle breakouts. You can read on my article covering this setup.

Long-Term View With Tactical Adjustments

I’m not here saying go all-in. I’m saying play the probabilities. If your setup’s there, take the trade with stops. If you’re investing, ignore the daily drama unless the fundamentals change. Warren Buffett sells too… he trims Apple regularly. And that’s fine. Everyone’s got their own time horizon and risk profile.

Bottom line? We’re likely in a bull market. Not everything will go up, but enough will. Dips get bought. Pullbacks feel shallow. The path of least resistance is higher... until it isn’t. But you won’t see the top coming. So don’t waste energy trying to.

$CRWD CrowdStrike just dropped 8–10% after earnings, only to bounce right back. That’s what happens in bull markets. Reactions fade, buyers step in, and stocks drift higher.

Stay on the right side of the trade. Respect the trend. Watch the June macro headlines, but don’t overreact.

Trade safe, and have a strong rest of the week.